Market liquidity decreased compared to the previous trading session, with the matching trading volume of VN-Index reaching more than 539 million shares, equivalent to a value of more than 12.9 trillion dong; HNX-Index reached more than 66.2 million shares, equivalent to a value of more than 1.1 trillion dong.

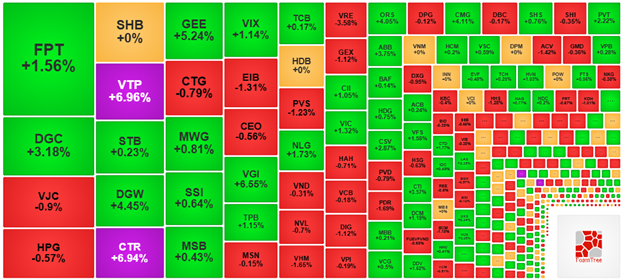

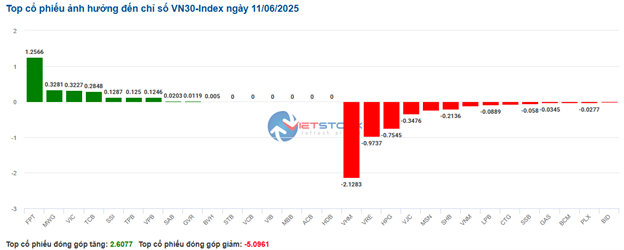

In the afternoon session, the VN-Index experienced a significant fluctuation. The opening was a sharp decline, followed by a return of buying pressure, helping the index to recover towards the end of the session and closing near the reference level in the red. In terms of impact, VHM, VCB, GVR, and VIC were the codes that had the most negative impact on the VN-Index with a 1.6-point decrease. On the other hand, FPT, HVN, VTP, and GEE were the codes that remained in the green and contributed more than 1.5 points to the overall index.

| Stocks with a strong impact on the VN-Index on June 11th |

Similarly, the HNX-Index also had a rather pessimistic performance, with the index being negatively impacted by the codes DTK (-7.75%), HUT (-1.46%), PVI (-1.26%), and THD (-1.38%)…

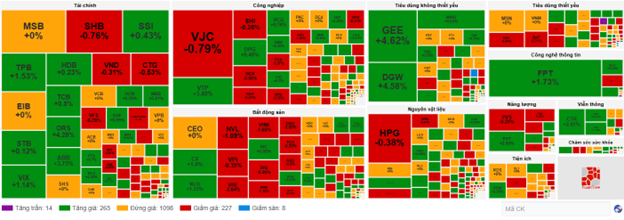

At the end of the session, the market increased by 0.09%. The telecommunications sector was the group with the strongest gain in the market, with a 5.15% increase, mainly from the codes VGI (+5.85%), CTR (+6.94%), FOX (+3.18%), and VNZ (+0.29%). This was followed by the information technology sector, which increased by 1.98%. On the other hand, the real estate sector recorded a decline of 0.64%, mainly due to the codes VIC (-0.44%), VHM (-0.69%), VRE (-1.51%), and BCM (-1.35%).

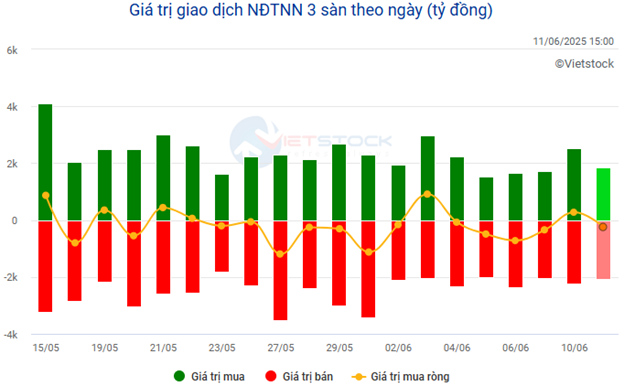

In terms of foreign trading, foreigners net sold more than 185 billion dong on the HOSE exchange, focusing on the codes HPG (116.99 billion), GEX (76.11 billion), CTG (76.01 billion), and STB (58.66 billion). On the HNX exchange, foreigners net sold more than 2 billion dong, focusing on the code MBS (6.71 billion), VGS (3.7 billion), VFS (1.74 billion), and PVI (1.18 billion).

Source: VietstockFinance

|

11:30 AM: Viettel Group stocks surge amid gloomy market

The market continued to fluctuate within a narrow range around the reference level. At the mid-session break, the VN-Index inched up 0.03%, reaching 1,316.68 points; while the HNX-Index fell 0.08%, dropping to 226.21 points at the end of the morning session. The market breadth recorded 318 advancing stocks against 267 declining stocks.

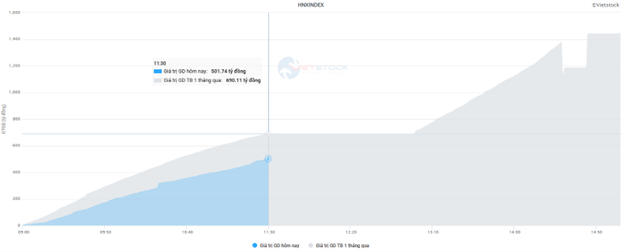

Liquidity continued to hit rock bottom, indicating that caution still prevailed in the market. The trading value on the HOSE this morning reached only over 6.3 trillion dong, a decrease of 41% compared to the 1-month average. Similarly, the HNX exchange also recorded a decrease of 27%, reaching nearly 502 billion dong.

Source: VietstockFinance

|

Among the top stocks influencing the VN-Index, VIC was the most prominent name on the positive side, contributing more than 1 point to the overall index. This was followed by FPT and GEE, which also added more than 1 point. On the other hand, VHM and VRE led the decline, taking away 1.5 points from the VN-Index.

Most industry groups only fluctuated within a narrow range. Only the telecommunications and information technology sectors outperformed with gains of 5.71% and 1.65%, respectively.

Notably, Viettel Group stocks simultaneously broke out with impressive buying demand after a long accumulation period. CTR and VTP hit the ceiling price, while VGI and VTK also recorded gains of more than 6%.

Source: VietstockFinance

|

In addition, a few other bright spots also traded positively amid the gloomy morning session, including FPT (+1.56%), DGC (+3.18%), DGW (+4.45%), GEE (+5.24%), CMG (+4.11%), NLG (+1.73%), and PVT (+2.22%).

Regarding foreign investors’ transactions, they net sold this morning after net buying slightly in the previous session. The strongest selling pressure was concentrated in HPG and CTG, with a net selling value of nearly 90 billion dong for each stock, far exceeding the rest. On the contrary, FPT attracted positive buying demand from foreigners with a net buying value of 67 billion dong.

10:35 AM: Strong polarization persists

The morning trading session witnessed a polarized market. Selling pressure emerged in large-cap stocks, causing the main indices to retreat temporarily. However, money flow continued to seek specific industry groups, creating a diverse picture and reflecting investors’ selectiveness in the current context.

As of 10:30 AM, the VN-Index recorded a slight increase of 0.02%, hovering around 1,316.52 points. In contrast, the HNX-Index decreased by 0.47 points, falling to 225.93 points. Large-cap indices were more affected, with VN30 rising 0.13% and HNX30 falling 0.08%. Conversely, the UPCOM index showed positive signals, increasing by 0.11% to 98.3 points, reflecting the continued upward momentum in some mid- and small-cap stocks.

Midway through the morning session, the VN30 basket exhibited polarization. The number of declining stocks slightly exceeded the number of advancing stocks. Specifically, there were 14 codes in the red, while 10 codes increased, and 6 codes remained unchanged. On the supportive side, the leaders were FPT, MWG, VIC, and TCB, contributing more than 2.1 points to the overall index. Conversely, the main pressure on the index came from the declines of VHM, VRE, HPG, and VJC, resulting in a negative impact on the overall basket and taking away more than 4.2 points. The fluctuations reflected the caution of the money flow.

Source: VietstockFinance

|

In terms of industry groups, the picture was quite diverse with many notable bright spots. Notably, the Semiconductor sector led the strong rally with an impressive gain of 4.76%, with VGI stock increasing by 4.76%. Other sectors also broke out, including Software (+1.36%), Consumer and Decorative Goods (+1.25%) with GEE rising by 4.62%, and Telecommunications (+1.09%).

Notable selling pressure was observed in the real estate sector, which recorded a decline of 0.7%, and the transportation sector, which fell by 0.49%.

The banking group, the sector with the largest market capitalization, recorded a slight decrease of 0.04% according to the industry index. However, many large-cap stocks in the industry faced notable corrective pressure, such as MBB falling by 1.34%, SHB decreasing by 0.76%, TCB dropping by 0.66%, VPB declining by 0.68%, CTG falling by 0.32%, and STB slipping by 0.33%. Conversely, the financial services group edged up 0.13%, led by SSI, which rose by 0.64%. The polarization among industry groups indicated that money flow was rotating and focusing on specific stories within individual sectors.

The mid-morning session at 10:30 AM presented a colorful market breadth. While there were 265 advancing stocks and stocks hitting the ceiling price, 227 stocks declined and hit the floor price. Notably, the number of stocks standing at the reference level dominated, totaling 1,098 codes. This reflected the hesitation and deep polarization in the market.

Source: VietstockFinance

|

Opening: Polarization at the beginning of the session with the green side dominating

At the start of the June 11th session, as of 9:30 AM, the VN-Index rebounded and fluctuated around the reference level. The HNX-Index also slightly increased and traded around the 226-point threshold. Additionally, the VN30 basket witnessed a dominant green side with 19 advancing codes, 7 declining codes, and a recovery in most industry groups.

Specifically, the energy sector led the overall recovery with a 0.68% increase, with buying demand concentrated mainly in the two large-cap oil and gas stocks, PVD rising by 0.79% and PVS increasing by 0.31%.

Furthermore, the information technology sector was among the top recovering sectors in the early session, with the duo of FPT rising by 0.69% and CMG climbing by 0.88%, along with VBH surging by 15%.

The financial sector also contributed to the green side despite the ongoing polarization, with most codes in the sector advancing. Specifically, stocks such as BID increased by 0.28%, TCB rose by 0.67%, CTG climbed by 0.26%, MBB gained 0.21%, and VPB added 0.56%…

Besides the three aforementioned groups, many large-cap stocks also exhibited positive dynamics. VIC, FPT, MWG, and HPG supported the indices.

Caution Prevails: A Vietstock Daily Overview for June 12th, 2025

The VN-Index witnessed a slight decline, with trading volume continuing to dip, indicating a clear dominance of cautious sentiment in the market. Without a significant improvement in buying pressure in the upcoming sessions, the index is likely to retest the crucial support level around the 1,300-point mark. At present, the Stochastic Oscillator remains downward-bound after exiting the overbought zone, while MACD consistently widens the gap with the signal line, post its sell signal. These indicators suggest that the risks of a short-term correction persist.

“VPBank Launches Record-Low Interest Rate Promotion at 6.6%”

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented move is accompanied by a host of other attractive offers, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.

The Cautious Cash Flow: Paused Revival

The afternoon session witnessed a slight uptick in liquidity; however, it failed to make up for the lackluster morning performance. For the first time in six weeks, the HoSE floor’s matching value fell below 13 trillion dong, with the combined value of the two floors dipping below 15 trillion dong. Investors seem to be adopting a wait-and-see approach.