Oil Prices Reach Multi-Week Highs

Oil prices climbed to multi-week highs as a weaker US dollar and positive sentiment surrounding US-China trade negotiations in London fueled expectations of improved global economic prospects, boosting oil demand.

Specifically, Brent crude oil rose by 0.57 USD (0.9%) to 67.04 USD per barrel, reaching its highest level since April 28. US WTI crude oil increased by 0.71 USD (1.1%) to 65.29 USD per barrel, with a peak of 65.38 USD—the highest since April 4.

The US Dollar Index dropped by 0.3%, making oil more affordable for holders of other currencies. Oil prices were also supported by hopes of a US-China trade deal, with Brent crude gaining 4% and WTI rising by 6.2% last week.

The potential impact of increased OPEC+ output next month was overshadowed by the positive trade negotiations. According to a Reuters survey, OPEC pumped 26.75 million barrels per day in May, an increase of 150,000 barrels per day compared to April. Saudi Arabia led the production boost, while Iraq made significant cuts to compensate for previous overproduction.

Gold Prices Edge Higher

Gold prices rose slightly due to a weaker US dollar and optimism surrounding US-China trade talks in London. Spot gold increased by 0.8% to 3,335.02 USD per ounce, and US gold futures climbed by 0.2% to 3,354.90 USD per ounce. The US Dollar Index fell by 0.3%, making gold more attractive to investors holding other currencies.

The meeting between officials from both countries follows a temporary pause in trade tensions last month. Analysts predict that positive outcomes from the negotiations could lead to a slight dip in gold prices, but they remain supported by expectations of interest rate cuts by the Fed, a weak economic outlook, and rising inflationary pressures.

Additionally, tensions in Ukraine have boosted gold’s appeal as a safe-haven asset. The People’s Bank of China continued to increase its gold reserves for the seventh consecutive month.

Other precious metals also saw gains, with platinum reaching 1,212.82 USD per ounce (the highest since May 2021), silver climbing to 36.71 USD (+2.1%), and palladium rising to 1,077.64 USD (+nearly 3%).

Copper Prices Rise on US-China Trade Hopes and Falling Inventories

Copper prices on the LME rose by 1% to 9,787 USD per ton due to optimism surrounding US-China trade negotiations and falling inventories, despite weak export data from China, the world’s top copper consumer.

LME copper inventories fell by 10,000 tons to 122,400 tons, a decrease of over 50% since February. Additionally, another 67,800 tons are scheduled for removal, mostly expected to be shipped to the US, where copper prices are significantly higher due to potential import tariffs.

China’s exports in May fell to a three-month low due to US tariffs. The country’s imports of copper and copper products in May decreased by 16.9% year-over-year and 2.5% month-over-month to 427,000 tons. The Yangshan copper premium fell to a three-month low of 41 USD per ton, down from 103 USD at the beginning of May.

Prices of other industrial metals showed little movement: aluminum rose by 1.2% to 2,480 USD per ton, tin increased by 1.1% to 32,710 USD, lead climbed by 0.3% to 1,989 USD, while zinc and nickel fell by 0.5%. A weaker US dollar also provided support to commodity prices.

Iron Ore Prices Slip

Iron ore futures slipped due to weak economic data from China, which dampened investor sentiment. However, hopes for progress in US-China trade negotiations limited the decline.

The September 2025 iron ore contract on the DCE fell by 0.71% to 703 Chinese yuan per ton (approximately 97.83 USD). On the Singapore Exchange, the July 2025 contract decreased by 0.74% to 94.80 USD per ton.

In May, China’s producer price index (PPI) dropped at the fastest pace in nearly two years, while consumer prices continued to fall, reflecting persistent pressures from the real estate crisis and trade tensions.

Additionally, China’s iron ore imports in May decreased by 4.9% month-over-month as steel mills exercised caution amid seasonally weak steel demand. However, falling port inventories and robust hot metal output—indicative of steady demand—prevented a steeper decline in prices.

Other steelmaking raw materials showed mixed movements: coking coal rose by 0.13%, while coke fell by 1.22%.

On the Shanghai Futures Exchange, steel prices traded within a narrow range: rebar and hot-rolled coil remained almost unchanged, wire rod fell by 0.66%, and stainless steel dropped by 0.47%.

Wheat, Corn, and Soybean Prices Decline

US wheat prices fell by nearly 2% due to seasonal harvest pressure as the winter wheat harvest in the Northern Hemisphere commenced. Corn and soybean prices also trended lower due to favorable weather conditions for crops in the US.

As of 17:59 GMT, July 2025 wheat futures on the CBOT dropped by 11 cents to 5.43-3/4 USD per bushel, ending a three-day winning streak. July corn fell by 8.5 cents to 4.34 USD per bushel, while July soybean futures dipped by 0.5 cents to 10.56-3/4 USD per bushel, and November 2025 soybean futures declined by 5 cents to 10.32 USD per bushel.

Investors paused their buying after last week’s short-covering rally. Ahead of the USDA’s weekly crop progress report, analysts expected around 8% of the US winter wheat crop to have been harvested.

In Russia, the world’s largest wheat exporter, consulting firm Sovecon raised its 2025 wheat production forecast by 1.8 million tons to 82.8 million tons due to favorable weather conditions.

The USDA reported US corn exports for the week at 1.657 million tons, exceeding expectations. However, Brazil’s second corn crop harvest could limit US corn export prospects.

Japanese Rubber Futures Fall After Three Days of Gains as US Dollar Weakens

Japanese rubber futures turned lower after three consecutive days of gains as the US dollar weakened ahead of trade negotiations between the US and China in London.

On the Osaka Exchange (OSE), the November 2025 rubber contract fell by 4.1 yen, or 1.39%, to 290.2 yen per kg.

On the Shanghai Futures Exchange (SHFE), the September 2025 contract decreased by 35 Chinese yuan (0.26%) to 13,660 yuan per ton. Meanwhile, the July 2025 butadiene rubber contract rose slightly by 25 yuan (0.22%) to 11,275 yuan per ton.

Thai smoked sheet rubber and block rubber prices increased by 1.08% and 6.39% to 73.9 baht and 69.95 baht per kg, respectively.

The US dollar weakened by 0.3% against the Japanese yen, falling to 144.39 after surging by 0.9% in the previous session. The stronger yen made yen-denominated assets less appealing to foreign buyers.

Natural rubber prices are often influenced by oil prices as they compete with synthetic rubber, a petroleum byproduct. Typically, rubber trees yield lower production from February to May before entering the peak harvest season, which lasts until September.

On the Singapore Exchange (SICOM), the July 2025 rubber contract last traded at 160.6 US cents per kg, a slight decrease of 0.2%.

Cocoa Prices Steady After Strong Gains, Coffee and Sugar Prices Rise

Cocoa prices on ICE steadied after a 5% surge last week as speculators took profits amid forecasts of rain in West Africa. Coffee and sugar prices, meanwhile, climbed on fresh buying and tighter supplies in some regions.

London cocoa dipped by 0.3% to £6,626 per ton, while New York cocoa was almost unchanged at $9,456 per ton. Hedge funds reduced their net long position in New York and London cocoa futures by 2,303 and 4,066 contracts, respectively, as of June 3. Despite the forecast of rains in West Africa this week, dealers noted that the soil remains dry, limiting crop growth.

StoneX stated, “Early reports for the 2025/26 crop indicate that Côte d’Ivoire’s production could be as low as 1.8 million tons, well below the average of 2.2 million tons, suggesting that the deficit could persist for several years.” Cocoa arrivals at Côte d’Ivoire’s ports from the start of the season until June 8 rose by 6.8% year-over-year.

Raw sugar climbed by 1.1% to 16.67 cents per lb after hitting a four-year low in the previous session. White sugar rose by 1.5% to $472.40 per ton. Improved crop conditions in India and Thailand were attributed to the early and strong monsoon rains. In Brazil, the cane harvest accelerated after a dry spell. However, prices remained under pressure from Thai mills’ delayed hedging.

Robusta coffee surged by 2.6% to $4,451 per ton, rebounding from a 9.5-month low last week. Arabica coffee rose by 1.1% to $3,594 per lb. The recent recovery was supported by a sharp drop in arabica coffee stocks on ICE—a decrease of 95,000 bags in a single week. However, ample supplies from Brazil and Vietnam continued to weigh on the market.

Cazarini warned that if the pace of withdrawals continued, the market could face a temporary deficit. Consulting firm Archer noted that Brazilian farmers were actively selling robusta to cover harvest costs.

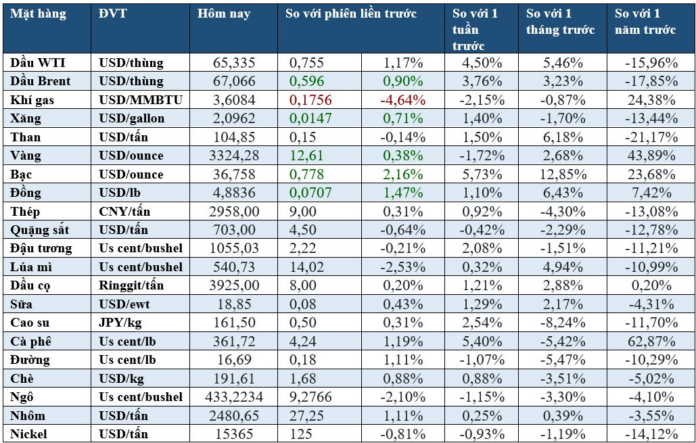

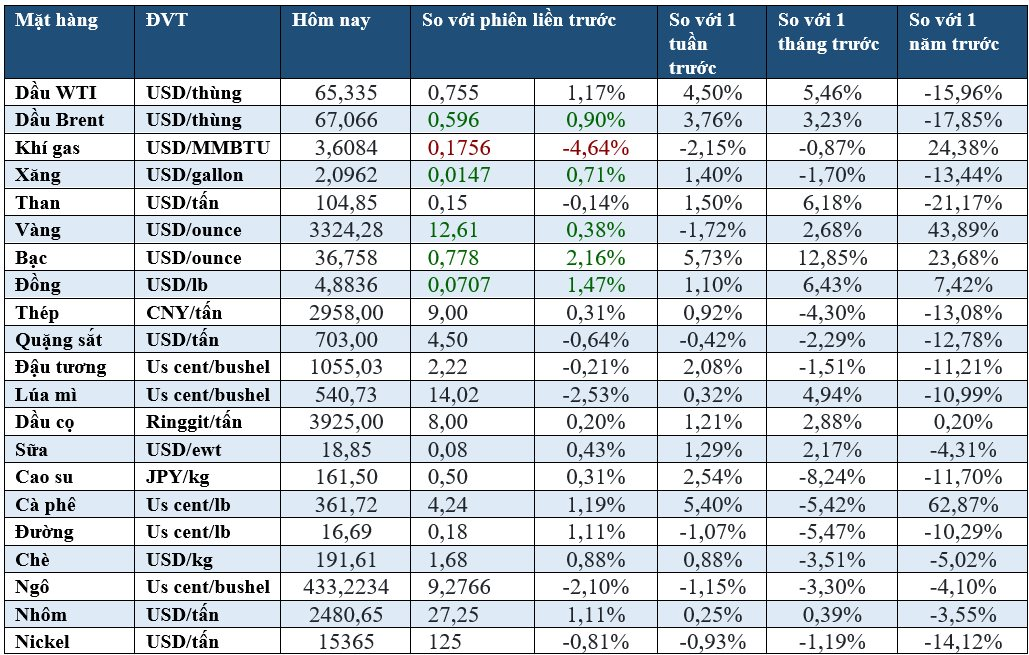

Prices of Key Commodities on Thursday Morning

The Energy Market on June 7: Oil Prices Continue to Surge, Gold Plunges Over 1%

The energy complex continued its upward trajectory on June 6th, with oil prices extending gains. Silver shone brightly, surging to a 13-year high, while platinum reached a 3-year peak. However, gold suffered a sharp decline, dropping over 1%. Raw sugar prices remained subdued, languishing at a 4-year low.

Gold Prices Slip on US-China Trade Talk Hopes

The sentiment among investors turned cautious ahead of the release of the U.S. non-farm payrolls report for May on Friday. With global economic uncertainties looming large, market participants are keenly awaiting insights into the health of the labor market, which could influence the Federal Reserve’s monetary policy trajectory. As the Fed has signaled a commitment to taming inflation, even at the risk of a recession, investors are bracing for a potential shift in their investment strategies.