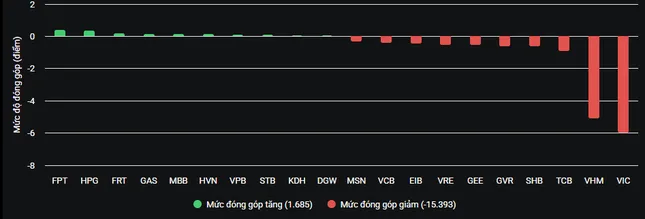

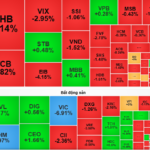

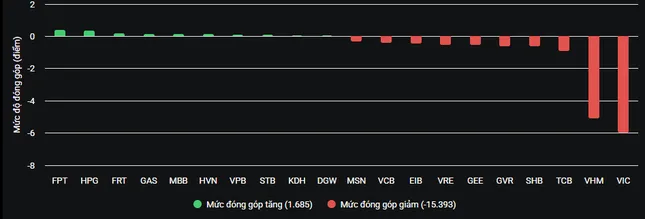

The Vietnamese stock market faced challenges due to pressure from large-cap stocks such as VIC and VHM. Both stocks plummeted, causing a combined loss of 11 points for the VN-Index. VRE also witnessed a 3.6% decline.

The negative performance of these two large-cap stocks occurred ahead of the foreign ETF’s portfolio restructuring. According to forecasts by MBS Securities, the ETFs are expected to sell around 15 million shares of VIC and VHM.

VIC and VHM’s slump wiped off a combined 11 points from the VN-Index.

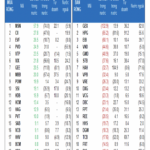

Specifically, the FTSE ETF will not add or remove any stocks from the FTSE Vietnam Index during this restructuring. However, as VIC currently accounts for 16.79%, exceeding the maximum limit of 15%, the fund will reduce its holdings of VIC, impacting VHM as well. It is anticipated that the FTSE ETF will offload over 2 million VIC shares and more than 2.5 million VHM shares. Conversely, SHB and EIB are expected to be purchased, with approximately 3.8 million and 1.4 million shares, respectively.

Regarding the VNM ETF, MBS also doesn’t foresee any changes in the portfolio, but there will be adjustments in holdings. The fund is expected to sell large volumes of VIC (7.2 million shares), VHM (5.1 million shares), VND (6.3 million shares), and VCI (3.5 million shares). On the buying side, stocks like EIB, HPG, and NAB are expected to be acquired.

The recent strong upward trend in VIC and VHM caused their weightings in the index basket to surpass the permissible limit, compelling the ETFs to downsize their holdings as per regulations.

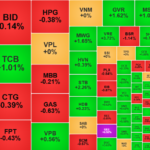

Beyond the Vingroup stocks, numerous other large-cap stocks witnessed simultaneous corrections. Sectors such as banking, securities, construction, materials, and chemicals were awash with red ink. More than 240 stocks declined, with the sea transportation group witnessing HAH hitting the floor price.

However, liquidity contracted during this corrective session, indicating that selling pressure wasn’t overwhelming. Domestic investors exercised caution, awaiting clearer signals before committing new funds, resulting in a slight slowdown in market inflows. The trading value on HoSE barely surpassed VND17,750 billion.

At the close, the VN-Index lost 19.32 points (1.45%) to finish at 1,310.57. The HNX-Index fell 2.12 points (0.93%) to 226.49, while the UPCoM-Index dropped 0.7 points (0.71%) to 98.19.

Foreign investors net sold over VND338 billion, focusing on SHB, HAH, VCI, PVD, and DIG, among others.

Stock Market Outlook for Tomorrow, June 10: Stocks to Face Continued Selling Pressure

The stock market on June 10 is expected to face continued pressure for adjustment. Investors should closely monitor the supply and demand of stocks.

Technical Recovery, But Is the Market Risking a “Bull-Trap”?

The VN-Index continued to be heavily influenced by a few key stocks, with VHM taking center stage today. Investors took advantage of the technical rebound to exit their positions, resulting in a gradual weakening of the market throughout the session. The VN-Index failed to reclaim the 1320-point threshold, while trading volume remained subdued.

Stock Market Blog: Buying Opportunities Not Yet “Ripe”

Today’s recovery momentum was quite positive, especially with the reversal witnessed in VIC and VHM. However, the rotation lacked clarity, liquidity was not robust, and there was a notable sell-off during the latter half of the afternoon session.