Robust Credit Growth

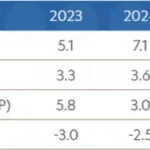

According to the latest statistics from the State Bank of Vietnam, as of the end of May, credit growth for the entire economy reached 6.52%, a significant increase compared to the 2.41% recorded in the same period last year.

It is estimated that in the first five months of the year, total credit outstanding increased by over VND 1 quadrillion to more than VND 16.6 quadrillion. This represents a record high increase in outstanding credit for this period.

Strong credit growth in the first five months.

To support economic growth, the State Bank has set a credit growth target of approximately 16% for 2025, which translates to injecting at least VND 2.5 quadrillion into the economy. In 2024, total credit growth for the economy was about 15.08%, equivalent to VND 2.1 quadrillion in credit injected into the market.

With the 16% credit growth target for 2025, the State Bank has outlined key solutions.

Commercial banks are required to continue reducing interest rates, supporting businesses and individuals in accessing capital more easily; prioritizing credit for production and business in priority sectors such as industry and high-tech agriculture, while tightly controlling risks in sensitive industries; promoting technology application, digital transformation, and simplifying administrative procedures to shorten loan processing time.

Additionally, banks are encouraged to expand their business connection programs, especially with small and medium-sized enterprises, to address difficulties related to collateral and bad debt.

The management agency also directs the banking industry to implement important credit packages with preferential interest rate mechanisms. Recently, the State Bank instructed nine banks to provide loans to young people under 35 years old to buy social housing, with a total limit of VND 145 trillion.

The lending rate is 2% lower than the average medium and long-term Vietnamese dong lending rate of the four state-owned commercial banks in the first five years of borrowing (from the first disbursement). In the next ten years, the interest rate is 1% lower.

Regarding the credit program for the agriculture, forestry, and fisheries sector, the State Bank has expanded the scope and objects of the program, renaming it the Credit Program for the Agriculture, Forestry, and Fisheries Sector, with a scale of VND 100 trillion.

Furthermore, the State Bank has announced a VND 500 trillion credit program (with the participation of 21 commercial banks) for lending to strategic infrastructure projects (such as transportation, power, and digital infrastructure) at preferential interest rates (reduced by 1% or more compared to medium and long-term lending rates).

Concerns Abound

The banking industry update report for the first quarter of this year by WiGroup highlights the bright spots in credit growth and profitability but also reveals significant pressure on asset quality and interest income.

Moreover, the downside of the credit growth trend is the increased risk of asset quality deterioration. The bad debt ratio in the industry has climbed to 2.16%, an 18.5% increase compared to the same period last year. Notably, the bad debt coverage ratio declined to 80%, indicating a slower increase in provisioning expenses during the period.

Economist Nguyen Quang Huy points out that most of the credit currently flows to large, reputable businesses or real estate projects. Banks tend to favor borrowers with high-value collateral and good credit histories, putting small and medium-sized enterprises at a disadvantage in accessing capital due to their lack of collateral.

Mr. Huy also draws attention to the fact that while interest rates have been reduced at certain times, the loan requirements of banks remain stringent. Borrowers must demonstrate strong financials, present clear business plans, and show stable profitability. However, after the challenging period caused by the pandemic and global economic fluctuations, many businesses cannot meet these standards. As a result, while credit may be growing, not all enterprises are able to access this capital.

The Greenback’s Grip: VNĐ/USD Exchange Rate Predictions

The Vietnamese Dong (VND) is predicted to remain in a fragile state against the US Dollar for the remainder of this quarter. However, from the fourth quarter onwards, the VND is anticipated to regain its momentum and join other Asian currencies in a collective improvement as trade tensions ease.

The Ultimate Guide to Mastering the Art of Currency Trading: Fiin Ratings’ Fresh Forecast on USD/VND Exchange Rates Unveiled

“The US dollar is predicted to weaken further, according to Fiin Ratings, easing exchange rate pressures in the coming months. This forecast bodes well for those with investments tied to the dollar, as a softer greenback could bring some much-needed relief.”

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)