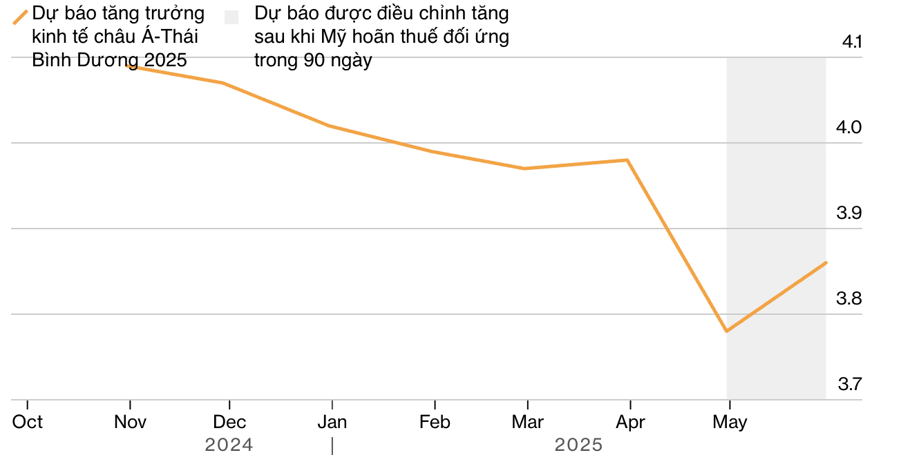

This reality provides policymakers in the region with additional leeway to support their economies amid risks from US tariffs and the uncertainty surrounding them, which are weighing on growth prospects.

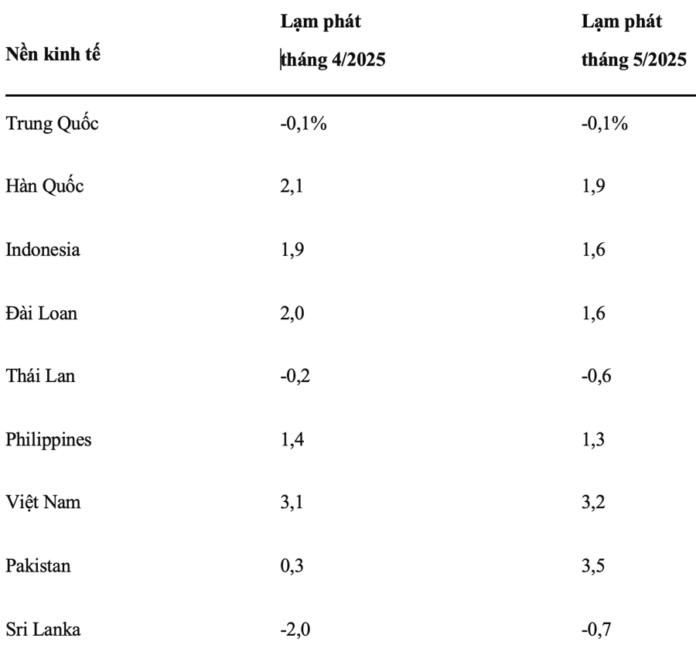

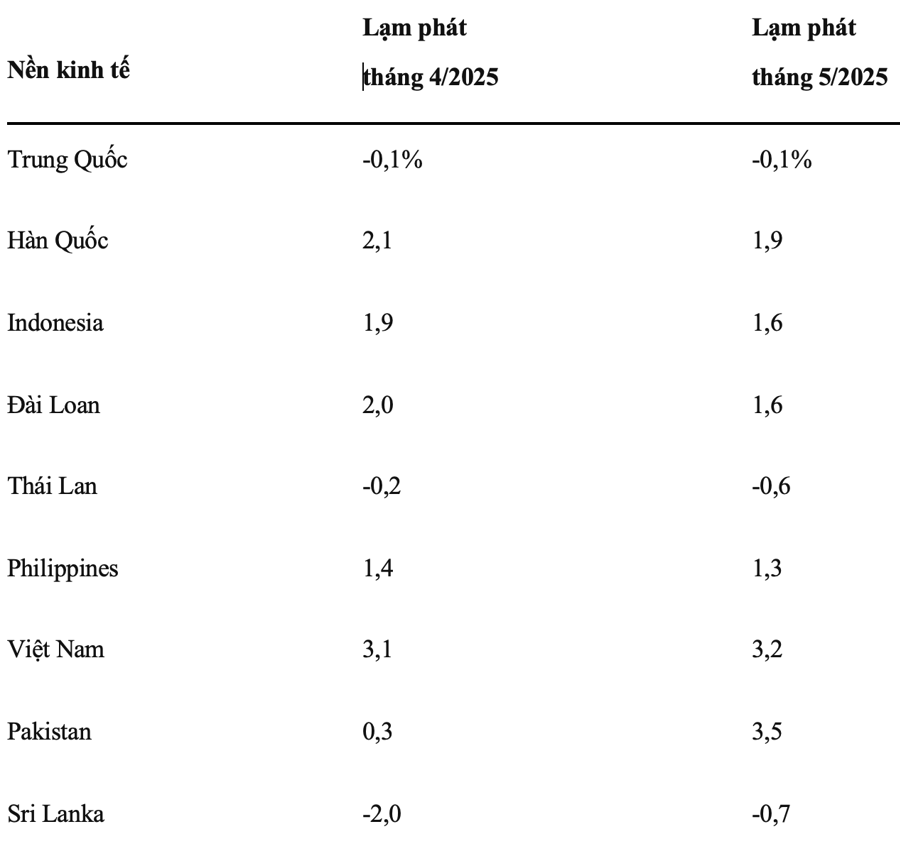

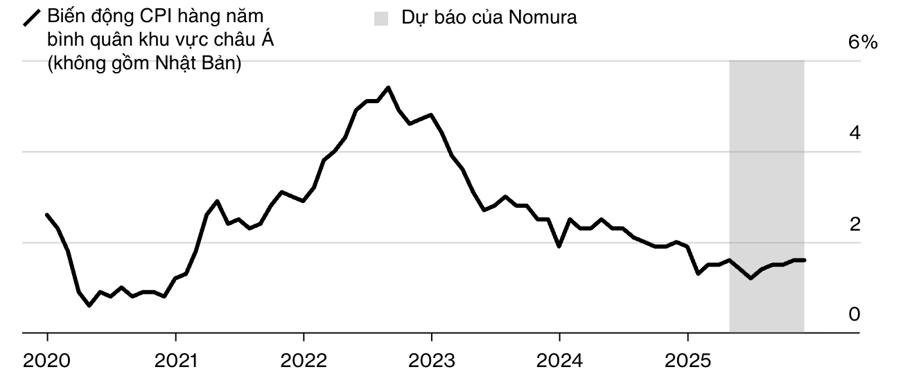

Inflation data from most Asian economies that have released their May reports show a slowdown in price growth. In April, the average consumer price index (CPI) for Asia, excluding Japan, was 1.5%, the lowest since Q1 2021, according to Nomura Bank data.

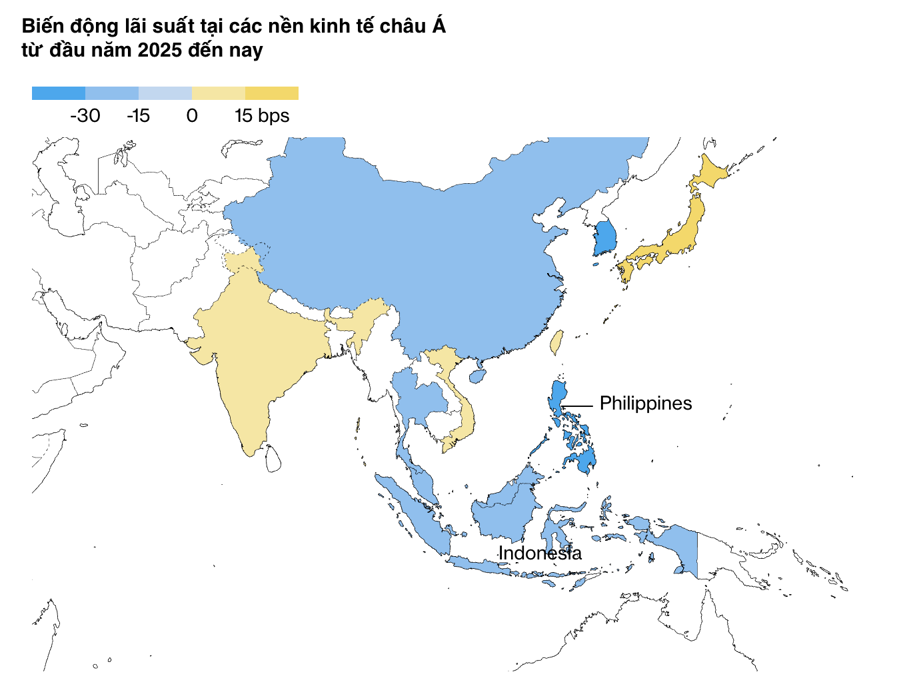

According to Bloomberg, over the past month, the interest rate swap market has increased bets on the likelihood of a rate cut by the Reserve Bank of Australia (RBA) and reduced bets on a rate hike by the Bank of Japan (BOJ). The market has also increased bets on rate cuts by central banks in South Korea, India, and Malaysia in the next three months.

So far, many central banks in the region have eased aggressively. Last week, the Reserve Bank of India (RBI) cut rates more than expected, by 0.5 percentage points. The Australian central bank also surprised with a softer stance after a 0.25 percentage point cut, with policymakers in both cases citing concerns about weakening demand and the potential impact of US tariffs.

“Inflation, deflation, stagflation – what happens in each economy will depend on the trade deals reached and how central banks react,” said Peter Kim, global market head at KB Securities, in an interview with Bloomberg.

China, the largest economy in Asia, is experiencing deflation. The country’s producer price index (PPI) fell for the 32nd consecutive month in May, the deepest decline in nearly two years.

In Japan, the second-largest economy in the region, BOJ Governor Kazuo Ueda said this week that the bank is yet to achieve its inflation target, and his comments sent the yen lower against the dollar. Although Ueda dismissed the possibility of a rate cut, his mention of the need to support the economy led to the impression that a rate hike is not on the cards anytime soon.

Meanwhile, South Korea’s unexpected inflation slowdown reinforces the case for a rate cut. Bloomberg Economics predicts the Bank of Korea (BOK) to lower rates by 0.25 percentage points in August and November, bringing the benchmark rate to 2% by the end of the year.

A similar story is playing out in many Southeast Asian economies.

“Central banks, instead of bringing rates to a neutral state if they’re not already there, are now easing,” said Tamara Henderson, ASEAN economist at Bloomberg Economics. “The question is how fast will they ease because the tariffs are going to be there.”

Henderson predicts Singapore and Thailand will fall into recession as US tariffs dampen global goods demand. In fact, since late 2024, growth forecasts for 2025 for most economies in the region have been cut, partly due to falling oil prices and tariffs casting a shadow over consumer and business sentiment.

The recent broad-based weakening of the US dollar, if sustained, means central banks in Asia won’t have to worry as much about their currencies when cutting rates. However, this also comes with some drawbacks. “In past economic cycles, weakness in Asian currencies played an important role in absorbing shocks when exports weakened. But this time, that cushion may not be there,” said Sonal Varma, chief economist at Nomura.

Nomura predicts the Japanese yen, Taiwanese dollar, and South Korean won will continue to strengthen this year.

On Asian currency outlooks, the path of interest rates by the US Federal Reserve (Fed) will also play a significant role. Fed Chairman Jerome Powell has so far turned a deaf ear to President Donald Trump’s calls for rate cuts, instead maintaining a cautious approach to assess the full impact of tariffs on US prices and employment.

Economists also believe Asia’s economic and policy outlook will depend heavily on US tariff policy.

“Unlike Covid, tariffs are not a shock that can boost inflation globally,” said Robin Brooks, a senior fellow at the Brookings Institution. He argued that replacing US demand won’t be easy, so there will be deflationary pressure in net exporting nations, while inflationary pressure in the US may increase. “The global inflation picture will not be uniform,” he said.

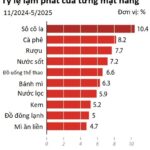

The Sad State of Asia’s Fourth-Largest Economy: Soaring Prices Leave Citizens Reeling, Even Instant Noodles and Boiled Eggs Become Luxuries

Instant noodles were once considered a cheap meal, but prices in South Korea are on a continuous upward trend.

Gold Prices Plummet Following US Jobs Report, SPDR Gold Trust Sells Off

However, the high demand for risk aversion and the depreciation of the US dollar this week have kept the precious metal prices buoyant, resulting in a weekly gain…