Illustration: TB

From 2020 to 2022, Vietnam’s real estate market witnessed a boom, especially in the apartment segment in major cities. Many young families, with the hope of settling down early, opted for bank loans to purchase properties, with repayment periods ranging from 15 to 20 years. Attractive loan packages with low-interest rates, along with the belief that incomes would rise through new business models such as online sales, dropshipping, or livestreaming, fueled this decision.

However, the global economic fluctuations following the Covid-19 pandemic, coupled with supply chain disruptions in some sectors, directly impacted the incomes of many households. Simultaneously, bank interest rates started to climb back up from mid-2024 after the initial promotional period, leaving many families financially strained.

In Nam Tu Liem, Hanoi, 28-year-old Bui Thi Le, a native of Nam Dinh, shared that in 2020, she and her husband took out a 1 billion VND loan from the bank to purchase a 32 sqm studio apartment for 1.4 billion VND, with a 20-year repayment period. With a bank interest rate of 10% per annum, she has to pay approximately 8.3 million VND in interest alone each month.

“When my online business was doing well, repaying the loan wasn’t much of a burden. But now, with changing economic circumstances, tighter controls on input and output of goods, and declining incomes, the loan interest has become a significant pressure. We have decided to sell our apartment at a price 200 million VND lower than the market price in 2024, but we haven’t found a buyer yet.”

Another case is that of Nguyen Tuan Anh, a 32-year-old IT employee living in Gia Lam, Hanoi. In 2021, with savings of 500 million VND, he and his wife purchased a 2.5 billion VND apartment, taking out a 2 billion VND loan from the bank. They were paying around 16.6 million VND in interest per month. However, post-pandemic, with reduced income, he had to rent out the apartment for 8.5 million VND per month and move into a cheaper rental himself to save costs. Recently, they also decided to put the apartment up for sale.

Similarly, Le Thuy Tinh, a 31-year-old resident of Hoang Mai district in Hanoi, shared that she bought a 72 sqm apartment in mid-2024 – right at the peak of the market. With a purchase price of 3.5 billion VND, she borrowed a significant portion from the bank. But just a few months later, the revenue from her online store plummeted. “Even though I’m selling it at a loss of 300 million VND, my apartment remains stagnant on the market,” she added.

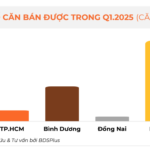

According to data from the online real estate exchange platform batdongsan.com.vn, a new urban area in Gia Lam district, Hanoi, currently has around 800 apartments listed for sale, while another new urban area in Tay Mo, Nam Tu Liem, has approximately 700 apartments on the market. Notably, many of these listings are advertised as “loss-cutting” sales. These are two new urban areas with a significant number of young families.

Economist Dr. Nguyen Anh Thi, a lecturer in Finance at the International University Linkage of Latrobe, commented that owning a home is a legitimate aspiration, especially for young families seeking stability. However, the decision to buy a property should be carefully considered based on actual income and long-term financial capacity.

“Homebuyers should maintain a loan-to-value ratio of less than 50%. If they have to borrow up to 70%, they need to thoroughly assess the risk factors because even a minor income fluctuation can push a family into a difficult situation,” advised Dr. Thi. He also pointed out that floating interest rates and gradually increasing living expenses over time should be factored into a “worst-case scenario” to avoid surprises.

“The phenomenon of many families being forced to sell their homes due to financial exhaustion is not just a personal issue but also raises broader concerns about consumer credit policies and risk management. Consumers need to shift their perception that real estate prices will always increase and that they can successfully ‘ride the wave.’ Investing in a property beyond one’s financial means is a choice that always carries significant risks,” analyzed Dr. Tran Phuong, from the LSE Strategic Economics Institute.

Dr. Tran Phuong also recommended that young families who have purchased apartments with long-term payments but are facing financial imbalances should promptly reassess their entire financial capacity to devise concrete solutions. “The top priority is to stabilize cash flow and not let the loan become a prolonged psychological burden and financial strain. If options like finding a bank with the best interest rates, temporarily renting out the apartment, restructuring expenses and income, etc., are not feasible, consider selling the apartment to reduce the pressure. It’s not necessary to hold on to the property at all costs. What’s crucial is maintaining financial health to be able to buy again later under better conditions,” emphasized Dr. Phuong.

Mr. Nguyen Van Tien, from the VIC real estate floor, opined that, in the short term, the secondary market might continue to face downward price pressure. However, in the long run, this could be an opportunity for the real estate market to restructure toward more substantial growth, aligning with the actual income and purchasing power of the population. “For young families, instead of chasing the ‘dream of owning a home at all costs,’ building a solid financial foundation, stabilizing income, and having a reasonable spending plan are the keys to ensuring financial security in the decision to own their dream home,” Mr. Tien expressed.

“Real Estate Businesses: Don’t Exploit Supply Scarcity to Manipulate Prices”

Dr. Nguyen Van Khoi, Chairman of the Vietnam Real Estate Association, has urged real estate businesses to refrain from exploiting the scarcity of supply to manipulate selling prices. He emphasized the importance of adhering to the government’s directives on price control and stabilizing the real estate market.

The Economy’s Upward Trend: Why Luxury Condos Are the Smart Investor’s Choice

“Hanoi and Ho Chi Minh City have always been alluring destinations for foreign investors, and this has sparked a high demand for luxury apartments in these vibrant cities.”

Danang’s Real Estate Market Heats Up: Luxury Apartments Starting from VND 800 Million Now on Sale

“The Danang Department of Construction announced on May 27th that they will be releasing a new batch of affordable housing units for sale at the An Trung 2 Apartment Complex in the Son Tra district. These units are aimed at providing quality housing options for low-income individuals and families in the area.”

“MIK Group Unveils Exclusive MIK Signature Privileges”

MIK Group is not just a leading real estate developer, but a visionary that puts the customer experience at the heart of its strategy. With the introduction of MIK Signature Privileges, an exclusive program of comprehensive privileges tailored for owners of their luxury properties, the group is elevating the standard of living for its esteemed clientele. This is a testament to MIK Group’s commitment to creating not just impressive projects, but also to crafting exceptional experiences that leave a lasting impression.