BAF reported that the animal feed raw material market has been experiencing a downward price trend in the first four months of 2025. Imports of corn, soybeans, and wheat have increased in volume but decreased in value and price compared to the same period in 2024.

Specifically, corn imports exceeded 3 million tons, with an average price of 258.2 USD/ton (a decrease of 12.8% in price, an 11% decrease in value, and a 2% increase in volume); soybean imports reached 73,000 tons, with an average price of 452 USD/ton (an 8% decrease in volume, a 22% decrease in value, and a 15% decrease in price); and wheat imports stood at 2.4 million tons, with an average price of 265 USD/ton (a 5% increase in volume, a 0.1% decrease in value, and a 4.5% decrease in price). Notably, Mr. Ngo Cao Cuong, Deputy General Director of BAF, predicted that the overall trend for animal feed raw material prices would decrease in the future due to the zero-tariff agreement on agricultural products between the US and Vietnam. This is considered a significant advantage for modern livestock companies with large herds and high biosecurity standards.

|

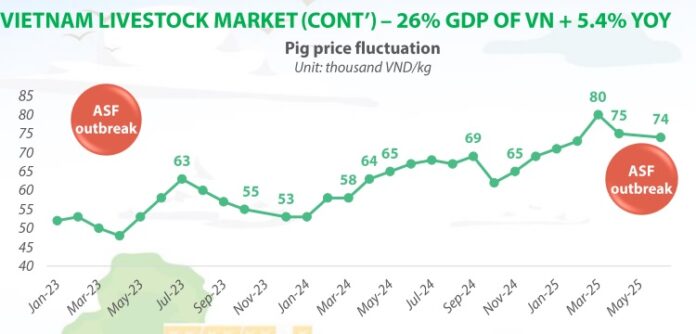

Live Hog Price Movement

Source: BAF

|

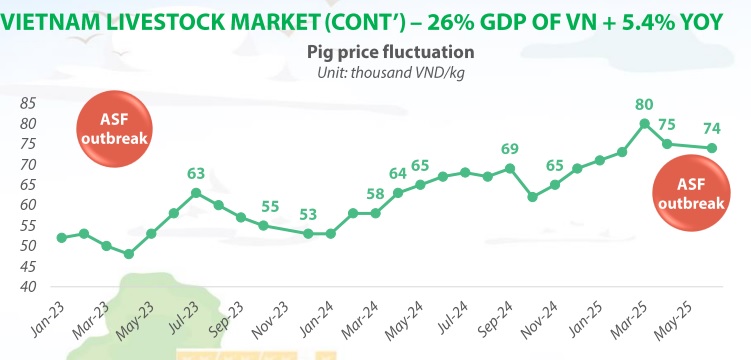

Updating on financial results, after announcing a record revenue in April, BAF reported that May continued to break this record with sales of 74,000 hogs, achieving a revenue of 550 billion VND. In the two-month cumulative, sales volume reached 134,000 hogs, bringing in approximately 1 trillion VND, almost equal to the whole of 2023.

|

BAF’s Hog Sales Volume and Revenue in April-May 2025 Set New Records

Source: BAF

|

Two multi-story farm projects with potential annual revenue of 12 trillion VND

One of the concerns of investors is the status of BAF’s multi-story farm projects. Currently, BAF plans to develop two multi-story farms: one in Tan Chau, Tay Ninh province, with a capacity of 64,000 sow pigs and 1.6 million commercial hogs per year; and the other in Dong Phu, Binh Phuoc province, with a capacity of 20,000 sow pigs and 500,000 commercial hogs.

The Deputy General Director of BAF revealed that the Tay Ninh project is expected to receive investment approval in June 2025. The construction is anticipated to start in 2026 and will take 8-12 months. The introduction of pigs into the farm is expected to happen around mid-2027. Revenue will start coming in about five months after the piglets are brought in or about ten months from the sows, and the farm will reach maximum capacity within 10-12 months.

Image of Multi-story Farm Project of Muyuan Group – BAF’s Partner

|

At maximum capacity, the Tay Ninh farm is estimated to generate over 10 trillion VND in annual revenue. The total investment for the cluster (including the feed mill and slaughterhouse) in Tay Ninh and a similar cluster with a capacity of 800,000 pigs/year) is more than 12 trillion VND.

For the Binh Phuoc project, the construction may start earlier, expectedly by the end of 2025, with operations commencing in 2026. The initial plan was for 20,000 sows and 500,000 commercial hogs, but there are adjustments being made, and the project is estimated to bring in about 3 trillion VND in annual revenue.

Thus, the two multi-story farm projects have the potential to contribute 12,000–13,000 trillion VND in annual revenue for BAF. The payback period is expected to be 5–5.5 years, based on a hog price range of 58,000–60,000 VND/kg.

A company that adheres to a chain model will ensure pork quality

Addressing concerns about pork quality following allegations against a leading livestock company for selling sick pigs, Mr. Cuong stated that this would inevitably happen if companies do not operate within a chain model and cannot control the process from start to finish.

“What defines clean pork? There are two aspects: physical cleanliness (at the slaughterhouse, i.e., appearance) and chemical cleanliness (i.e., antibiotic and growth promoter residues). Ensuring chemical cleanliness is of utmost importance because we consume pork. If we partner with external parties, it becomes challenging to guarantee the meat’s quality.” – Mr. Cuong.

BAF owns the brand “Vegetarian Pigs”

|

Mr. Cuong affirmed that the meat from BAF’s chain, with its integrated model encompassing farms, slaughterhouses, and retail outlets, would ensure meat quality. Similarly, livestock companies adhering to a chain model and controlling the process from the source of piglets would benefit from consumers’ growing demand for clean meat.

Currently, BAF still collaborates with some household farmers, but this ratio has significantly decreased by 70-80%. About 90% of BAF’s pork supply now comes from its own farms. Mr. Cuong explained that partnering with household farmers was necessary when the company lacked farming space. BAF closely monitors and controls the processes of these partner farms, from providing consultations and requiring the use of specific vaccines to supplying animal feed.

Looking ahead, as the company expands its own farms, it will move towards discontinuing partnerships with household farmers. In fact, BAF has already commissioned over six large-scale farms in the first quarter of 2025. In the first four months of the year, the company has completed M&A deals with more than 13 companies with land funds and initiated procedures to build farms. These farms are expected to become operational in 2025-2026, with a combined capacity of nearly 63,000 sows and 500,000 commercial hogs.

According to Mr. Cuong, continuous M&A activities are considered a strategic move in the context of the industry’s challenges due to epidemics and livestock laws. The expected hog sales volume for 2025 is about 900,000 hogs, with a planned revenue of 5,500 billion VND and a pre-tax profit of 774 billion VND, double that of the previous year. These efforts align with the company’s goal of producing 10 million commercial hogs by 2030.

Notably, BAF recently transferred a farm, the Xuan Nghi Phat Company in Tay Ninh, which it had acquired in February 2025. This farm spanned over 111 hectares and had a capacity of 7,500 sow pigs.

Explaining the reason for the sale, Mr. Cuong shared that BAF’s M&A policy is to acquire 100% of companies with complete legal status. For projects with incomplete legal documentation, BAF will only acquire a partial stake (40-60%) to secure the land. During this process, if the partner completes the legal requirements, BAF will proceed with the full payment. However, if the legal issues remain unresolved, the project will be returned to the original owner. The Xuan Nghi Phat farm encountered legal complications, so BAF transferred it back to the seller.

– 16:42 11/06/2025

The Billion-Dollar Ballpoint: Unveiling Thien Long’s Strategic Move in Acquiring Ho Chi Minh City’s Premier Bookstore Chain

“The acquisition of the Phuong Nam Bookstore chain marks a significant milestone as it represents the first time a business has ventured into the multi-billion-dollar educational retail space, seamlessly extending its value chain from manufacturing to distribution.”

“Two Retail Giants Merge: A New Chapter for Thien Long and Phuong Nam Bookstore”

Through its subsidiary, the Thien Long Group (coded TLG) has announced its plan to invest a dominant stake in Van Hoa Phuong Nam Joint Stock Company (PNC). This move marks the union of two well-known brands, a strategic step towards TLG’s long-term goal of expanding its toy business.