The company plans to issue shares to pay dividends for the years 2018, 2019, 2020, 2021, and 2024, with a combined ratio of 75.1%. Additionally, they will issue shares to increase capital from equity (share bonus) at a rate of 83.9%. After the issuance, the company’s charter capital will increase from 1,148.5 billion VND to 2,974.7 billion VND.

The source of capital for the share issuance to pay dividends will come from undistributed profits on the consolidated financial statements for 2024, expected to be 862.56 billion VND. For the share bonus scheme, the capital will come from the investment fund (nearly 745 billion VND) and capital surplus (218.8 billion VND).

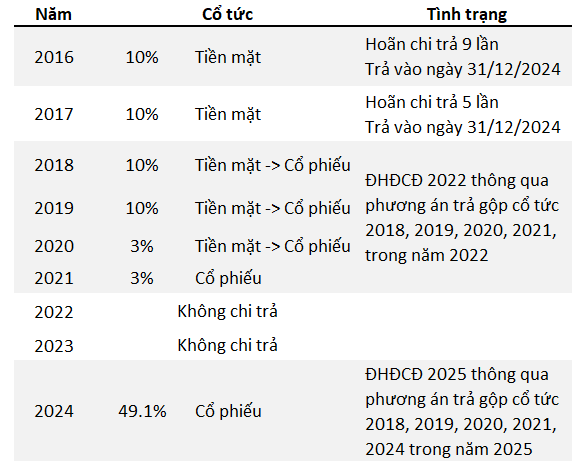

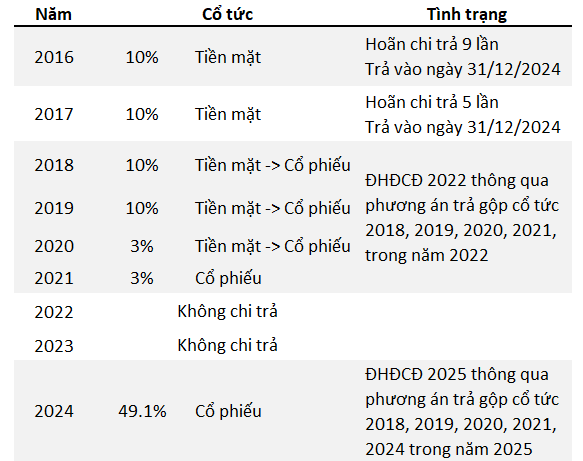

Dividends for the years 2018, 2019, 2020, and 2021 had a ratio of 26%, while the dividend for 2024 was 49.1%.

This cumulative dividend is based on SJS‘s history of paying dividends over the past few years. Specifically, the 2019 General Meeting of Shareholders approved a 10% cash dividend (nearly 114 billion VND) from 2018 post-tax profits. The 2020 General Meeting of Shareholders approved a 10% cash dividend (nearly 114 billion VND) from 2019 post-tax profits, and the 2021 General Meeting of Shareholders approved a 3% cash dividend (34.1 billion VND) from 2020 post-tax profits.

The total cash dividend from post-tax profits for the years 2018, 2019, and 2020 was 23% (nearly 262 billion VND). To focus financial resources on production and business activities, the 2022 General Meeting of Shareholders approved changing the form of dividend payment for 2018, 2019, and 2020 from cash to shares.

Combined with the 3% stock dividend for 2021, SJS planned to pay cumulative dividends for four years from 2018 to 2021 in 2022. However, the company has not yet implemented this issuance and will continue to seek shareholder approval at the 2025 Annual General Meeting of Shareholders to combine it with the 2024 dividend.

Similarly, the 84% share bonus proposal was also approved in 2022.

|

History of SJS‘s dividend payments in recent years

Source: VietstockFinance, compiled by the author

|

Not only have the dividends for the above period been delayed for several years, but SJS has also repeatedly postponed the payment of cash dividends for 2016 (10% ratio) and 2017 (10% ratio). Specifically, the company postponed the payment of 2016 dividends nine times and the 2017 dividends five times due to financial difficulties in arranging funds. In December 2024, the company announced that it would pay the 2016 and 2017 dividends on December 31, 2024.

In addition to these delays, the SJS General Meeting of Shareholders approved the suspension of cash dividend payments for 2022 and 2023 to focus capital on production and business activities.

In 2024, SJS recorded revenue of 646 billion VND and a net profit of over 268.5 billion VND, increases of 55% and 45%, respectively, compared to the previous year. In the first quarter of 2025, the company achieved revenue of 143.3 billion VND, a 21% increase, and a net profit of 67.2 billion VND, a nearly 53% increase over the same period last year. The positive business results in the first quarter are attributed to the company’s continued business operations in the Nam An Khanh project.

The consolidated financial statements for the first quarter of 2025 show that SJS has inventory worth 4,209.7 billion VND for the Nam An Khanh New Urban Area project, accounting for over 98% of the balance.

In 2025, the company plans to achieve a business production value of 2,479 billion VND, a 75% increase compared to 2024. As a result, revenue and profits are expected to grow by 86% and 111.5%, respectively, reaching 1,211 billion VND and 753 billion VND. The company aims for an investment value of 3,755 billion VND in 2025, with a dividend payout ratio of 10-15%.

| Financial results of SJS from 2017 to 2024 |

Recently, SJS registered to sell nearly 1 million treasury shares from June 12, 2025, to July 11, 2025. The Board of Directors approved a minimum selling price of 64,000 VND per share. It is estimated that SJS could receive a minimum of over 61 billion VND if all the shares are sold as planned.

In the stock market, SJS share price experienced a strong increase of 75% from the end of November 2024 to March 2025, surpassing 100,000 VND per share at some point. After this surge, SJS corrected to the 90,000 VND per share range and has been fluctuating since mid-April 2025.

| Share price movement of SJS in the last year |

– 13:13 12/06/2025

“PVT Announces Stock Dividend: A Generous 32% Payout to Shareholders”

“PetroVietnam Transportation Corporation (HOSE: PVT) has announced a dividend payout of 32% for the year 2024. Shareholders owning 100 shares will be entitled to receive an additional 32 shares. The record date for this dividend issuance has been set as June 19, 2024, with the ex-rights trading date being the day before, June 18.”

“HSC Finalizes Shareholder List for the Offering of Nearly 360 Million Shares”

In July 2025, HSC launched a rights issue of 359.98 million shares to its existing shareholders, aiming to boost its chartered capital beyond VND 10.8 trillion.

Aerial Enterprise Allocates 60% Dividend Payout in Cash, Prepares for Takeoff on the “$16 Billion Mega Project”

Introducing a dynamic enterprise that is soaring to new heights; with an impressive performance in 2024, this business is taking off. The company has proposed a generous cash dividend, reflecting its financial prowess and confidence in its future endeavors. This year, one of its key objectives is to forge a strategic partnership with ACV in operating a cargo terminal at the prestigious $16 billion airport project. With meticulous preparation, this enterprise is poised to take flight, reaching new horizons of success.