I. MARKET ANALYSIS OF STOCKS AS OF JUNE 11, 2025

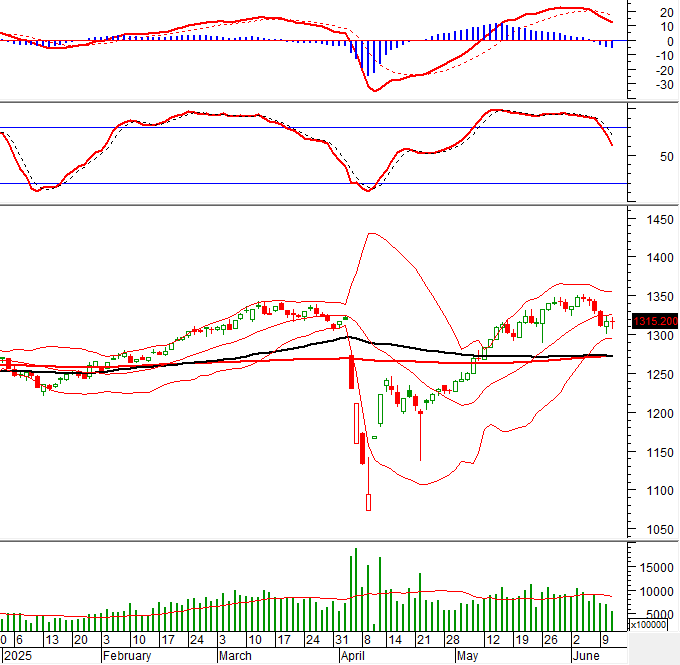

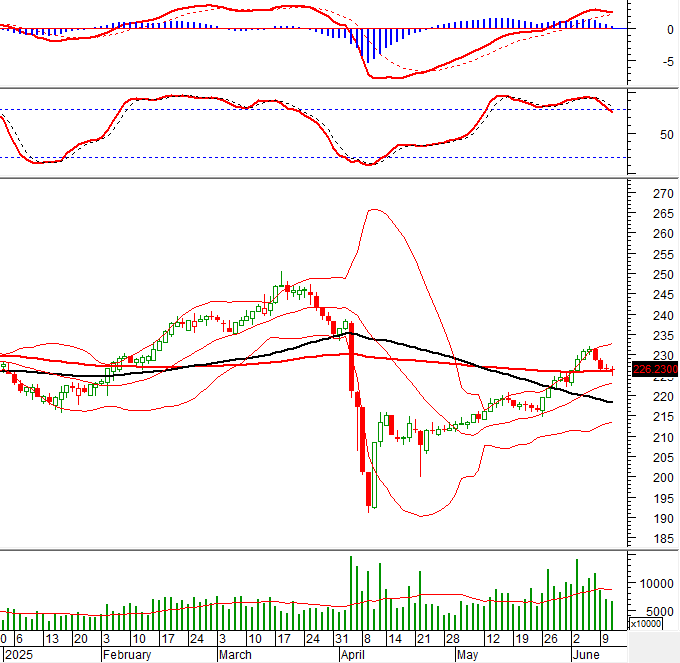

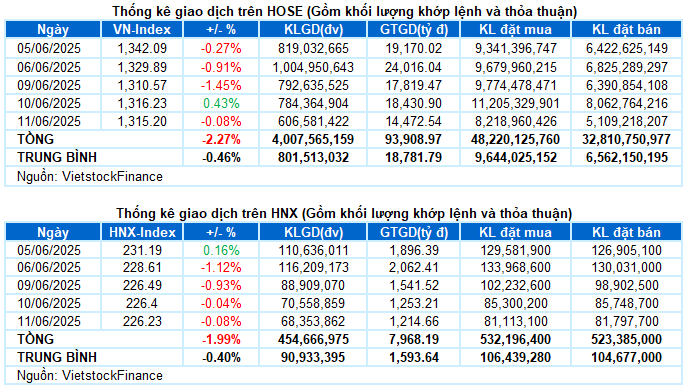

– The main indices witnessed a slight decline during the trading session on June 11th. The VN-Index decreased by 0.08%, settling at 1,315.2 points, while the HNX-Index experienced a similar decline, ending the day at 226.23 points.

– Market liquidity continued its downward trend. The matched order volume on the HOSE decreased by 23.2%, barely reaching 540 million units. Meanwhile, the HNX recorded a slight decrease of 4.4% compared to the previous session, with over 66 million units.

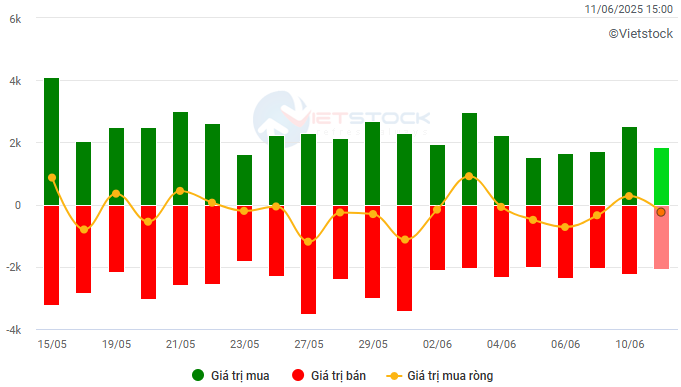

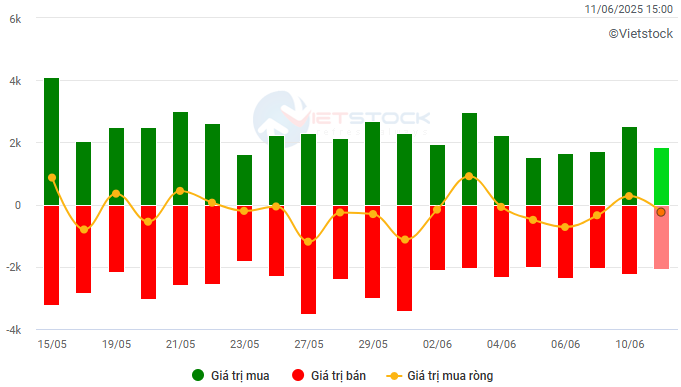

– Foreign investors net sold with a slight value of nearly VND 186 billion on the HOSE and VND 2.5 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM. Unit: VND billion

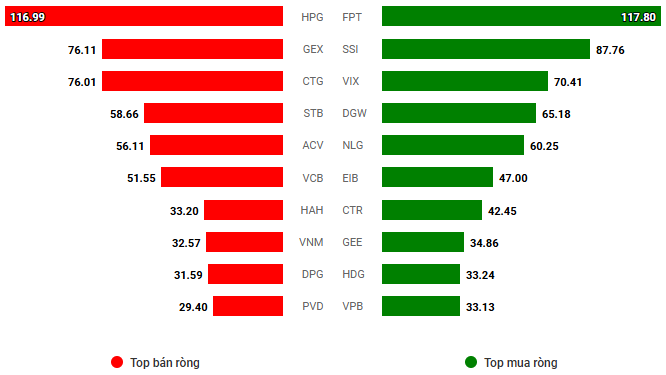

Net buying/selling value by stock code. Unit: VND billion

The June 11th trading session commenced with a positive note, riding on the recovery momentum from the previous session. However, the buying side couldn’t sustain their advantage for long as the participation of investment funds remained limited. The index gradually slipped and fluctuated around the reference level towards the end of the morning session. In the afternoon session, the large caps faced increased volatility, causing the VN-Index to fluctuate significantly. At one point, the VN-Index lost nearly 6 points but managed to narrow its loss to just over 1 point by the end of the session, closing at the 1,315.2-point threshold.

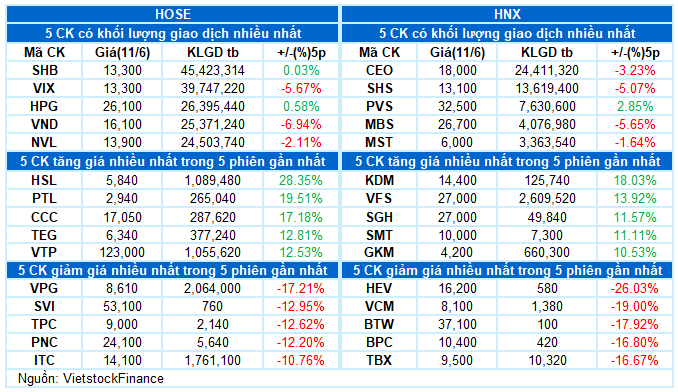

– In terms of impact, VHM, VCB, and GVR were the most detrimental stocks, deducting more than 1 point from the VN-Index. Conversely, FPT and HVN made the most positive contributions, offsetting the losses with equivalent gains.

– The VN30-Index closed near the reference level, reaching 1,405.15 points. The basket witnessed a mixed performance, with 16 declining stocks, 11 advancing stocks, and 3 stocks remaining unchanged. VJC, VRE, and PLX were the worst performers, dropping by more than 1.5%. On the other hand, FPT, TPB, SHB, and BVH attracted robust buying interest, increasing by over 1%.

Most sectors were dominated by red figures. The telecommunications and information technology groups stood out with remarkable gains, driven by the strong performance of large caps such as CTR hitting the ceiling price, VGI (+5.85%), FOX (+3.18%), ELC (+1.77%), VTK (+5.69%), FPT (+1.9%), and CMG (+4.4%).

In contrast, the real estate sector lagged the market, with extensive losses across the board. Stocks that declined by more than 1% with considerable liquidity included NVL, DIG, DXG, VRE, PDR, TCH, KBC, KDH, VPI, and SCR. Some notable exceptions were NLG (+1.06%), HDG (+1.13%), DXS (+2.41%), AGG (+2.4%), and ITC (+3.3%). The remaining sectors witnessed declines but also displayed some level of differentiation, preventing any significant losses.

The slight decline in the VN-Index, coupled with the continued decrease in trading volume, indicates a prevalent cautious sentiment among investors. If buying demand does not show signs of improvement in the upcoming sessions, the index is likely to retest the crucial support area around the 1,300-point level. At present, the Stochastic Oscillator indicator continues to trend downward after exiting the overbought zone, while the MACD is consistently widening the gap with the Signal line following a sell signal. These indicators suggest that the short-term downside risks have not been eliminated.

II. TREND AND PRICE MOVEMENT ANALYSIS

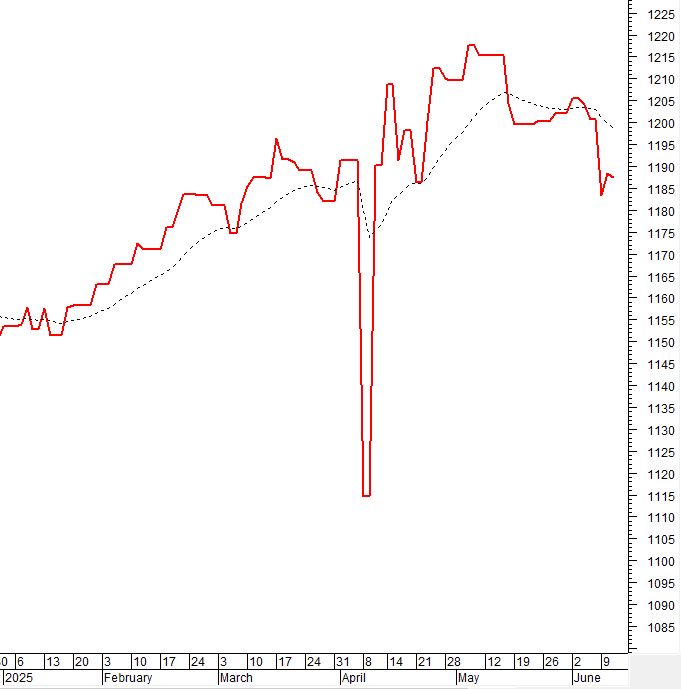

VN-Index – Trading volume remains below the 20-day average

The VN-Index witnessed a slight decline, and the trading volume continued to decrease, indicating a clear dominance of cautious sentiment among investors. If buying demand does not show signs of improvement in the upcoming sessions, the index is likely to retest the crucial support area around the 1,300-point level.

Currently, the Stochastic Oscillator indicator continues to trend downward after exiting the overbought zone, while the MACD line consistently widens the gap with the Signal line following a sell signal. These indicators suggest that the short-term downside risks remain and have not been eliminated.

HNX-Index – Stochastic Oscillator exits the overbought zone

The HNX-Index experienced a slight decline amid fluctuating movements, and the trading volume remained below the 20-day average. This reflects investors’ cautious and uncertain sentiment.

At present, the Stochastic Oscillator indicator has exited the overbought zone after providing a sell signal. If the MACD indicator also gives a similar signal in the coming sessions, the downside risks will increase.

Analysis of Money Flow

Movement of smart money: The Negative Volume Index indicator of the VN-Index has crossed below the EMA 20-day. If this state persists in the next session, the risk of a sudden downturn (thrust down) will increase.

Foreign capital flow: Foreign investors returned to net selling in the trading session on June 11, 2025. If foreign investors maintain this stance in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS FOR JUNE 11, 2025

Economic and Market Strategy Division, Vietstock Consulting and Research

– 17:14 06/11/2025

“VPBank Launches Record-Low Interest Rate Promotion at 6.6%”

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented move is accompanied by a host of other attractive offers, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.

The Cautious Cash Flow: Paused Revival

The afternoon session witnessed a slight uptick in liquidity; however, it failed to make up for the lackluster morning performance. For the first time in six weeks, the HoSE floor’s matching value fell below 13 trillion dong, with the combined value of the two floors dipping below 15 trillion dong. Investors seem to be adopting a wait-and-see approach.

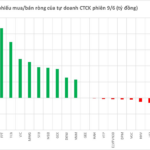

A Mysterious Force ‘Pours’ Over $34 Million into Vietnam’s Stock Market in a Single Day

The HoSE-listed securities firms witnessed a notable uptick in net buying from proprietary trading activities, with a total value of 816 billion VND.