Ho Chi Minh City Securities Joint Stock Company (HSC, HCM code, HoSE floor) has just announced the implementation of the plan to issue shares to existing shareholders according to Certificate of Registration No. 141/GCN-UBCK granted by the Chairman of the SSC on June 3, 2025.

Accordingly, on June 25, HSC will finalize the list of shareholders to offer 359.98 million shares at a price of VND 10,000/share through the exercise of subscription rights. The entitlement ratio is 2:1, meaning that for every 2 shares held, shareholders will be entitled to purchase 1 new share.

The registration and payment receipt for the share purchase will take place from July 14, 2025, to August 13, 2025. The transfer period for subscription rights is from July 14, 2025, to August 8, 2025. Existing shareholders who are domestic investors are not allowed to transfer their subscription rights to foreign investors.

Illustrative image

Upon completion of the offering, HSC expects to raise approximately VND 3,599.8 billion. The company plans to allocate nearly VND 2,520 billion (70%) to supplement capital for margin lending activities and nearly VND 1,080 billion (30%) to proprietary trading activities.

Consequently, HSC will increase its charter capital from VND 7,208 billion to VND 10,808 billion. This capital increase plan was approved at the 2024 Extraordinary General Meeting of Shareholders.

In the first quarter of 2025, HSC reported a 16% growth in operating revenue, reaching nearly VND 1,000 billion. Profit from loans and receivables contributed the most, amounting to nearly VND 523 billion, an increase of 54% compared to the same period last year. Meanwhile, proprietary trading activities decreased by 18% to nearly VND 249 billion, and brokerage revenue also decreased by 23%, amounting to over VND 164 billion.

Notably, operating expenses surged by 48% to VND 613 billion. As a result, HSC reported a pre-tax profit of VND 283 billion and a post-tax profit of nearly VND 227 billion, down 18% compared to the previous year.

As of the end of the first quarter of 2025, HSC’s total assets decreased by 2.8% to VND 30,462 billion. The largest component of the asset structure was loan balance, amounting to VND 20,389 billion.

The company’s financial assets recognized through profit and loss (FVTPL) stood at VND 7,190 billion, a decrease of VND 570 billion from the beginning of the year. HSC invested VND 5,000 billion in bonds of large banks such as BIDV, MBBank, and VietinBank.

The equity portfolio was valued at VND 2,136 billion, slightly down from the beginning of the year and currently showing a loss. During the period, HSC reduced its holdings in certain stocks: FPT decreased from VND 676 billion to VND 2.5 billion, and STB decreased from VND 440 billion to over VND 17 billion.

In the capital structure, short-term borrowings decreased slightly to VND 19,535 billion, including domestic bank loans of VND 13,155 billion and foreign bank loans of VND 4,187 billion.

The Cautious Cash Flow: Paused Revival

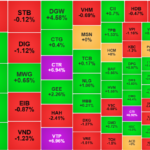

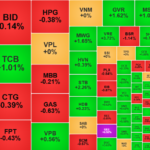

The afternoon session witnessed a slight uptick in liquidity; however, it failed to make up for the lackluster morning performance. For the first time in six weeks, the HoSE floor’s matching value fell below 13 trillion dong, with the combined value of the two floors dipping below 15 trillion dong. Investors seem to be adopting a wait-and-see approach.

A Private Bank to Boost Capital, Closing in on Agribank

“With a recent capital boost, this bank is poised to soar. The financial institution has just received approval for a substantial increase in its capital, setting the stage for dynamic growth and expanded services. This development signifies a pivotal moment in the bank’s journey, marking its transition into a new era of enhanced capabilities and broadened horizons.”

Technical Recovery, But Is the Market Risking a “Bull-Trap”?

The VN-Index continued to be heavily influenced by a few key stocks, with VHM taking center stage today. Investors took advantage of the technical rebound to exit their positions, resulting in a gradual weakening of the market throughout the session. The VN-Index failed to reclaim the 1320-point threshold, while trading volume remained subdued.

The Hunt for Whale Money: Proprietary Traders Scoop Up $400 Billion on HOSE, Foreigners Turn Net Buyers

The market rebounded from a series of adjustments, with a harmonious flow of capital from proprietary and foreign investors. Trading centered on large-cap stocks such as HPG, FPT, EIB, and VIX, indicating a strong presence of institutional investors and a positive outlook for the market’s future trajectory.