In preparation for the upcoming 2025 Annual General Meeting to be held on June 16, TNH Hospital Group Joint Stock Company (TNH: MCK) has announced its nominees for the Board of Directors for the term 2025-2030.

Specifically, Access S.A., SICAV-SIF – Asia Top Picks, a Luxembourg-based fund that currently holds 10.1% of TNH’s chartered capital, has nominated Ms. Nguyen Thi Thuy Giang (born in 1984) to the Board.

Ms. Giang is a graduate of the National Economics University, specializing in Corporate Finance. She is also a member of the Association of Chartered Certified Accountants (ACCA) and a Certified Member of the Vietnam Institute of Directors (VIOD).

With several years of experience at Deloitte Vietnam and SSI Securities Corporation, Ms. Giang was elected to the Board of Directors of TNH Hospital at the 2024 Annual General Meeting. Additionally, she serves as the Chief Inspector of Bac Giang LGC Garment Corporation and a member of the Credit Rating Committee of S&I Credit Rating Joint Stock Company.

As of the end of the first quarter of 2025, the TNH Hospital Board of Directors for the term 2020-2025 comprised nine members: Chairman Hoang Tuyen, Vice Chairman Le Xuan Tan, and members Nguyen Van Thuy, Vu Hong Minh, Tran Thien Sach, Ly Thai Hai, Ngo Minh Truong, Nguyen Thuy Giang (all appointed in June 2024), and Romeo Fernandez LeIdo (appointed in December 2024).

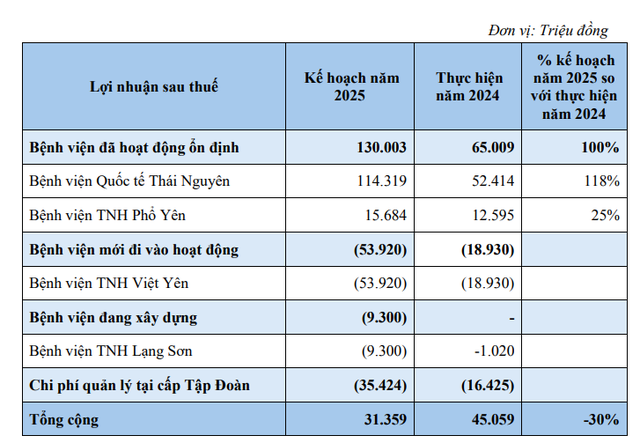

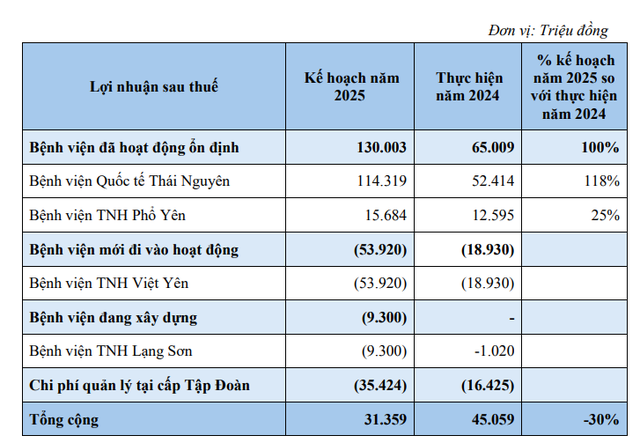

According to previously released documents, TNH Hospital plans to present its 2025 business plan to shareholders, targeting a revenue of 620 billion VND, a 40% increase from the previous year. However, the net profit target is 31.3 billion VND, a 30% decrease.

For 2025, TNH aims for higher revenue growth contributed by both established and newly operational hospitals. However, the net profit is expected to decrease mainly due to the new hospitals not yet being profitable.

Specifically, this year, TNH Vietnam Yen Hospital is projected to incur a loss of 53.9 billion VND, and the hospital under construction is expected to lose 9.3 billion VND. Additionally, there will be 35.4 billion VND in management expenses at the group level.

Source: TNH

In 2025, the company will continue to invest in equipment and deploy new technical services across its three operational facilities, meeting the needs of residents in Thai Nguyen, Bac Giang, and neighboring provinces. TNH will also focus on effective revenue and expense management to ensure stable and growing profits from business operations after the opening of TNH Vietnam Yen Hospital.

Simultaneously, the company will proceed with its investment projects, including the TNH Lang Son Hospital, the Thai Nguyen International Hospital Phase 3, the TNH Pho Yen Hospital Phase 2, and the hospital in Danang.

Previously, TNH Hospital fell short of its 2024 business plan. Specifically, TNH’s net revenue reached over 440 billion VND, achieving 81.5% of the set plan, while net profit for 2024 only attained 29.1% of the target.

Last year, the company dedicated its resources to the operation of the TNH Vietnam Yen Hospital project, starting November 1, 2024. Additionally, the Thai Nguyen International Hospital and TNH Pho Yen Hospital were impacted by the prolonged Typhoon No. 3 Yagi in the third quarter of 2024, resulting in a decrease in the number of patients seeking treatment and affecting the year’s revenue.

TNH Hospital continued to face challenges in the first quarter of 2025. According to the consolidated financial statements for the first quarter of 2025, TNH Hospital generated 93 billion VND, a slight increase from the same period last year.

However, the cost of goods sold surged by 54% to 100.9 billion VND, resulting in a gross loss of 7.5 billion VND, compared to a gross profit of over 27 billion VND in the previous year.

Additionally, financial expenses for the period amounted to 10.8 billion VND, triple that of the same period last year, mainly due to interest expenses. Selling expenses reached 1.1 billion VND, and management expenses totaled 15 billion VND, increasing by 82% and 2.5 times, respectively, compared to the first quarter of 2024.

Consequently, TNH Hospital incurred a net loss of 34.8 billion VND in the first quarter of 2025, compared to a net profit of 15 billion VND in the same period last year.

The Penultimate Powerhouse: A Dynamic Duo’s Departure on the Eve of the Annual General Meeting

“Ahead of the 2025 Annual General Meeting, Mr. Ho Duc Toan and Mr. Bui Duc Hoan have tendered their resignations from their positions as Members of the Board of Directors of the Danh Khoi Group. The resignations come as a surprise to many, as the duo has been instrumental in the company’s growth and success over the years.”

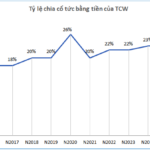

“TCW shareholders approve a cash dividend of VND 2,300 per share”

“Tan Cang Warehousing Joint Stock Company (UPCoM: TCW) announces that June 18th is the ex-dividend date for the 2024 cash dividend. The dividend will be paid at a rate of 23%, equivalent to VND 2,300 per share.”