|

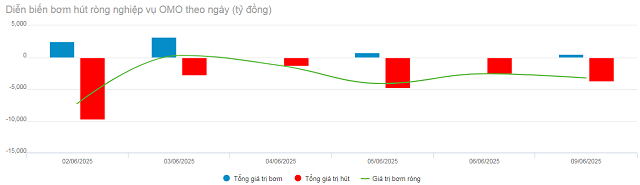

OMO net pumping evolution in the past week (02-09/06/2025). Unit: Billion VND

Source: VietstockFinance

|

Specifically, due to the decline in borrowing demand from commercial banks, the State Bank (SBV) only issued VND 6,822 billion in the pledge channel of securities, at an interest rate of 4%. Meanwhile, there were VND 15,362 billion matured, thus bringing the outstanding balance in the term purchase channel to VND 46,023 billion. Overall, the SBV net withdrew VND 18,282 billion from the system.

|

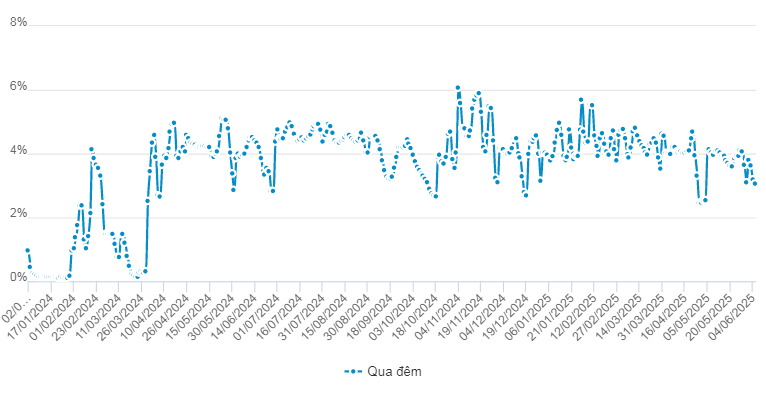

Evolution of overnight interbank interest rates since the beginning of 2024. Unit: %/year

Source: VietstockFinance

|

In the interbank market, the average overnight trading volume decreased by 24% compared to the previous week, to over VND 450 thousand billion/day. Overnight interest rates fell 28 basis points to close at 2.82%/year on 06/06 – the lowest since April 26.

|

DXY performance in the last 3 years

Source: marketwatch

|

In the international market, USD-Index (DXY) fell 0.24 points to 99.2 last week, after new data on the labor market and PMI showed that the US economic growth is slowing.

Vietcombank’s exchange rate closed at VND 25,830-26,220/USD (buying – selling) on 06/06, up VND 20 in both directions compared to the previous week.

– 11:44 10/06/2025

“Seamless OMO Channel Transactions.”

“During the week of May 19-26, open market operations (OMO) witnessed a balanced state as the State Bank injected liquidity into the market, almost equivalent to the volume of maturing reverse repo transactions.

Interbank Overnight Interest Rates Remain at a One-Year Low

“Liquidity in the banking system remained relatively stable during the week of April 28 to May 5. The overnight interbank interest rates persisted at low levels ahead of the extended holiday weekend.”