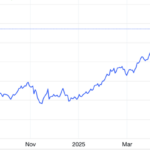

Global gold prices surged overnight and this morning (June 12th) as weaker-than-expected inflation data from the US increased the likelihood of an early interest rate cut by the Federal Reserve. However, the SPDR Gold Trust, a major player in the market, has just sold off a significant amount of gold.

As of 9:44 am Vietnam time, gold spot prices in Asian markets rose by 22.3 USD/oz compared to Wednesday’s close in the US, equivalent to a 0.7% increase, trading at 3,377.9 USD/oz according to Kitco exchange data. When converted using Vietcombank’s USD selling rate, this price is equivalent to approximately 106.6 million VND per tael, a 1.2 million VND increase from yesterday morning.

At the same time, Vietcombank quoted USD at 25,810 VND (buying rate) and 26,200 VND (selling rate).

During the New York session last night, gold immediately jumped to close at 3,355.6 USD/oz, a 31.8 USD/oz or nearly 1% surge from the previous session’s close.

Gold prices climbed after the US Labor Department released data showing that the Consumer Price Index (CPI) for May rose 0.1% from the previous month and 2.4% from a year earlier. Reuters economists had predicted respective increases of 0.2% and 2.5%.

The core CPI, excluding volatile energy and food prices, rose 0.1% from the previous month and 2.8% from a year earlier, also below the expected increases of 0.3% and 2.9%, respectively.

“The unexpected CPI dip supported the precious metals market today as it pushed down both US Treasury yields and the dollar index,” said Tai Wong, an independent precious metals trader, in an interview with Reuters.

In the interest rate futures market, traders are betting on a 68% chance of a Fed rate cut by September, according to the FedWatch Tool from CME Group.

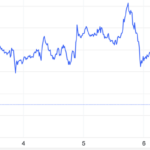

Reflecting expectations of an early rate cut, the 10-year US Treasury yield fell by 6 basis points to 4.12%. The 2-year yield dropped by more than 5 basis points to 3.95%, while the 30-year yield declined by 2.4 basis points to 4.93%.

The US Dollar Index, which measures the greenback against a basket of six major currencies, slipped below 98.5 from the previous session’s high of nearly 99.

Gold, a non-interest-bearing asset priced in USD, benefits from both lower yields and a weaker dollar.

Analysts attribute the continued high demand for gold as a risk hedge to the unpredictable nature of US trade policies and escalating geopolitical tensions in the Middle East.

On June 11th, President Donald Trump stated his willingness to further delay imposing tariffs beyond the July 8th deadline to conclude trade negotiations with other countries and territories. However, he also mentioned that he would be sending letters regarding tariffs to America’s trading partners in two weeks.

Regarding the Middle East, two US State Department officials disclosed to NBC News that the US is preparing to evacuate some staff from its embassy in Baghdad, without specifying the reason. Additionally, a unit of the British Royal Navy warned of escalating tensions in the region, which could lead to “increased military activity.” Trump expressed his growing skepticism about the possibility of a deal with Iran to avoid military conflict.

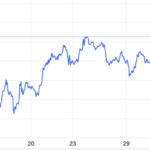

Contrarily, the world’s largest gold ETF, the SPDR Gold Trust, offloaded 1.7 tons of gold during Wednesday’s session, marking the second consecutive day of sales. This reduced their total holdings to 934.2 tons.

“The market is anticipating gold to reclaim its recent high of 3,403 USD/oz as a springboard for further upside. If gold fails to respond to positive economic data, it could signal a short-term correction,” Wong analyzed.

On Thursday, gold traders will closely monitor the US Producer Price Index (PPI) report, released ahead of the Fed’s monetary policy meeting scheduled for June 17-18.

The Energy Market on June 7: Oil Prices Continue to Surge, Gold Plunges Over 1%

The energy complex continued its upward trajectory on June 6th, with oil prices extending gains. Silver shone brightly, surging to a 13-year high, while platinum reached a 3-year peak. However, gold suffered a sharp decline, dropping over 1%. Raw sugar prices remained subdued, languishing at a 4-year low.

Gold Prices Slip on US-China Trade Talk Hopes

The sentiment among investors turned cautious ahead of the release of the U.S. non-farm payrolls report for May on Friday. With global economic uncertainties looming large, market participants are keenly awaiting insights into the health of the labor market, which could influence the Federal Reserve’s monetary policy trajectory. As the Fed has signaled a commitment to taming inflation, even at the risk of a recession, investors are bracing for a potential shift in their investment strategies.