The “Tariff Liberation Day” Twist

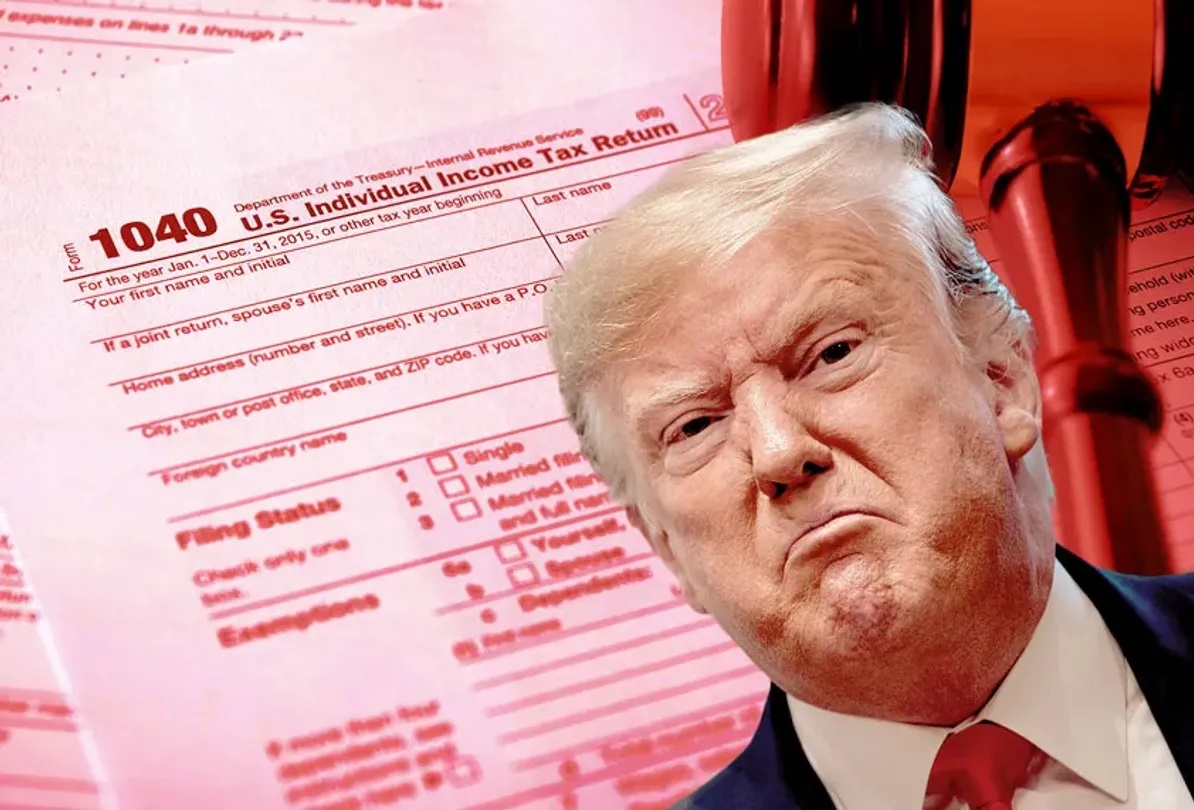

On April 2, 2025, President Donald Trump dubbed the day as “Tariff Liberation Day,” as he announced the imposition of reciprocal tariffs on almost all of America’s trading partners. The unexpected move saw tariffs as high as 10% on most imported goods, effective April 5, 2025, with even higher tariffs for countries with significant trade surpluses with the US, such as 34% for China, 20% for the EU, 25% for South Korea, 32% for Taiwan, and a staggering 46% for Vietnam.

Trump’s Tariff Turmoil

|

The announcement sent shockwaves through global stock markets, with the Dow Jones plunging over 1,100 points on April 2 and continuing its freefall on the next trading day, resulting in one of the worst days for Wall Street since the COVID-19 pandemic. The S&P 500 and Nasdaq Composite also suffered their worst losses since March 2020, as investors worldwide reacted to the news.

| Dow Jones plunged by nearly 1,700 points following Trump’s tariff announcement |

|

Source: VietstockFinance

|

| Similarly, the Nasdaq… |

|

Source: VietstockFinance

|

Major indices around the world mirrored the downward trend, with Europe’s DAX, FTSE 100, and CAC 40, as well as Asia’s Nikkei 225, Hang Seng, KOSPI, and Shanghai Composite, all experiencing significant losses. The Nikkei 225 shed 2.77%, or nearly 990 points, on April 3, while the DAX dropped 3.01%, or over 673 points.

| …and the Nikkei 225 took a hit |

|

Source: VietstockFinance

|

April 3, 2025, became a historic trading day in Vietnam as the VN-Index witnessed its biggest single-day point drop, plunging 87.99 points, or 6.68%, to close at 1,229.84. A sea of red flooded the exchange, with only 13 gainers compared to 352 losers. Foreign investors joined the sell-off, net-selling a massive 5.73 trillion VND worth of shares during the session.

Global Reactions

Trump’s tariffs sparked varying responses from affected countries, with some opting for negotiations and others retaliating in kind. On April 4, Beijing announced plans to impose 34% tariffs on all US products, while the EU passed new trade countermeasures targeting American industrial and agricultural goods worth around €26 billion ($28 billion). Canada struck back with 25% tariffs on American auto imports and targeted $30 billion CAD worth of US goods, with plans to expand their measures further.

These reactions fueled fears of a full-blown trade war, exacerbating the downward spiral in financial markets and exacerbating investor losses. On April 4, the S&P 500 and Nasdaq continued their freefall, shedding nearly 6% each, while the DAX dropped 4.95% and the Nikkei 225 lost 2.75%. The VIX, often dubbed the “fear index,” surged to elevated levels during the session.

However, negotiations yielded results. On April 9, the Trump administration unexpectedly announced a 90-day delay in implementing the higher reciprocal tariffs for most countries (excluding China), while maintaining the previously announced 10% minimum tariff.

This news brought a sigh of relief to markets worldwide. In the US, the S&P 500, Dow Jones, and Nasdaq Composite posted one of their strongest daily gains in history, surging 9.52%, 7.87%, and 12.16%, respectively, on April 9. The Shanghai Composite and Hang Seng Index also climbed, rising 1.58% and 1.51%. Meanwhile, the DAX and Nikkei 225 closed lower due to time zone differences and delayed reactions.

| Dow Jones breathed a sigh of relief as Trump delayed tariffs |

|

Source: VietstockFinance

|

| Similarly, the Nasdaq rebounded |

|

Source: VietstockFinance

|

Moving Past the Fear

Despite the 90-day tariff delay, tensions escalated between the world’s two largest economies as Trump raised tariffs on Chinese goods to 125% and then to 145% on April 10. In response, Beijing imposed a 125% tariff on American goods and asserted that it would “ignore” any further US tariff hikes.

Consequently, the Dow Jones tumbled more than 1,400 points on April 10, with the S&P 500 falling 2.9%. The Nikkei 225 and DAX initially rose due to time zone differences but reversed course the following session. Conversely, the Shanghai Composite and Hang Seng remained resilient, continuing their upward trajectory despite the tariff tensions.

| Dow Jones tumbled again as trade tensions escalated |

|

Source: VietstockFinance

|

| Hang Seng remained resilient amid tariff tensions |

|

Source: VietstockFinance

|

On May 12, the two economic giants reached a temporary agreement, with the US agreeing to reduce tariffs on Chinese goods from 145% to 30% (including the existing 20% tariff and a new 10% base tariff), and China reciprocating by lowering tariffs on American goods from 125% to 10%. Global stock markets reacted positively to this development, with S&P 500 futures rising over 2% and the Hang Seng climbing nearly 3%.

In parallel, the US engaged in bilateral negotiations with several key trading partners, including the UK, Japan, South Korea, India, and Vietnam, to resolve tariff disputes. Notably, a trade deal between the US and the UK was signed on May 8, with the US reducing tariffs on cars, steel, and aluminum from the UK, and the UK eliminating tariffs on American ethanol. These positive developments, coupled with markets absorbing much of the initial shock, fueled a recovery rally.

| Dow Jones quietly climbed higher after the initial tariff shock |

|

Source: VietstockFinance

|

| The CAC 40 also joined the recovery |

|

Source: VietstockFinance

|

Major stock markets worldwide gradually recovered, and by mid-May (as of May 16), they had almost recouped all their losses from the record-breaking sell-off. However, uncertainties and risks remain, as evidenced by Trump’s recent decision to halt negotiations due to the sheer number of ongoing trade talks, with new tariff announcements expected in the coming weeks.

– 08:07 11/06/2025

The Price of Gold Soars to a 3-Week High as the US Dollar Plunges and SPDR Gold Trust Maintains its Buying Spree.

The primary catalyst for this rally in gold prices is the weakening of the US dollar, which has plummeted to a six-week low.

The Hottest Stock on the Block Unveiled

The regional stock markets surged following the news of a US court blocking Trump’s tariff plans. However, the VN-Index struggled to maintain its peak performance this year due to profit-taking pressures, resulting in a return of bearish sentiment. Novaland’s NVL stock surprised, while SHB consistently topped the stock exchange in liquidity, trading over VND 1,000 billion on May 29th.