In the context of rising Vingroup stocks, two investment funds managed by Dragon Capital, DCDS (DC Dynamic Securities Investment Fund) and VFMVSF (Vietnam Long-Term Growth Fund), made notable moves by significantly increasing their holdings of VHM shares, owned by Vinhomes JSC, in May 2025.

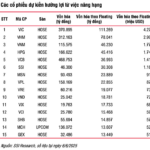

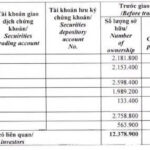

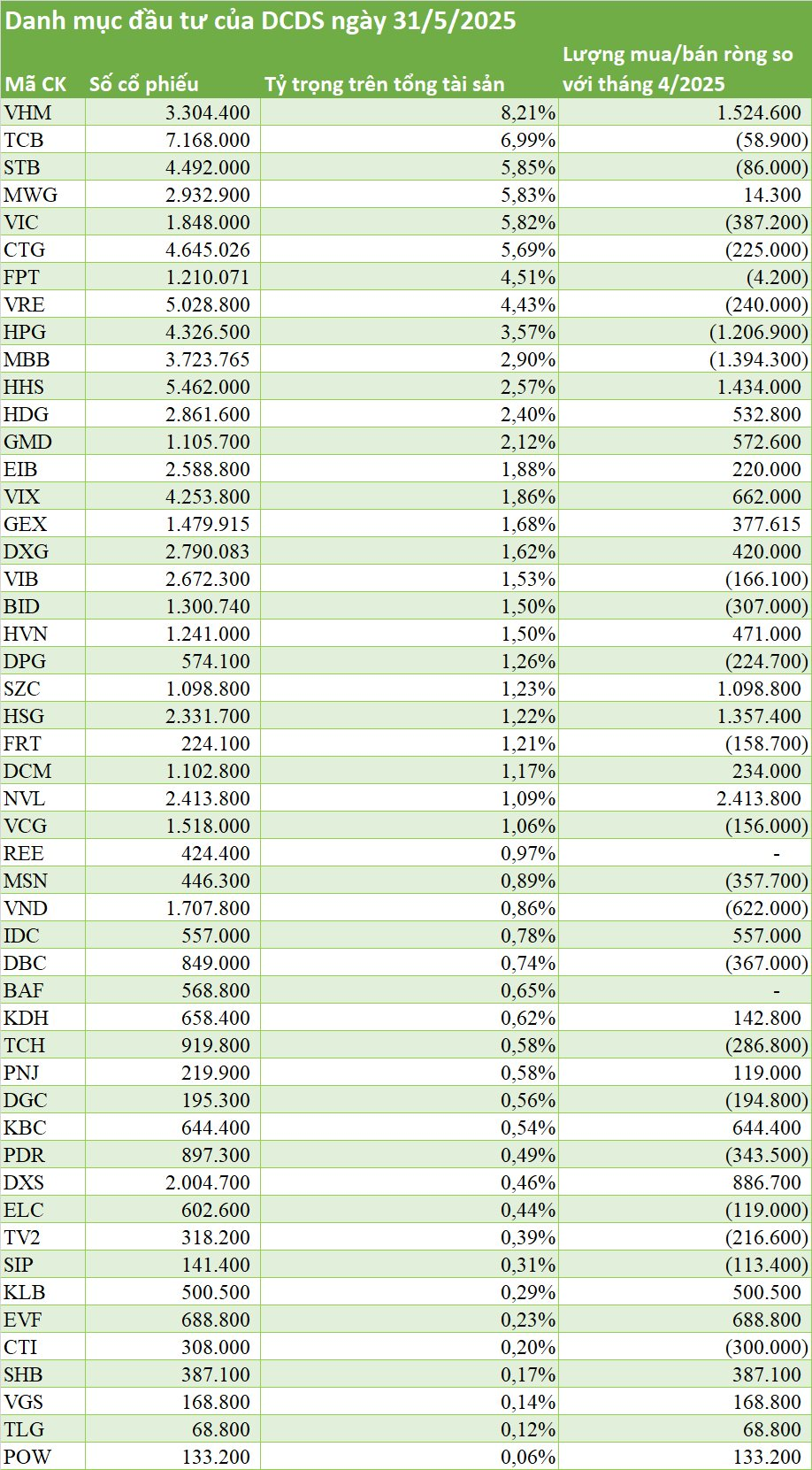

Specifically, in May 2025, the DCDS fund substantially increased its VHM holdings from nearly 1.8 million shares (accounting for 3.51% of total asset value) to over 3.3 million shares (8.21%), becoming the largest holding in the portfolio.

DCDS acquired an additional 1.5 million shares, almost doubling its VHM holdings within just one month.

Similarly, the VFMVSF fund also ramped up its investment in VHM, increasing its share count from over 4.4 million (3.19% of total asset value) to nearly 8.3 million (7.36%), making it the third-largest holding in the portfolio, after MWG and TCB. This increase amounted to nearly 3.9 million additional VHM shares.

Combined, the two funds purchased nearly 5.37 million additional VHM shares within a month. This move had a positive impact on the investment performance of the two funds, as VHM stocks had been on an upward trajectory recently.

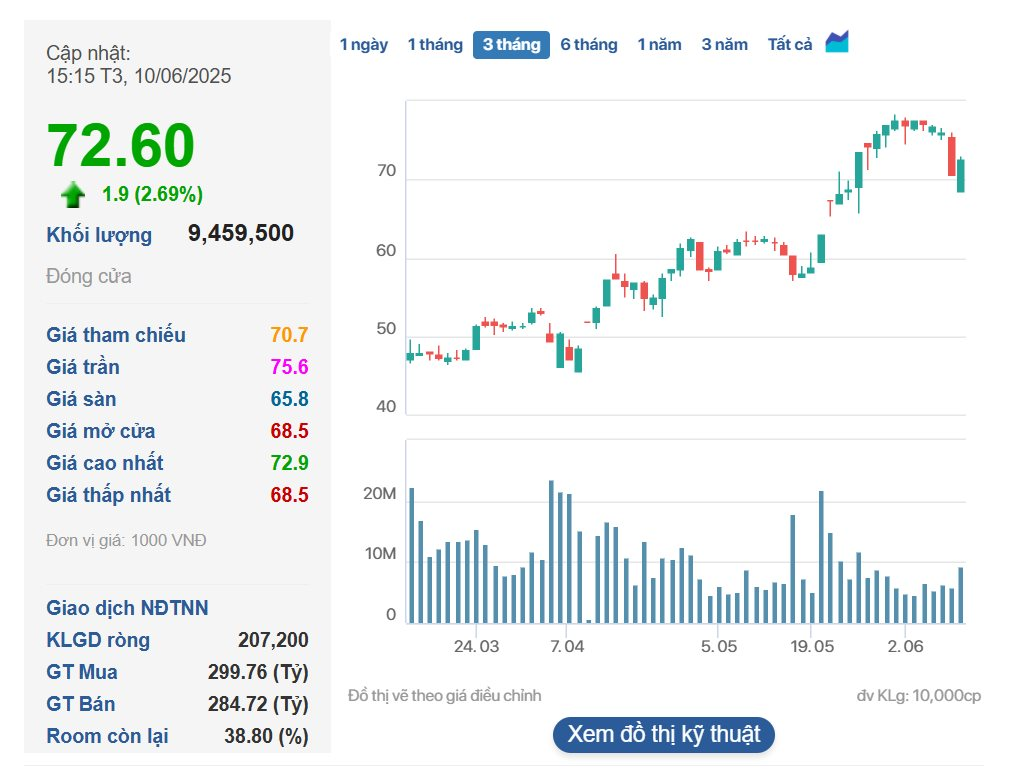

As of the trading session on June 10, VHM shares were priced at 72,600 VND each, reflecting a 24% increase compared to April. If we consider May alone, VHM shares witnessed a remarkable 33% surge.

The primary reason for VHM’s strong performance in May is attributed to the listing of VPL, a Vingroup ecosystem peer, on the stock exchange.

Additionally, impressive business results are considered a crucial catalyst for VHM’s surge. For the first quarter of 2025, Vinhomes recorded consolidated net revenue, including revenue from joint venture contracts and bulk sales recorded as financial revenue, of VND 19,269 billion, up 124% compared to the same period in 2024.

Consolidated after-tax profit reached VND 2,652 billion, a 193% increase compared to the first quarter of 2024. Handovers at Vinhomes Royal Island and Vinhomes Ocean Park 2-3 projects continued to be the main drivers of the period’s performance.

As of March 31, Vinhomes boasted total assets of VND 561,504 billion and equity of VND 223,396 billion.

The Vietnam Stock Market: October 2025’s Potential Upgrade and Benefitting Stocks

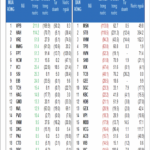

According to SSI Research, changes related to account opening times, payment accounts, foreign ownership, NPS, CCP, and more, will address the issues previously raised by FTSE Russell. These adjustments are key to Vietnam’s aspiration of an upgrade to emerging market status by October 2025.

Unlocking the Potential: Dragon Capital Trims FPT Retail Holdings, Slashes Ownership Below 10%

FPT Retail’s stock, FRT, has soared by approximately 37% since its early April lows, marking a remarkable two-month recovery.