The momentum from yesterday’s rebound fizzled out as money flow chose not to “chase” the market. Today’s trading liquidity on the two exchanges dropped to the lowest level in 30 sessions, and price resilience entirely depended on how sellers offloaded their holdings.

The VN-Index still managed to eke out a small gain at the opening, extending the rise from the previous day’s close by 5.8 points and briefly surpassing the 1322.07 mark. However, the buying force quickly weakened, causing the market to slip into negative territory. By the morning session’s end, the index was up a mere 0.45 points, finishing at 1316.68.

The standout feature of the morning session was the liquidity, with the HoSE’s trading value dropping by 33% compared to the previous morning to just over 5,775 billion VND. Yesterday, the market rebounded with relatively low liquidity, and today, money flow contracted even further. This defensive reaction indicates investors’ reluctance to chase prices and their preference to stay on the sidelines.

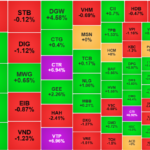

The VN-Index remained in positive territory mainly due to support from VIC, which rose 1.32%, and FPT, which climbed 1.56%. These two stocks alone contributed nearly 1.7 points to the index’s meager 0.45-point gain. VIC and FPT also faced certain pressure as they couldn’t sustain their highest prices: VIC slipped by 0.86%, and FPT dipped by 0.59%. The VN30 basket followed a similar pattern, with many stocks even reversing from gains to losses. At its best, the basket had 25 gainers, but by the session’s end, only 13 remained in positive territory, while 14 turned red.

On the downside, the most significant pressure came from VHM, which fell 1.65%, VRE, which declined by 3.58%, and BCM, which dropped by 1.18%. Other large caps generally showed weakness, with VCB, BID, CTG, HPG, and GAS all in the red. Fortunately, selling pressure wasn’t too intense, and the VN30 group’s liquidity was extremely low at 2,568 billion VND, a 44% drop from the previous morning and the lowest since late April 2025.

The overall market this morning was in a state of reduced buying but not increased selling. The VN-Index maintained a positive breadth with 145 gainers versus 126 losers, and at its best around 9:45 am, it had 160 gainers against 82 losers. The weak selling pressure was evident in the narrow decline: Out of the 126 losers, only 41 fell by more than 1%, and only 10 had trading values exceeding 10 billion VND. If the selling pressure were more intense, either liquidity would have increased, or the decline in stock prices would have been more widespread. Aside from VHM and VRE, only a few other stocks stood out in terms of selling compared to the rest: EIB fell by 1.31% with a matching value of 120.5 billion, GEX dropped by 1.12% with 67.7 billion, DIG declined by 1.12% with 63 billion, PDR fell by 1.69% with 46 billion, and HHS decreased by 1.28% with 24.4 billion.

On the upside, the situation was more favorable, with money flow still pushing prices up in numerous stocks, although none could maintain their highest levels. Among the 65 stocks rising by more than 1%, 22 had trading values exceeding 10 billion VND. Seven stocks had trading values surpassing 100 billion VND: FPT rose by 1.56% with 408.1 billion, DGC climbed by 3.18% with 242.3 billion, VTP jumped by 6.96% with 175.8 billion, DGW increased by 4.45% with 161.2 billion, CTR surged by 6.94% with 156.8 billion, GEE advanced by 5.24% with 149.4 billion, and VIX rose by 1.14% with 134 billion…

From a capital allocation perspective, the group of stocks rising over 1% accounted for 37.8% of the total trading value on the HoSE. This is a bright spot in the context of very low overall market liquidity. At the very least, investors are still seeking out and finding stocks that stand out prominently.

Foreign investors also significantly reduced their buying. Total investment on the HoSE fell by 31% from the previous morning to 863.6 billion VND. Meanwhile, selling decreased by 14% to 1,098.2 billion VND, resulting in a net sell-off of 234.6 billion VND. Compared to the net sell-off of 18 billion VND the previous morning, this is a significant change, although it didn’t stem from increased selling pressure. Several stocks experienced notable net selling, including HPG (-88.6 billion VND), CTG (-86.8 billion VND), VCB (-33.2 billion VND), STB (-25.4 billion VND), PVD (-26.8 billion VND), and DPG (-23.4 billion VND). On the net buying side, we saw FPT (+67.5 billion VND), VIX (+44.1 billion VND), SSI (+43.3 billion VND), NLG (+30.5 billion VND), GEE (+30.1 billion VND), EIB (+26.9 billion VND), and CTR (+26.4 billion VND). It’s evident that many of the stocks that performed well this morning benefited from strong foreign buying. In a context of low overall selling pressure and liquidity, this support is particularly notable.

Market Pulse June 11: VN-Index Caught in Tug-of-War, VGI and CTR Surge Ahead

The market closed with the VN-Index down 1.03 points (-0.08%), settling at 1,315.2; while the HNX-Index dipped 0.17 points (-0.08%), ending at 226.23. It was a mildly positive day for the broader market, with buying interest outpacing selling pressure as 345 tickers advanced against 309 declining names. However, the large-cap universe painted a different picture, with the VN30 basket witnessing a sea of red – 16 tickers declined, 11 advanced, and 3 remained unchanged.

The Cautious Cash Flow: Paused Revival

The afternoon session witnessed a slight uptick in liquidity; however, it failed to make up for the lackluster morning performance. For the first time in six weeks, the HoSE floor’s matching value fell below 13 trillion dong, with the combined value of the two floors dipping below 15 trillion dong. Investors seem to be adopting a wait-and-see approach.

A Mysterious Force ‘Pours’ Over $34 Million into Vietnam’s Stock Market in a Single Day

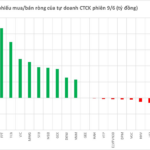

The HoSE-listed securities firms witnessed a notable uptick in net buying from proprietary trading activities, with a total value of 816 billion VND.