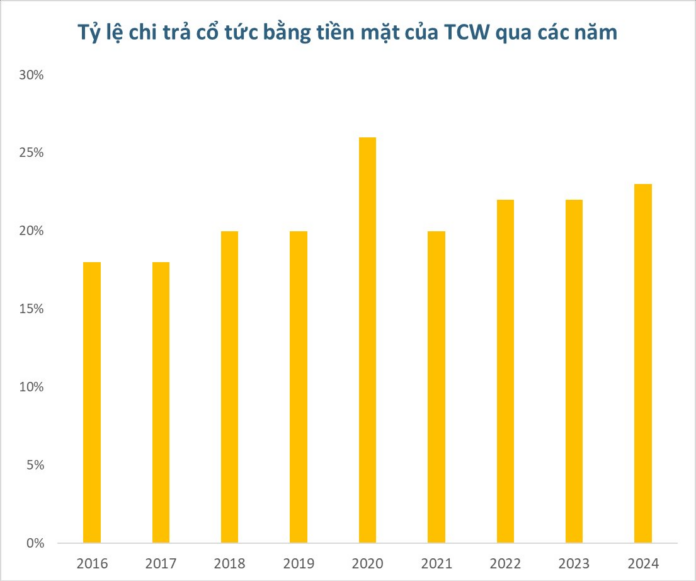

On June 19, Tan Cang Port Joint Stock Company (code: TCW) will finalize the list of shareholders to distribute cash dividends for 2024. The implementation ratio is 23%/share, equivalent to VND 2,300 per share held by shareholders.

With nearly 20 million shares circulating, TCW expects to spend approximately VND 46 billion on dividend payments. The expected payment date is June 30, 2025. As of the end of the first quarter of 2025, Tan Cang General Company Limited holds 59% of TCW’s charter capital and is expected to receive more than VND 27 billion in dividends this time.

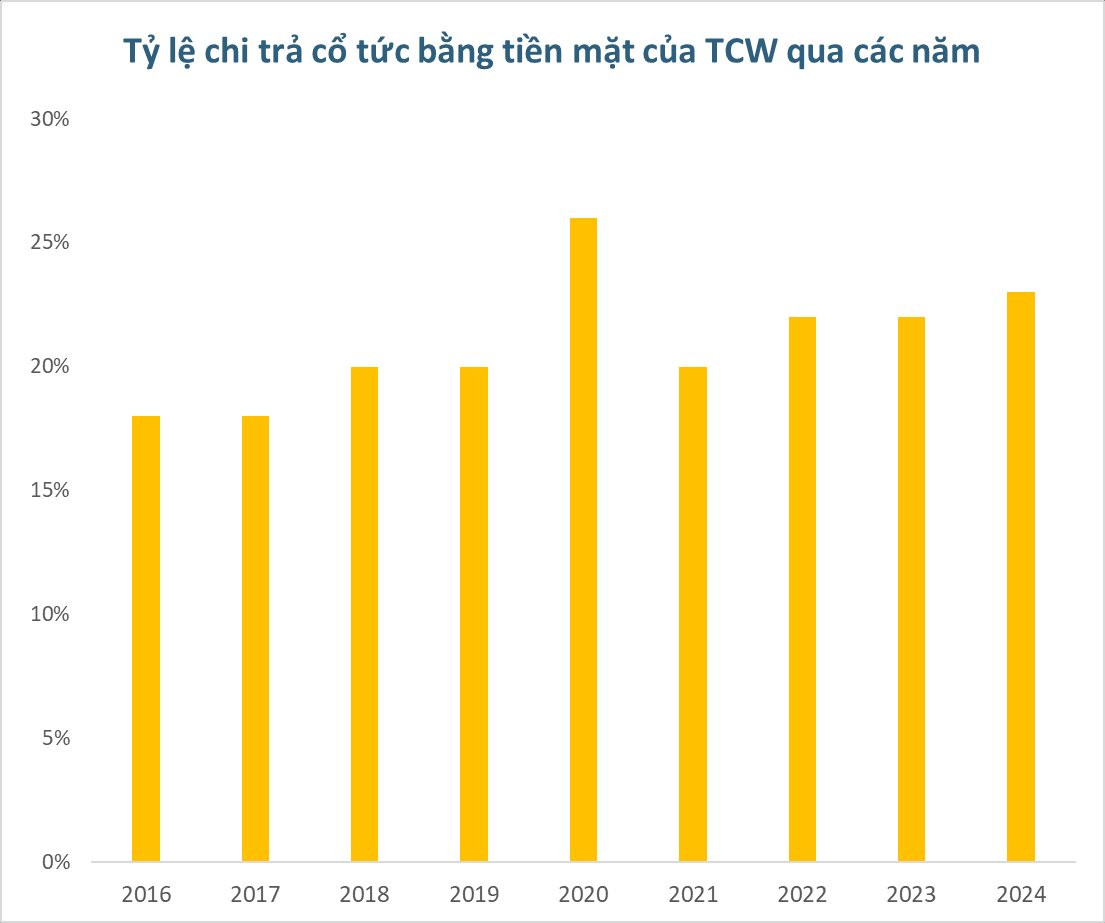

TCW has a tradition of consistently paying dividends, and the 23% ratio for 2024 is the highest in the last four years, second only to the 26% rate in 2020.

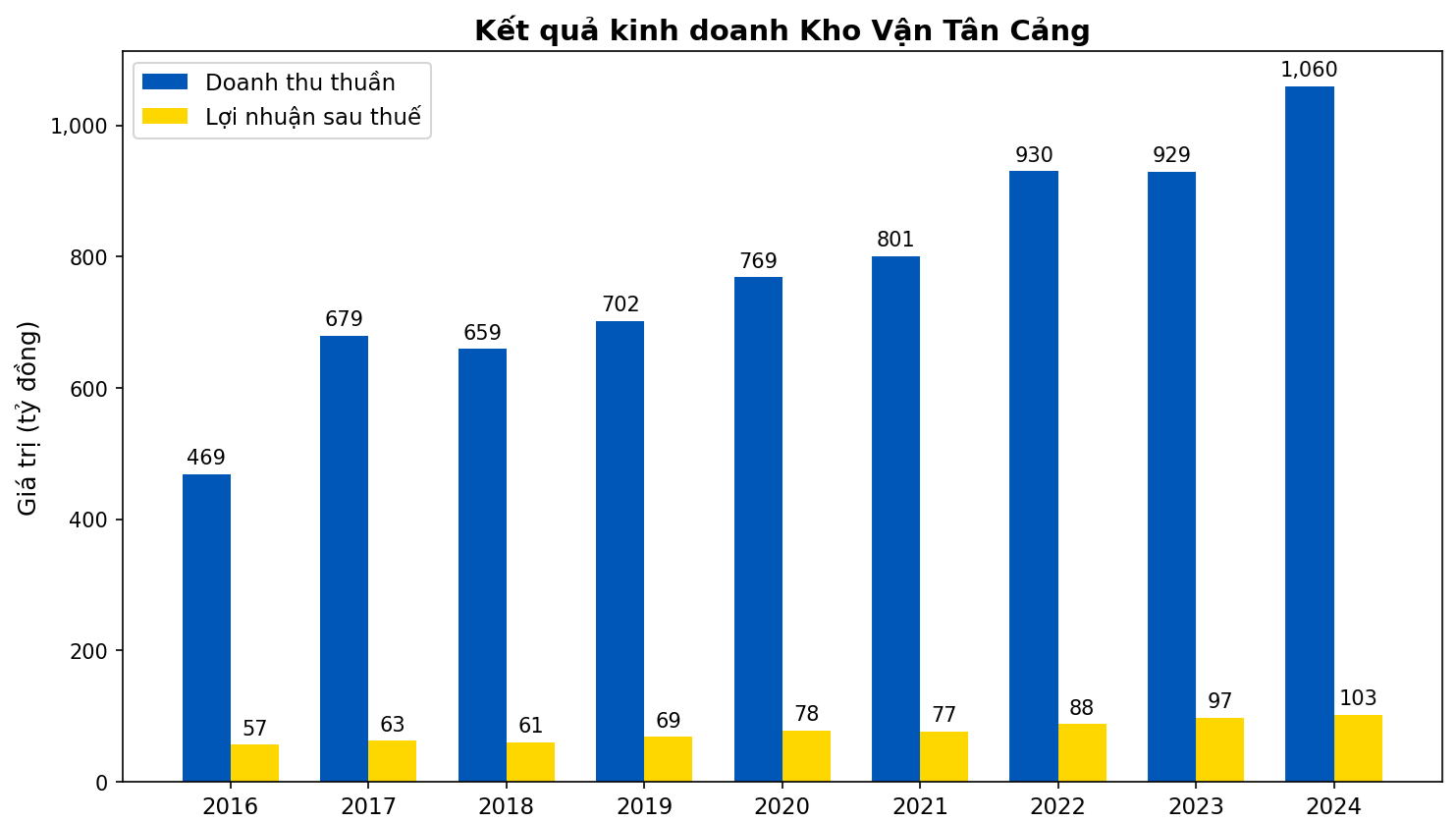

The business performance in the past year was relatively positive, with the highest revenue and net profit since its establishment. Specifically, TCW recorded VND 1,060 billion in net revenue for the whole of 2024 and VND 103 billion in PAT, up 14% and 6%, respectively, compared to the previous year.

In 2025, TCW foresees several challenges, including intense competition in port operations and logistics services, fluctuating material and fuel prices, natural disaster risks during the rainy season, and global geopolitical instability that could disrupt supply chains, increase production costs, and impact output.

Consequently, TCW has cautiously set its business plan, targeting revenue of over VND 1,136 billion and after-tax profit of more than VND 109 billion, a modest growth of about 6-7%.

In the market, TCW closed at VND 33,800/share on June 10.

“TCW shareholders approve a cash dividend of VND 2,300 per share”

“Tan Cang Warehousing Joint Stock Company (UPCoM: TCW) announces that June 18th is the ex-dividend date for the 2024 cash dividend. The dividend will be paid at a rate of 23%, equivalent to VND 2,300 per share.”

Aerial Enterprise Allocates 60% Dividend Payout in Cash, Prepares for Takeoff on the “$16 Billion Mega Project”

Introducing a dynamic enterprise that is soaring to new heights; with an impressive performance in 2024, this business is taking off. The company has proposed a generous cash dividend, reflecting its financial prowess and confidence in its future endeavors. This year, one of its key objectives is to forge a strategic partnership with ACV in operating a cargo terminal at the prestigious $16 billion airport project. With meticulous preparation, this enterprise is poised to take flight, reaching new horizons of success.

Stifled by Land Procedures, Businesses Scrap Plans

The process of dissolving a business in Ho Chi Minh City has been fraught with challenges, according to the local business association. The procedure is often time-consuming, especially for those businesses deemed to pose tax risks, resulting in a peculiar predicament where businesses are “dead but cannot be buried.”