HSBC: Proactive Risk Management is Key During Volatile Times. (Photo: Vietnam+)

|

On June 11th, Douglas Matheson, Senior Director of Credit Risk Management and Compliance at HSBC Vietnam, shared insights on the recent “black swan event” in April when the US announced a 46% countervailing duty on Vietnamese exports.

According to the HSBC Global Trade Pulse survey, even with the final tax rates and timing unclear, businesses are already feeling the impact. 80% of Vietnamese companies surveyed faced increased costs, and 75% expect this situation to persist in the medium term. Many are considering shifting their target market focus and enhancing data analytics to navigate the volatility. Interestingly, 76% of the businesses remain optimistic, viewing the tariff challenges as a catalyst for innovation and future resilience.

Mr. Matheson emphasized that each event disrupts global businesses, highlighting the importance of robust risk management and building resilience.

The expert analyzed three critical areas where companies can enhance their business resilience and adaptability: partner credit risk in trade, foreign exchange volatility, and internal governance and control.

Partner Risk

In Mr. Matheson’s view, with increasingly globalized and vulnerable supply chains, a single weak link can disrupt business operations. This could be a financially strained supplier, a logistics partner facing legal issues, or a late-paying customer. In an increasingly uncertain world, international trade disputes are also on the rise.

Partner credit risk should be considered across multiple functions, including finance, strategy, and business, rather than being confined to support office processes. Companies should monitor risks at the portfolio level, assessing partner risks, considering local laws of the buyer, additional risks in longer trade terms, and managing risk concentration across parties and countries.

Additionally, the International Chamber of Commerce’s (ICC) standard trade rules, which define the allocation of risks and responsibilities between the seller and buyer, are essential tools for risk management. These rules include determining who covers shipping costs, bears the risk of damage or loss of goods, and handles customs clearance.

HSBC plays a crucial role in supporting business growth without significantly increasing partner risk. By re-examining traditional trade tools like letters of credit or promissory note guarantees, companies can substantially reduce the risk of non-payment for exporters by shifting the risk to a more stable international bank.

This approach safeguards businesses when their partners face cash flow challenges due to adjustments in global trade. Discussions with banks about trade finance can also uncover valuable risk mitigation tools and unlock working capital.

Mr. Douglas Matheson, Senior Director of Credit Risk Management and Compliance at HSBC Vietnam. (Photo: Vietnam+)

|

Foreign Exchange Risk

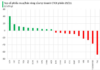

Mr. Matheson also addressed foreign exchange risks, which can occur abruptly and be highly disruptive. Currency fluctuations can erode profit margins and distort forecasts, even for seemingly stable currencies.

In 2022, the Japanese Yen hit a 38-year low against the US dollar, dropping over 25% in a few months due to divergent monetary policies. Even the relatively stable Chinese Renminbi depreciated in April 2023.

These fluctuations can significantly impact profits, especially for companies with narrow profit margins or long contract cycles. However, many companies lack adequate protection against such risks. According to HSBC’s 2024 Enterprise Risk Management Survey, 47% of corporate financial managers admitted their organizations were unprepared for foreign exchange rate risks, ranking it higher than supply chain risks (35%) or climate risks (34%). Over 40% of the surveyed businesses experienced reduced income due to inadequate hedging.

Mr. Matheson emphasized that while standalone hedging solutions can be costly, a comprehensive foreign exchange strategy focused on stabilizing profit margins instead of market predictions can yield more sustainable results over time.

Governance: The Insider Threat

Internal governance failures, from blatant fraud to operational errors, can bring down a company faster than market downturns. However, governance is often viewed as a compliance box-ticking exercise rather than a strategic imperative. Essentially, governance risk involves integrity and robustness in decision-making structures, ensuring that critical thinking is embedded in controls and processes to foster resilience.

Internal controls, such as clear segregation of duties, dual authorization, and robust audit trails, are vital. Encouraging employees to speak up, ask questions when inconsistencies arise, and express concerns without fear of retaliation is crucial. A well-crafted whistleblower policy is meaningless if the company culture doesn’t encourage dissent. Even if raised concerns turn out to be unfounded, such a culture should be nurtured.

Diversity in experience and background, both in management and on boards, can offer valuable counterarguments and insights. Rotating key control personnel, conducting periodic scenario testing, and rigorous independent audits contribute to a more comprehensive risk management culture.

Ultimately, governance risk is the foundation upon which all other risk management efforts rely. A strong governance framework instills confidence in investors and lenders, especially during stressful times. Without this foundation, even the best risk management systems will crumble under pressure.

From Speculation to Defense

In today’s world, volatility is the new normal, with complex geopolitics, climate events, technology disruptions, cyber-attacks, and economic fragmentation likely to persist.

For business leaders, the question is not if the next disruption will occur but if their organization can identify and adapt to the risks it presents. This requires a shift in mindset, moving risk management from a reactive, siloed function to a proactive and integrated approach. Potential risks and coping strategies should be discussed at all organizational levels, encouraging innovation while remaining vigilant about unintended consequences.

“Ultimately, organizations with a strong risk management culture, recognizing that we must learn to live with black swans, will outperform their competitors in navigating shocks,” emphasized Mr. Matheson.

Thuy Ha

– 15:48 06/11/2025

A Vietnamese Business Catches the Eye of Over 120 ESG Investment Funds with Its Impressive Governance

The ‘G’ in ESG – often overlooked, but governance is increasingly coming into focus for businesses as they strive to answer a critical question: How do we govern our journey towards sustainability goals, such as net-zero?

“My Investment Appetite”: “I Prefer Stocks Because They’re Transparent, Merit-Based, and Free From Schmoozing.”

“I prefer the title ‘savvy investor’ to ‘stock market queen,’ because it reflects my belief that anyone can create wealth through wise financial decisions. It’s not about royalty or privilege; it’s about empowering individuals to take control of their financial destiny and turn their money into a productive asset.”

Gold Prices Surge on Monday Morning, Defying Analysts’ Cautious Forecasts

Gold prices surged during the early morning trading session on Monday, June 2nd, soaring past the $3,300 per ounce mark and reclaiming the ground lost in the previous week’s trading.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)