Pomina Steel Joint Stock Company (Stock Code: POM) has announced its consolidated financial statements for Q1 2025.

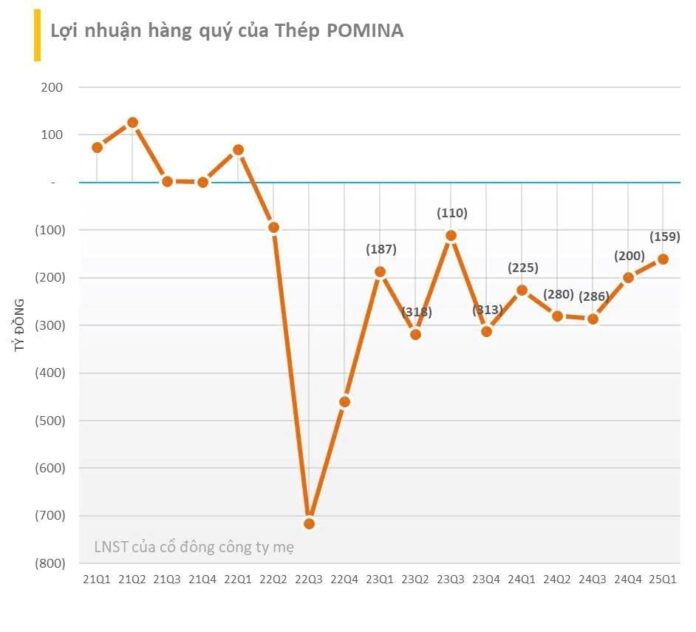

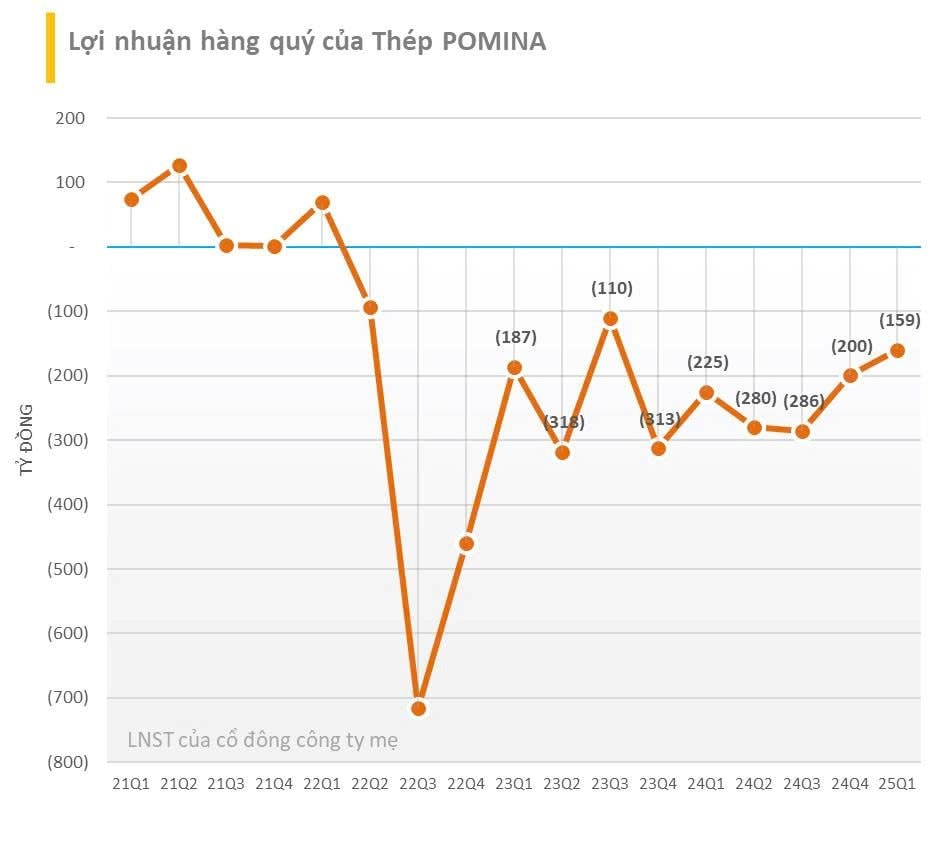

Net revenue reached VND 1,029 billion, up 118.3% from the previous year. Pomina has stopped selling below cost, recording a gross profit of VND 59.7 billion (compared to a loss of VND 6.5 billion in the same period last year). However, financial expenses alone amounted to VND 176 billion, excluding other expenses, resulting in a net loss of VND 159.3 billion (compared to a loss of VND 224.9 billion in Q1 2024).

As of March 31, 2025, Pomina Steel had accumulated losses of VND 2,697 billion, equivalent to 96.4% of its charter capital (VND 2,796 billion). The company has incurred losses for 12 consecutive quarters.

The company stated that in Q1 2025, the performance of its subsidiaries improved. This led to a reduction in the provision for financial investment losses compared to Q1 2024, which, in turn, decreased financial expenses and consolidated losses.

Meanwhile, the Company continues to control non-recurring expenses and other costs to minimize expenses as the factory remains temporarily closed.

The delay in submitting the Q1 2025 report was due to personnel changes, and the verification and compilation of data between affiliated units required more time to ensure the accuracy and compliance of the report.

Pomina Steel, formerly known as Pomina Steel Mill 1, was established on August 17, 1999, by Pomina Vietnam Steel Company Limited. On July 17, 2008, the company was transformed into Pomina Steel Joint Stock Company with a charter capital of VND 500 billion.

On April 7, 2010, Pomina Steel Joint Stock Company officially listed its shares on the Ho Chi Minh City Stock Exchange (HOSE) under the symbol POM.

Once dubbed the ‘king’ of Vietnam’s steel industry, especially during the period from 2000 to 2010, Pomina has faced challenges and lost its top position to Hoa Phat Group, even falling out of the top 5.

Since May 2024, POM shares have been delisted from HOSE due to late submission of audited financial statements for three consecutive years (after 11 years of listing). Currently, POM shares are traded on UPCoM, ending the session on June 10 at VND 1,500 per share.

The Trade Deficit With Vietnam: An Inevitable Economic Outcome?

The current trade deficit is a natural outcome of the relationship between a developed economy like the United States and a developing one like Vietnam, according to the Chairman of the US-ASEAN Business Council. This deficit is not a cause for concern but rather a reflection of the two countries’ different economic stages.

The Crypto Conundrum: Why the Draft Proposal Raises ‘Serious Concerns’

“The decision to only permit centralized trading of certain crypto assets could potentially stifle innovation and technological advancement, rendering some crypto assets illegal during their trial and developmental phases, from a business perspective.”

Market Pulse June 11: VN-Index Caught in Tug-of-War, VGI and CTR Surge Ahead

The market closed with the VN-Index down 1.03 points (-0.08%), settling at 1,315.2; while the HNX-Index dipped 0.17 points (-0.08%), ending at 226.23. It was a mildly positive day for the broader market, with buying interest outpacing selling pressure as 345 tickers advanced against 309 declining names. However, the large-cap universe painted a different picture, with the VN30 basket witnessing a sea of red – 16 tickers declined, 11 advanced, and 3 remained unchanged.

“Thai Conglomerate Completes Acquisition of Nhựa Duy Tân, Cementing a Bright Future.”

The SCG Group (Thailand) has successfully acquired the remaining 30% stake in Nhựa Duy Tân, Vietnam’s leading household plastics company.