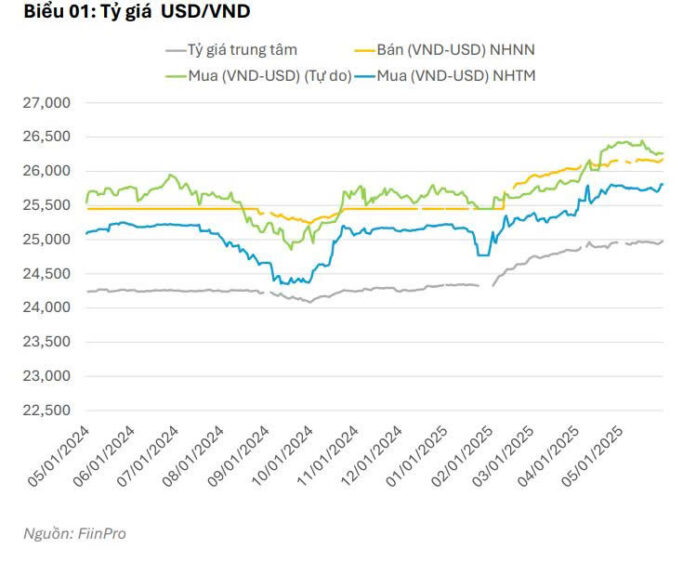

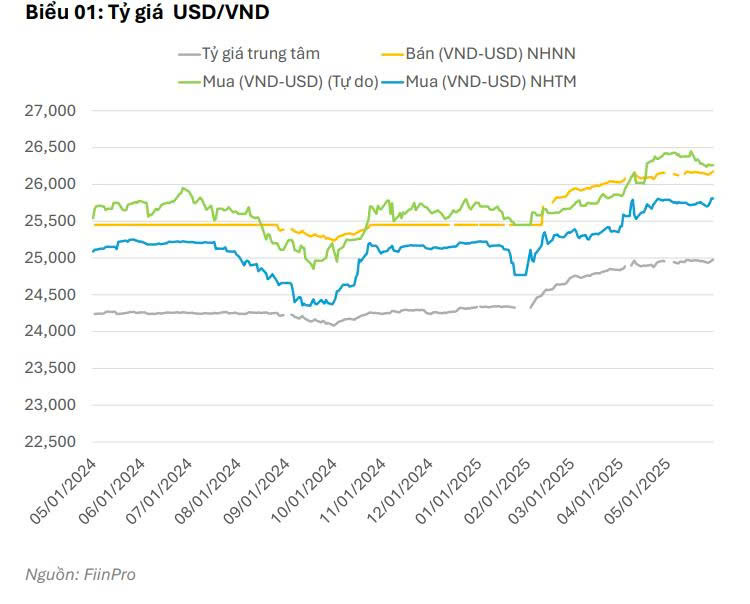

In the recently released May bond report, Fiin Ratings stated that the USD/VND exchange rate remained high due to increased domestic USD demand from businesses and the State Treasury, further constraining supply. Meanwhile, the State Bank of Vietnam (SBV) flexibly adjusted the mid-rate to allow the market more self-regulation.

According to Fiin Ratings, the DXY index recovered in May due to positive developments in trade negotiations between the US, UK, and China. However, this upward trend was short-lived as Moody’s downgrade of the US national credit rating and rising policy uncertainties pressured the currency.

In the domestic market, USD demand surged as businesses ramped up imports of raw materials to rush order completion before the 90-day deadline and stock up for the peak season. Vietnam’s import turnover in the first five months reached USD 175.6 billion, up 17.5% year-on-year, with production inputs accounting for 93.8%. Imports from the US rose to USD 7.2 million, a 25% increase year-on-year, a move to ease potential tariff barriers and alleviate exchange rate pressure.

The State Treasury’s continued USD purchases to service foreign debt payments further tightened USD supply in the market. Despite a slight downward trend, the exchange rate remained high in May. The SBV proactively adjusted the mid-rate higher. Going forward, a predicted weakening of the US dollar may ease exchange rate pressure, allowing the SBV to widen the ceiling range for self-regulation instead of direct intervention using foreign reserves.

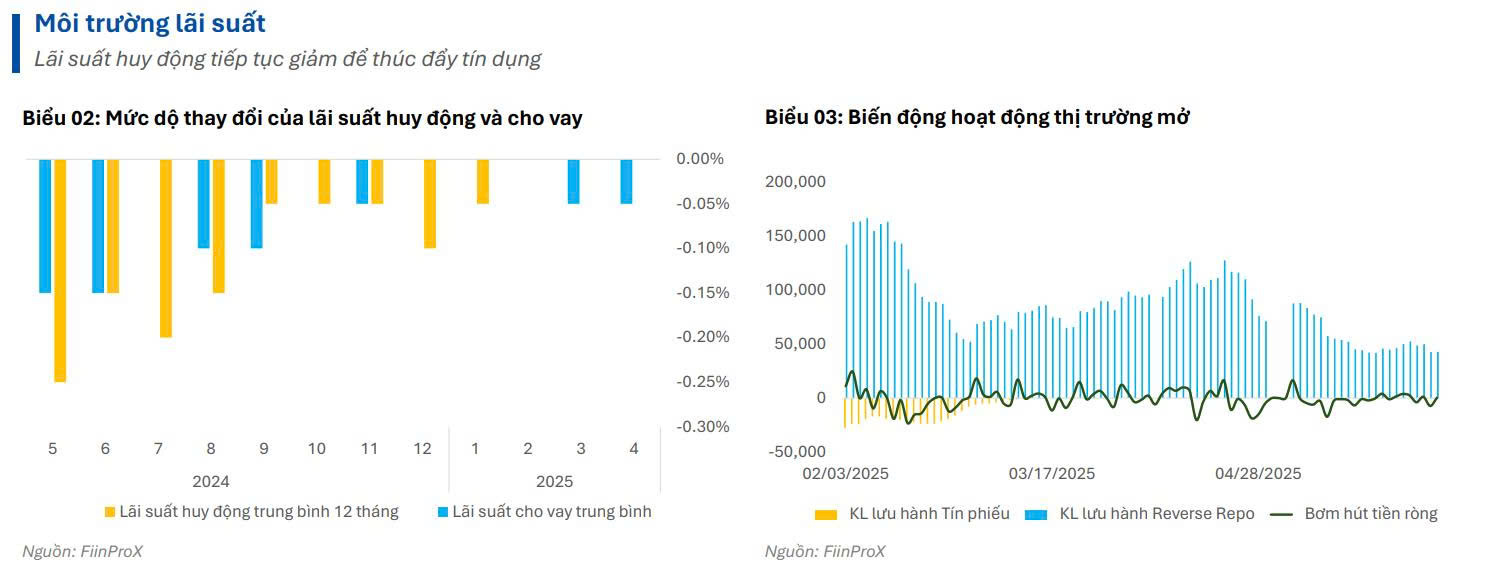

On interest rates, Fiin Ratings noted that the downward trend in deposit interest rates has slowed as some banks have started to raise rates again. Credit growth in the first four months increased by 4.27% year-on-end due to the attractive borrowing conditions created by the low-interest-rate environment.

After the interbank interest rate dropped significantly to 2.54%, the SBV scaled back open market operations (OMO) injections, resulting in maturing funds exceeding new injections. However, the SBV resumed net injections of approximately VND 100.2 trillion (-54.5% mom) as interbank rates rebounded, with total OMO outstanding from the beginning of the year to May 30 at VND 50 trillion. In May, the interbank market was generally liquid, with the overnight interbank rate fluctuating between 3.78% and 3.92% and ending the month at 3.10%.

“We believe that the room for further reductions in deposit and lending rates is narrowing amid the risk of US tariffs on Vietnamese exports (expected at 20-30%). Additionally, the Fed’s delay in cutting interest rates to counter inflation may contribute to sustained exchange rate pressure in the near term,” Fiin Ratings forecasted.

Stable Deposit Interest Rates for Early June

As of early June, interest rates at banks have stagnated, with only a handful of institutions opting for a slight reduction in savings deposit rates.

The Dollar’s Descent

Last week (June 2–6, 2025), the US dollar weakened in the international market as a slew of new data signaled a slowdown in US economic growth, putting downward pressure on the greenback.