| VN-Index Shakes Up Strongly in the Afternoon Session |

|

Source: VietstockFinance

|

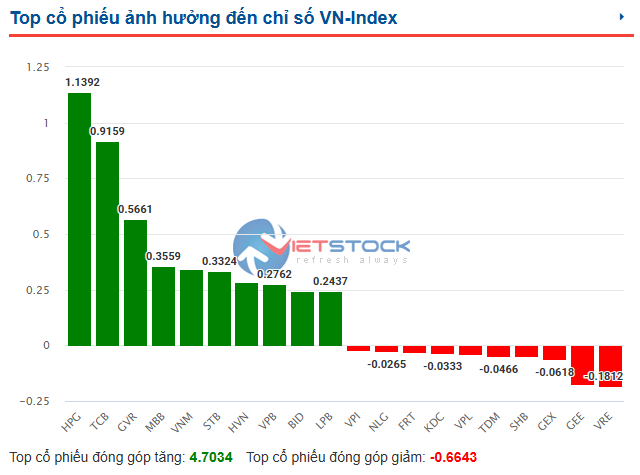

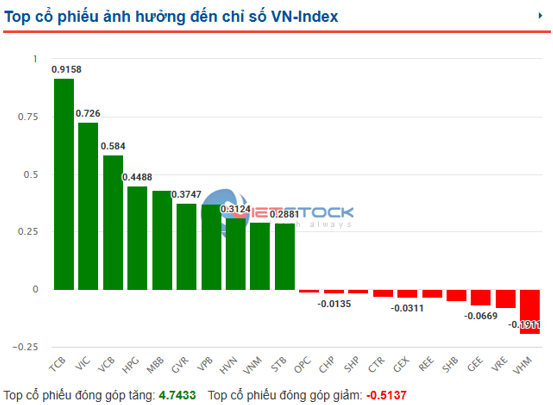

The trio of VIC, VHM, and VRE put considerable pressure on the VN-Index, respectively taking away more than 2.9 points, 1.9 points, and nearly 0.5 points, totaling over 5.3 points. This pressure was evident when looking at the real estate industry on the market map, with a contrasting picture appearing as stocks in the same industry rose positively, including NVL up 2.52%, DIG up 1.14%, VPI up 1.56%, DXG up 1.6%, KHG up 3.14%, and even DXS hitting the ceiling.

However, on a more positive note, many large-cap stocks also brought in a significant number of points, led by TCB with over 1.4 points, HPG with nearly 1.1 points, STB with almost 1 point, GVR with nearly 0.8 points, and MBB with over 0.6 points.

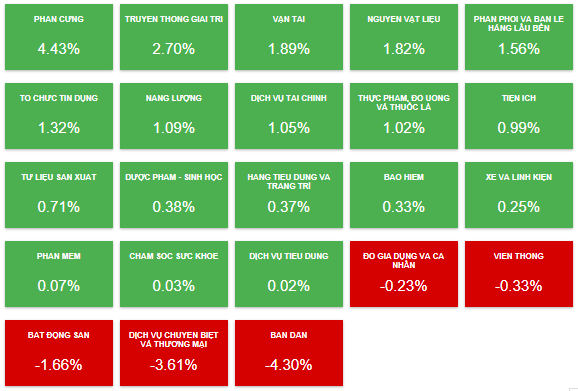

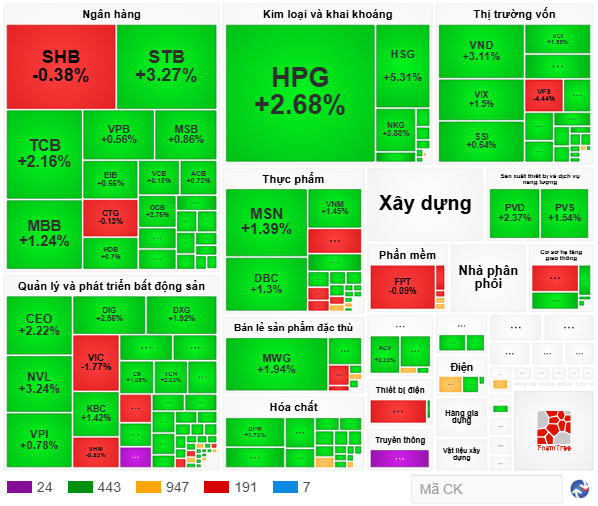

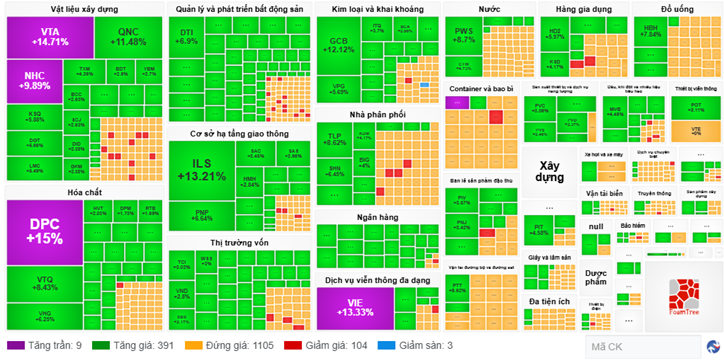

Overall, positivity was present across 18 industries, led by hardware with a 4.43% increase, followed by entertainment and media with a 2.7% rise. Seven industries recorded increases of over 1%, including transportation, raw materials, distribution and durable goods retail, banking, energy, financial services, and food, beverage, and tobacco.

Notable among these was the banking group, with a series of stocks posting strong gains. Standouts included STB, up 5.02%; TCB, up 2.82%; MBB, up 1.86%; MSB, up 2.15%; VND, up 2.48%; and OCB, up 5.05%. The securities group also performed well, with VND up 2.48%, VCI up 1.97%, and FTS up 1.1%.

Many leading stocks in other industries also showed positivity, such as MSN in the food industry, up 1.54%; MWG in retail, up 2.58%; DGW in wholesale, up 3.87%; and stocks in the metals and mining industry, including HPG, up 2.68%; HSG, up 4.06%; and NKG, up 3.1%.

|

Most industries gained during the June 12 session

Source: VietstockFinance

|

VN-Index closed the June 12 session at 1,322.99, up 7.79 points. Meanwhile, HNX-Index rose 1.5 points to 227.73, and UPCoM-Index climbed 0.12 points to 98.16. The total market value improved significantly compared to the previous session, reaching 21,780 billion VND.

The market recorded 514 rising codes, with 34 ceiling codes, indicating widespread enthusiasm. This excitement was also reflected through the Large Cap, Mid Cap, and Small Cap groups, which simultaneously increased by 0.6%, 0.74%, and 0.39%, respectively, while Micro Cap decreased by 0.1%.

In this context, foreign investors also returned to net buy nearly 411 billion VND, with the largest contribution coming from the “tycoon” of the steel industry, HPG, with nearly 222 billion VND, far surpassing the stocks that followed. On the net selling side, SHB topped the list with a scale of nearly 105 billion VND.

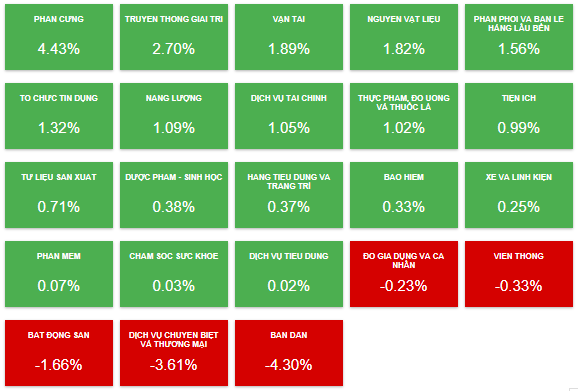

Morning Session: Narrow Fluctuations After a Strong Initial Rise

The market closed the morning session by maintaining the positivity that appeared at the beginning, with the VN-Index gaining 7.54 points to 1,322.74, the HNX-Index climbing 1.46 points to 227.69, and the UPCoM-Index rising 0.28 points to 98.32. Overall, green dominated the market.

Statistics show that up to 467 stocks rose, including 24 ceiling codes, mainly in industries such as construction materials, real estate, water, and pharmaceuticals. In contrast, only 198 codes decreased, including seven floor codes and 947 unchanged codes.

Although the market rose in the morning session, the results were determined early on, and the market then fluctuated within a narrow range. Looking at the VN-Index’s daily chart, the amplitude is becoming increasingly compressed and continuously testing the 1,322-point threshold.

|

Market Fluctuates After Early Rise

Source: VietstockFinance

|

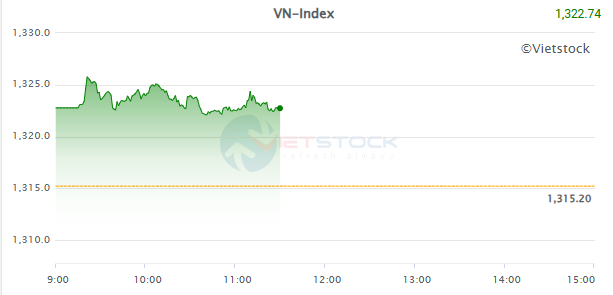

This increase in the index was significantly contributed by large-influence groups such as banking (STB up 3.27%, TCB up 2.16%, MBB up 1.24%…), real estate (CEO up 2.22%, NVL up 3.24%, DIG up 2.56%, DXG up 1.92%, DXS ceiling…), metals and mining (HPG up 2.68%, HSG up 5.31%, NKG up 3.88%…), and securities (VND up 3.11%, VIX up 1.5%, VCI up 1.55%…)

Notable rising stocks in other industries included MSN, up 1.39%; DBC, up 1.3%; VNM, up 1.45%; DPM, up 1.73%; MWG, up 1.94%; PNJ, up 2.78%; PVD, up 2.37%; and PVS, up 1.54%.

|

Green Dominates the Market in the Morning Session

Source: VietstockFinance

|

With these developments, it is no surprise that the top contributors to the VN-Index’s point gain were stocks in the aforementioned groups, led by TCB, with nearly 1.1 points, and HPG, with almost 1.1 points.

In contrast, the Vingroup trio of VIC, VHM, and VRE occupied the top three positions in terms of point deduction, respectively taking away more than 1.4 points, nearly 0.6 points, and over 0.3 points.

Liquidity on the VN-Index reached nearly 9,568 billion VND, far exceeding the average value of the previous session. In this context, foreign investors also traded actively, with purchases of over 1,346 billion VND and sales of over 1,174 billion VND, resulting in a net sell-off of more than 172 billion VND.

HPG was the most net bought stock, with nearly 174 billion VND, far surpassing the stocks that followed, such as NVL, with over 58 billion VND, and MSN, with nearly 47 billion VND. Conversely, CTG was the most net sold stock, recording nearly 49 billion VND, followed by FPT, with over 39 billion VND, and ACB, with nearly 33 billion VND.

10:40 am: HPG Takes the Lead

Continuing the positive momentum from the beginning of the morning session, the market witnessed more ceiling codes. HPG emerged as the stock that contributed the most points to the VN-Index today, while also being the most net bought stock by foreign investors.

Source: VietstockFinance

|

The number of ceiling codes was predominantly distributed across industries such as construction materials, real estate, textiles, water, construction, marine transportation, containers, and packaging. Among them, the construction materials and real estate groups recorded an outstanding number of ceiling codes.

In terms of trading volume, large-influence groups such as banking, metals and mining, real estate, securities, and food significantly impacted the overall market.

In the banking group, TCB rose 1.83%, MBB climbed 1.03%, and STB increased 1.98%…, thereby contributing positively to the market’s points.

The real estate group also performed well, with CEO up 2.22%, NVL gaining 2.16%, DIG rising 1.14%, and even DXS hitting the ceiling.

The metals and mining group was positive, with HPG up 2.87%, NKG climbing 3.88%, and HSG increasing 5.94% after positive estimated business results for eight months. Notably, HPG was the stock that contributed the most points to the VN-Index, with over 1.1 points.

The large-cap securities group also witnessed widespread positivity, with VND up 3.11%, VIX climbing 1.13%, VCI rising 1.13%, and FTS gaining 1.38%.

The total market value reached nearly 7,236 billion VND, of which the VN-Index accounted for over 6,542 billion VND, a significant increase compared to the previous session and slightly higher than the 5- and 10-session averages.

Foreign investors net bought nearly 148 billion VND, notably with HPG contributing more than 163 billion VND to the net buy value.

Opening: Green Dominates

The Vietnamese stock market opened with a dominant green color, with even ceiling codes appearing in the construction materials and chemicals groups. Liquidity also increased compared to recent sessions.

As of 9:40 am, the VN-Index rose 7.46 points to 1,322.66, the HNX-Index climbed 1.45 points to 227.68, and the UPCoM-Index increased 0.11 points to 98.15. The total market liquidity reached over 142 million shares, corresponding to a value of over 3,154 billion VND, generally more active than in recent sessions.

The market witnessed 400 rising codes, overwhelmingly outnumbering the 107 falling codes. Looking at the market map, green prevailed and almost completely dominated, notably in the construction materials, chemicals, transportation infrastructure, securities, metals and mining, distribution, and banking industries.

|

Green Dominates the Early Morning Session on June 12

Source: VietstockFinance

|

In the construction materials group, VTA and NHC hit the ceiling, while green spread across QNC, KSQ, DGT, LMC… In the chemicals group, DPC hit the ceiling, while many other stocks also performed well, including HVT, DPM, VTQ, and VHG…

The market also recorded many other green industries, such as real estate, chemicals, transportation infrastructure, securities, metals and mining, distribution, and banking.

Notably, the real estate and banking groups, with their large market capitalization, quickly contributed directly to the VN-Index’s points. The top 10 positive impact stocks brought in nearly 4.2 points, led by VIC, with nearly 1.2 points, VCB, with almost 0.6 points, and TCB, with over 0.4 points…

Source: VietstockFinance

|

Globally, Asian markets opened mixed, with All Ordinaries and Singapore Straits Times slightly rising, while Hang Seng, Nikkei 225, and Shanghai Composite opened lower.

Last night, US stocks declined as investors considered the preliminary trade agreement between the US and China, along with new inflation data. At the close of the June 11 session, the S&P 500 fell 0.27% to 6,022.24 points, ending a three-day winning streak; the Nasdaq Composite lost 0.5% to 19,615.88 points; and the Dow Jones dropped 1.1 points to 42,865.77 points.

– 15:40 June 12, 2025

Two Bank Stocks Were Actively Net Purchased by Proprietary Securities Companies in the June 11th Session

The proprietary trading arms of securities companies recorded a net buy value of VND 27 billion on the Ho Chi Minh Stock Exchange (HoSE).

The New Tax Declaration for 2.2 Million Business Households: A Comprehensive Guide to Navigating the Changes.

By the end of 2024, Vietnam is expected to have approximately 2.2 million stable business households, with a total tax revenue of nearly VND 26 trillion from this sector. With the planned abolition of the lump-sum tax from January 1, 2026, the Ministry of Finance has proposed a new regulation. This proposal suggests that individuals and business households will be required to self-declare and pay taxes according to a direct tax calculation method (a percentage of revenue), with a roadmap for the implementation of electronic invoices based on revenue.