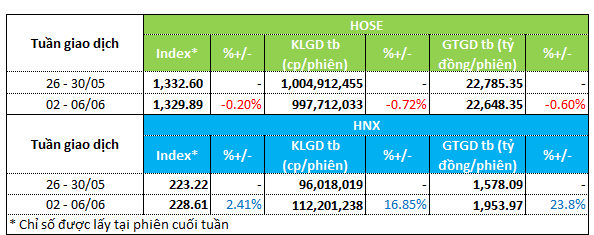

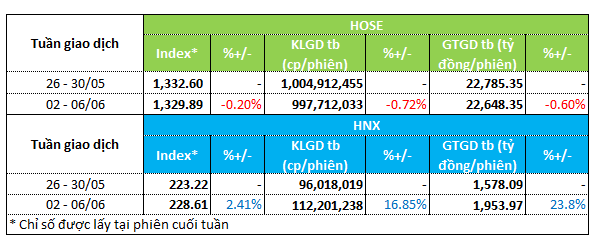

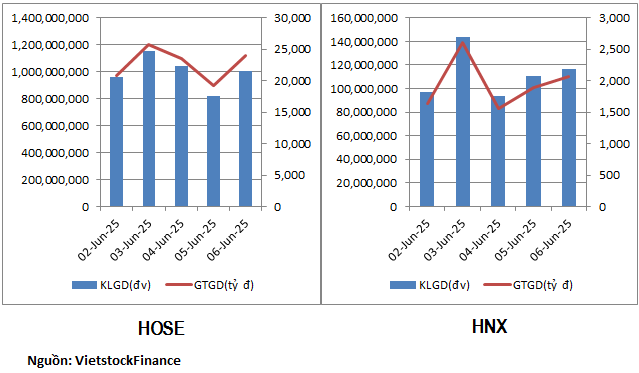

Stocks witnessed mixed performances during the first trading week of June. The HOSE witnessed a dip in both index and liquidity, while the HNX posted gains on both fronts.

Specifically, the VN-Index slipped by 0.2% to 1,329.89 points. The average trading volume on the HOSE dipped by nearly 1% compared to the previous week, settling at 997.7 million units per session. The average trading value decreased slightly by 0.6% to VND22.6 trillion per session.

On the contrary, the HNX-Index climbed by 2.4% to 228.61 points. Liquidity on this exchange surged compared to the previous week, with trading volume rising by nearly 17% to 112.2 million units per session. The trading value also increased by almost 24% to VND1.9 trillion per session.

|

Market liquidity overview for the week of 02/06/2025 – 06/06/2025

|

The real estate group witnessed a positive week with strong capital inflows. Many mid-and small-cap real estate stocks topped the list of stocks with the strongest liquidity growth during the past trading week. SCR, DRH, CCL, HAR, and DXS led the pack on the HOSE with over 100% increases in liquidity. Notably, SCR witnessed a surge in trading volume of over 200% to nearly 10 million units per session. DRH also witnessed a liquidity increase of more than 200%. Last week, SCR and DRH simultaneously broke out in terms of market price, with gains of nearly 20% and 30%, respectively.

On the HNX exchange, several real estate stocks also made it to the list of stocks with strong liquidity growth, including NRC and TIG.

Apart from the real estate sector, the construction and securities sectors also attracted modest capital inflows. CIG, HTN, CTI, C69, VC2, and MST were among the construction stocks that witnessed strong liquidity growth on both exchanges.

Securities stocks, mainly on the HNX exchange, such as VDS, MBS, PSI, EVS, and VIG, were among the top gainers in terms of liquidity.

On the other hand, the transportation group witnessed capital outflows. VOS, MHC, GMD, VTO, VSC, and VIP dominated the group of stocks with the sharpest declines in liquidity on the HOSE.

|

Top 20 stocks with the highest and lowest liquidity growth on the HOSE

|

|

Top 20 stocks with the highest and lowest liquidity growth on the HNX

|

The list of stocks with the highest and lowest liquidity growth is based on a minimum average trading volume of 100,000 units per session.

– 19:28 09/06/2025

Market Pulse, June 9: VIC, VHM Wipe Out Over 10 Points from VN-Index

The market closed with notable losses, as the VN-Index fell by 1.45% to 1,310.57, shedding 19.32 points. Likewise, the HNX-Index declined by 0.93%, or 2.12 points, settling at 226.49. The session was dominated by sellers, with 507 declining tickers against 228 advancing ones. Within the VN30 basket, 19 stocks retreated, 7 advanced, and 4 remained unchanged, echoing the broader market’s bearish sentiment.

The Cautious Cash Flow: Liquidity at a 21-Day Low, Foreigners Sell Over VND 500 Billion

The market witnessed a significant downturn during Monday’s morning session, with a sea of red and a sudden dip in liquidity. The VN-Index took a severe hit, retreating to just above the 1320-point mark, largely due to the substantial decline of two heavyweight stocks, VIC and VHM.

Market Beat: A Pulse Check on Investor Sentiment

The market witnessed a lackluster performance in the morning session, with no significant recovery efforts. The subdued participation of cash flow, coupled with persistent pressure from the pillar group, painted a gloomy picture. VN-Index hovered at 1,323.17 points, reflecting a 0.51% decline, while HNX-Index mirrored this sentiment with a 0.52% drop, settling at 227.42. The market breadth further emphasized the bearish trend, with 386 declining stocks outweighing the 222 advancing ones.