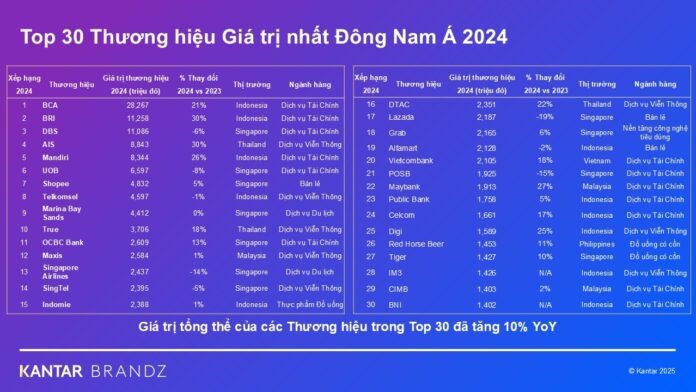

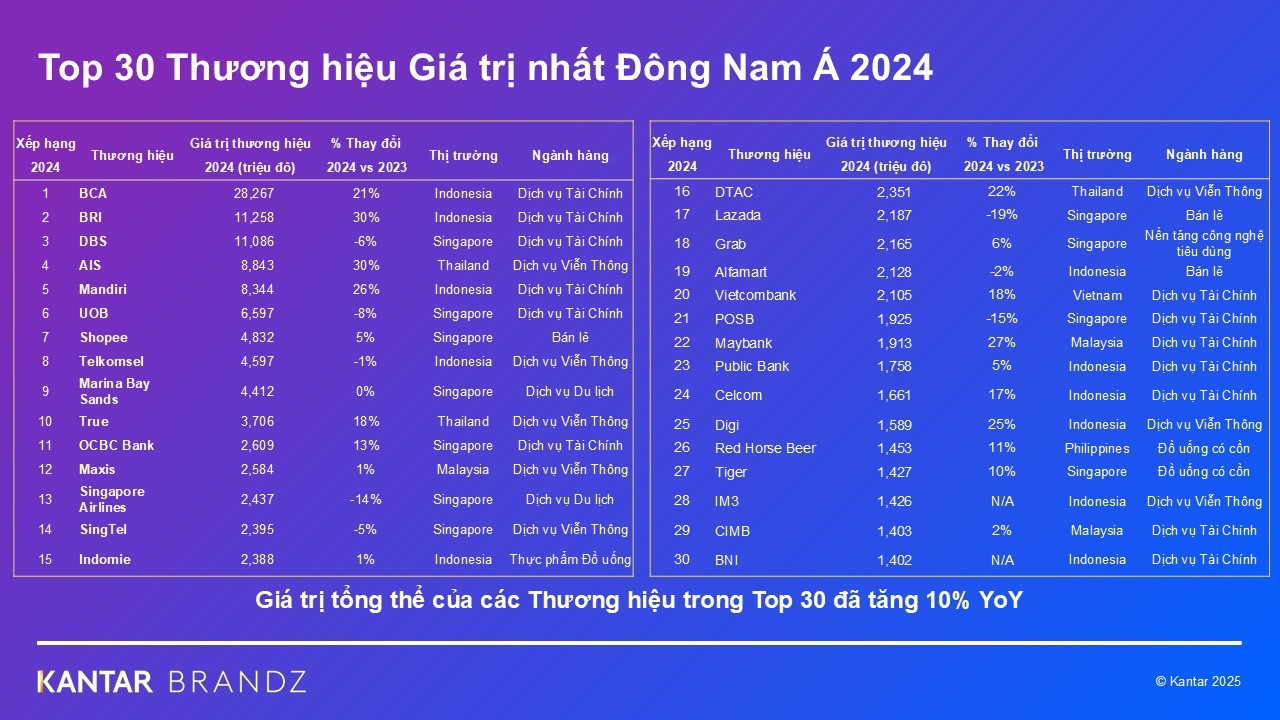

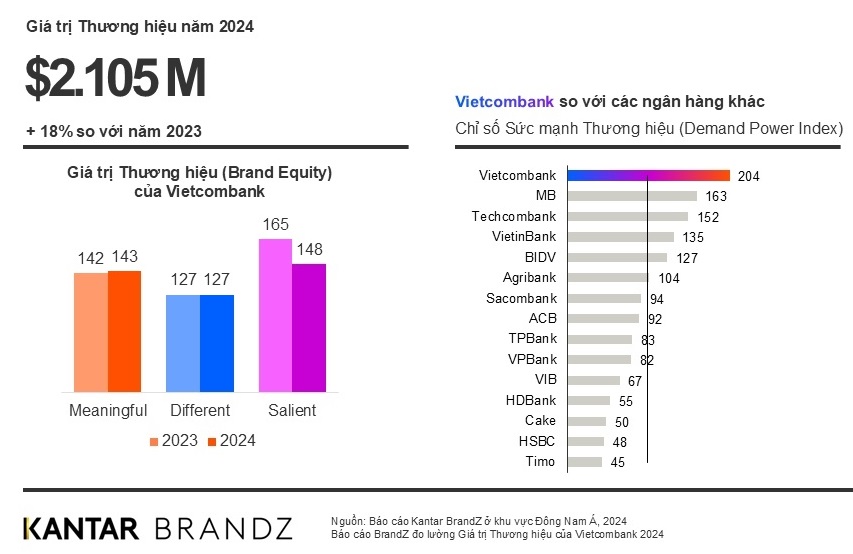

Kantar BrandZ, a leading global market research company, has released its 2024 ranking of the top 30 most valuable brands in Southeast Asia. Among the list, Vietnam proudly claims one representative, the Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank). Ranked at 20th place, Vietcombank’s brand value is estimated at $2.105 million, reflecting an impressive 18% increase from 2023.

According to Kantar’s report, Vietcombank takes the lead in Vietnam’s banking sector with a 14% market share in consumer mindshare. The bank’s Demand Power Index, a measure of brand strength, stands at an impressive 204 points, significantly outpacing its domestic competitors and establishing a comfortable lead over the second-placed Vietnamese brand, which scored 163 points.

Vietcombank’s performance showcases not only its leadership in brand strength within Vietnam but also its superiority relative to the industry average (100) across all brand value aspects. The bank achieves 148 points for brand memorability, 143 points for emotional connection and consumer needs fulfillment—indices that reflect a strong bond between customers and the brand.

Additionally, Vietcombank excels in differentiation and industry leadership with a score of 127 points, indicating its unique and outstanding service and product offerings that set it apart from its peers. These indices not only reinforce Vietcombank’s position as Vietnam’s leading bank but also testify to its successful journey in building a sustainable brand, while highlighting the remarkable transformation of Vietnamese enterprises in the regional market.

Mr. Le Hoang Tung, Deputy General Director of Vietcombank, shared his thoughts: “This recognition from Kantar attests to Vietcombank’s relentless efforts in brand development and our commitment to innovation to enhance customer experience. It marks a significant step forward for Vietcombank on the Southeast Asian brand map.”

Vietcombank’s Deputy General Director, Mr. Le Hoang Tung (left), receives the “Top 30 Most Valuable Brands in Southeast Asia” certificate from Kantar’s Strategy Development Director, Mr. Sumit Kamra

Kantar BrandZ’s brand valuation methodology relies on two main pillars: Financial value and Brand Contribution. Brand Contribution is determined through consumer surveys that measure current brand appeal, future value creation potential, and pricing power. By combining qualitative and quantitative data, Kantar BrandZ’s ranking provides an accurate reflection of brand value in the minds of consumers and in the marketplace.

As the sole Vietnamese brand on the list, Vietcombank’s presence underscores its success not only in terms of financial performance but also in establishing a strong brand image that resonates with consumers both domestically and internationally.

The 2025 Bank Rankings: HDBank, Owned by Billionaire Nguyen Thi Phuong Thao, Surges Ahead as the Top 5 Remain Unchanged.

The top 5 banks, Vietcombank, Techcombank, VietinBank, BIDV, and MB, continue to dominate the market, while the lower half of the rankings witnessed a shuffle.

The Big Three’s Banking Strategies: Unveiling the Intriguing

In 2025, while many private banks are pursuing aggressive credit growth strategies to capitalize on the economic recovery cycle, state-owned banks such as Vietcombank, VietinBank, and BIDV are taking a more cautious approach. Instead of focusing on expansion, they are prioritizing credit portfolio restructuring, risk management, and optimizing cash flow.

The Art of Monetary Absorption: Navigating the Open Market

Last week (May 26 – June 02, 2025), the banking system’s liquidity remained relatively stable, with the State Bank of Vietnam (SBV) conducting net injections through its open market operations at a low volume.

“Dollar and Yuan Dance to Different Tunes: A Tale of Contrasting Fortunes.”

“As of 8:30 a.m. on June 2nd, the USD exchange rate at Vietcombank and BIDV was set at 23,850-23,210 VND/USD for buying and selling, respectively. This marks an increase of 20 VND in both buying and selling rates compared to the morning of May 30th, indicating a slight strengthening of the USD against the VND in the interbank market.”