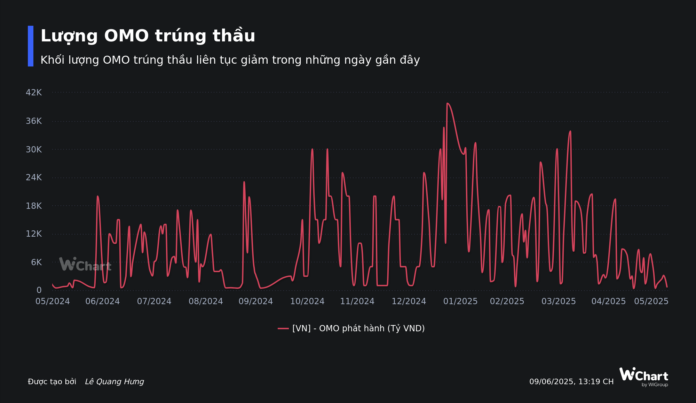

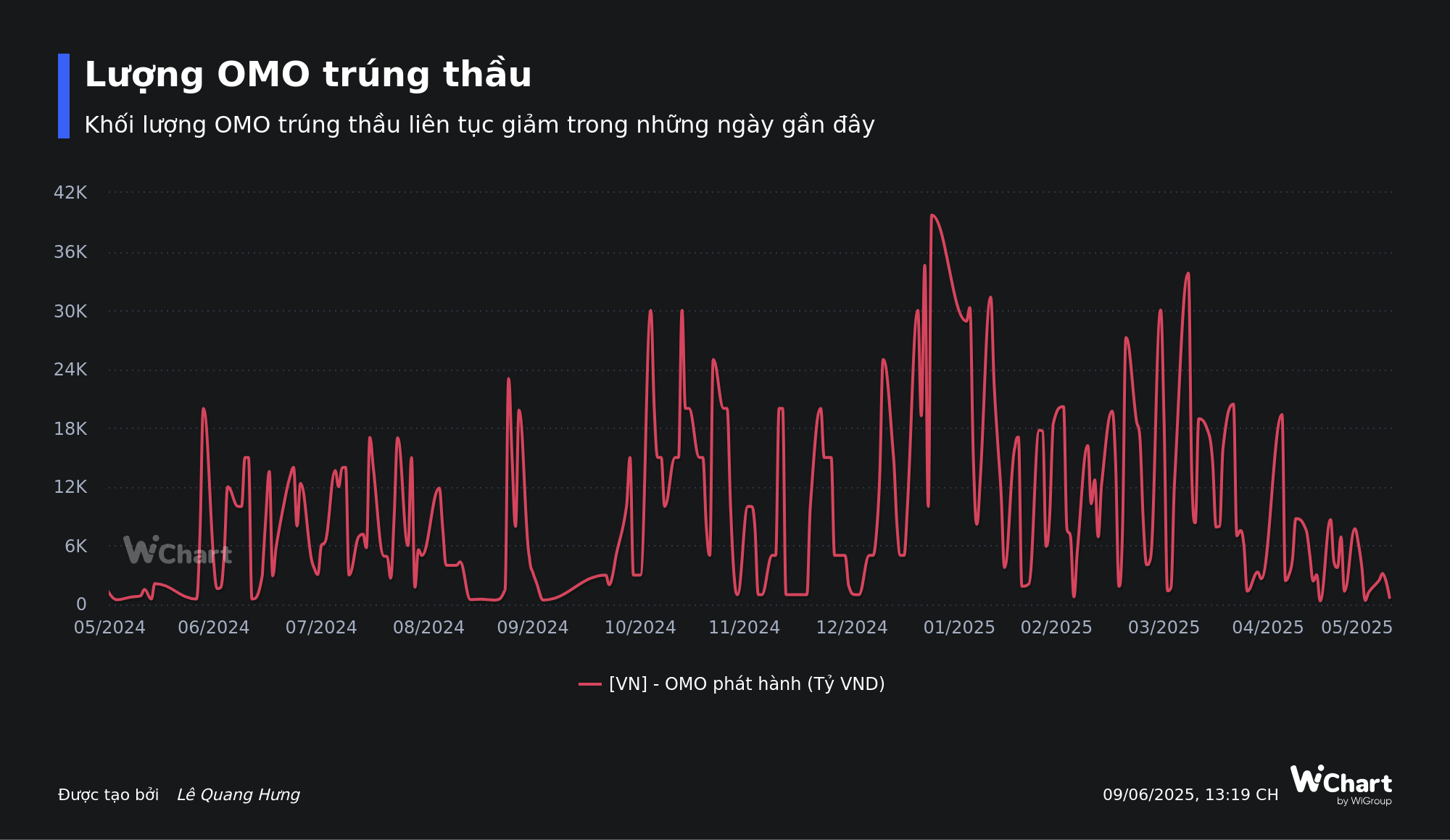

In the open market this past week (June 2–6), the State Bank of Vietnam (SBV) offered 140,000 billion VND in overnight, 7-day, 14-day, 35-day, and 91-day maturity loans at a fixed interest rate of 4.0%. However, only 6.33 trillion VND worth of bids were accepted across all tenors—the lowest amount in recent months. Notably, there were no successful bids in the auctions held on June 4 and 6.

Meanwhile, 21.36 trillion VND in bills matured last week in the secured lending channel, reducing the circulating volume to 34.932 trillion VND—the lowest level since the beginning of 2025. Overall, the SBV withdrew a net amount of nearly 15.03 trillion VND from the market through open market operations this past week.

In recent weeks, the low bid acceptance rates in the open market operations and the SBV’s consistent net withdrawal status indicate that the banking system has signaled ample VND liquidity. As a result, VND interbank interest rates for tenors of one month and below continued to decrease in most trading sessions last week. On June 6, the overnight, 1-week, 2-week, and 1-month VND interbank interest rates stood at 2.80% (down 0.28 percentage points from the previous week), 3.26% (down 0.62 pp), 3.64% (down 0.48 pp), and 4.04% (down 0.32 pp), respectively. Currently, VND interbank interest rates are at their lowest levels since the beginning of 2025.

The downward trend in VND interbank interest rates since the start of 2025 can be attributed to the SBV’s proactive and flexible management of open market operations to reduce market interest rates. This, in turn, has supported credit institutions in accessing low-cost capital from the SBV, enabling them to further reduce lending rates in line with the Government’s and Prime Minister’s directives.

Specifically, the SBV has gradually lowered the issuance interest rate of treasury bills while also reducing the issuance volume and eventually halting their issuance from March 5, 2025. These actions have sent a strong and positive signal about the SBV’s commitment to lowering market interest rates.

At the same time, the SBV has conducted open market operations with up to 91-day maturity to inject longer-term liquidity into the system. This has helped credit institutions provide timely capital for the economy’s production and business activities, contributing to a reduction in market interest rates.

According to the SBV, these measures aim to ensure that the banking system maintains a surplus in liquidity, strengthen the sentiment in the monetary market, and reduce interbank interest rates.

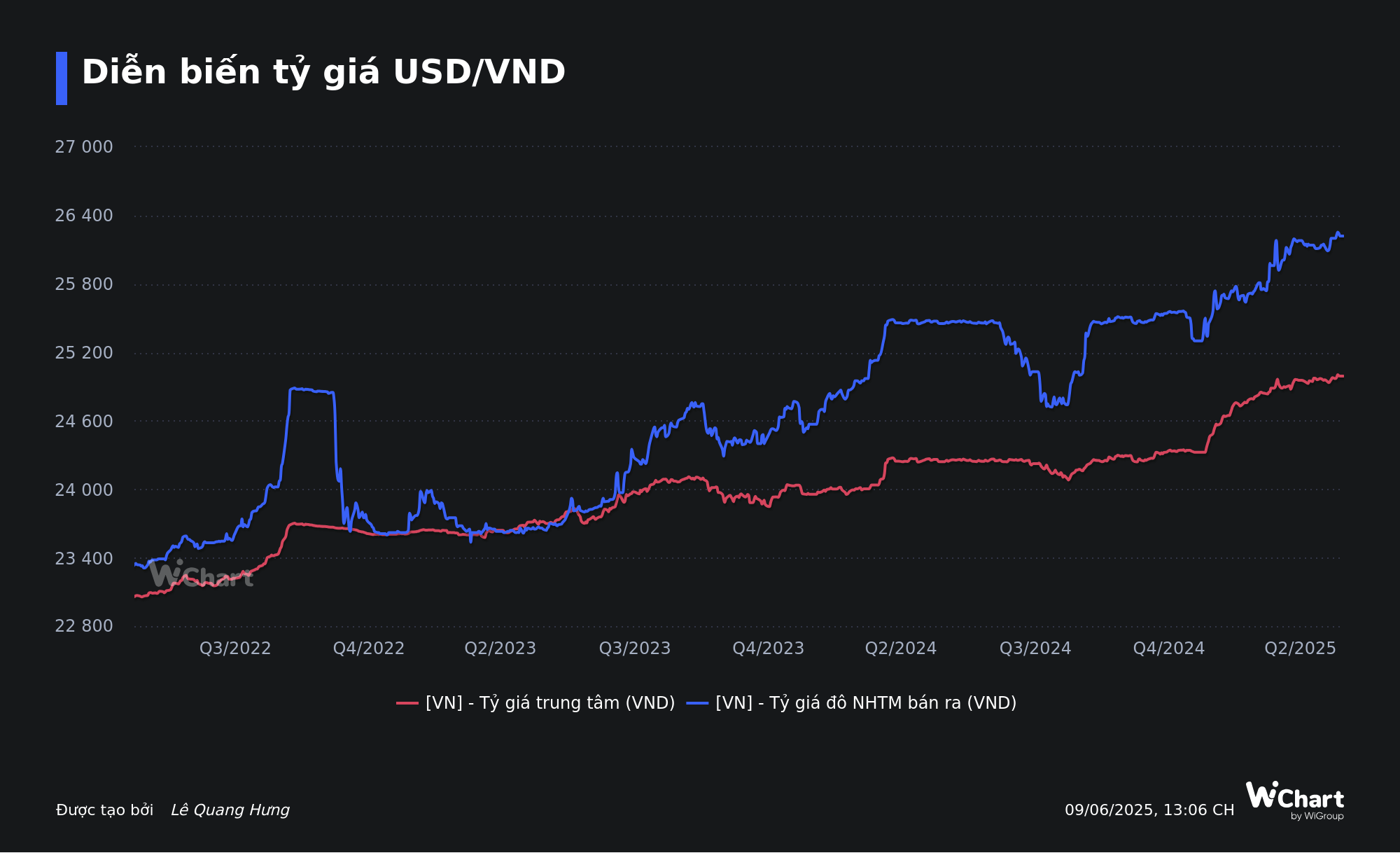

The decrease in interbank interest rates has supported the reduction of deposit and lending interest rates in the market. However, this has also exerted pressure on the USD/VND exchange rate, especially amid the negative impact of the Trump administration’s trade policies.

In fact, since the beginning of the year, the official USD exchange rate has maintained an upward trend. Last week, the central exchange rate surpassed the 25,000 VND mark for the first time on June 4, while the interbank exchange rate approached 26,100 VND. Meanwhile, USD rates at commercial banks have also increased, even reaching the allowed ceiling and remaining above 26,200 VND/USD. Since the beginning of the year, the central exchange rate has increased by 2.7%, and the USD rate at commercial banks has risen by 2.6%.

Notably, the VND has continued to depreciate against the USD despite the greenback touching a three-year low against other major currencies, with the DXY index falling by 9% since the beginning of 2025.

According to MBS Securities, the increase in the USD/VND exchange rate, despite the weakness of the US dollar in the international market, is mainly due to internal factors in Vietnam. Firstly, the exchange rate is under pressure due to the State Treasury’s continued purchase of USD from commercial banks, limiting the supply of foreign currency. Secondly, there is an increased demand for foreign currency from businesses amid global trade instability. Additionally, the deep cuts in VND interbank interest rates have caused the interest rate differential between VND and USD to turn negative, further adding pressure on the exchange rate.

As of June 6, VND interbank interest rates stood at: overnight (2.80%), 1-week (3.26%), 2-week (3.64%), and 1-month (4.04%).

USD interbank interest rates were: overnight (4.30%), 1-week (4.36%), 2-week (4.40%), and 1-month (4.42%).

Speaking at the conference on promoting credit growth in April, Ms. Mai Thi Trang, Deputy Director of the Monetary Policy Department, stated that the US administration’s announcement of a 46% import tax on goods from Vietnam poses a significant challenge to the SBV’s management of exchange rates and interest rates. However, the SBV remains committed to supporting credit institutions by providing timely liquidity and maintaining stable policy rates to create favorable conditions for reducing lending rates in the future.

The SBV has also implemented open market operations such as refinancing to provide long-term capital to credit institutions, helping them access low-cost funds to stabilize deposit interest rates and reduce lending rates.

According to the Deputy Director of the Monetary Policy Department, the SBV set a credit growth target of 16% for 2025. With this target, the banking system is expected to inject about 2 quadrillion VND into the economy, and the current outstanding credit of the economy has exceeded 16 quadrillion VND.

The representative from the Monetary Policy Department emphasized that the SBV will closely monitor and adjust the credit growth target promptly to meet the needs of credit institutions. Therefore, credit institutions need not worry about liquidity or credit room but should focus on implementing solutions to stabilize deposit interest rates and reduce lending rates.

Optimizing the Gold Market: Starting with Transparency

After 13 years, Decree No. 24/2012/ND-CP on the management of gold business activities remains pertinent in removing gold from the banking credit system and preventing the “goldification” of the economy. However, the question of how to channel these resources into productive business ventures rather than hoarding and clandestine transactions remains unanswered.

Is Cheap Credit Always a Good Idea for Home Buyers?

Mortgage interest rates are at an all-time low for young people under 35, with some banks offering rates as low as 3.88% per annum and loan periods of up to 40 years. As a result, the outstanding balance of housing loans has improved since the beginning of the year.

“Masan MeatLife to Receive $16 Million in Dividends from Subsidiary, Investing in Meat Processing and Preservation Enterprise.”

Masan MeatLife JSC (UPCoM: MML) is planning to transfer its undistributed profit of VND 380 billion from MML Farm Nghe An Ltd. by December 31, 2025, at the latest. Concurrently, the Company has approved a plan to contribute a maximum of VND 380 billion to MEATDeli HN Ltd., also to be finalized by the same date.

A Fresh Start: Reviving the Quang Ngai Interchange Project After Six Years

After more than 6 years of stalled construction, the Dung Quat – Tri Binh Interchange, connecting the Danang – Quang Ngai Expressway, has finally been revived and is back on track.