The Vietnam Credit Rating Services Corporation (VIS Rating) released its May 2025 report on the corporate bond market, revealing a clear differentiation in credit trends. While commercial banks led the market with a surge in new issuances, the real estate sector continued to face challenges with delayed payments and maturity risks in the upcoming months.

In May 2025 alone, the total value of new issuances reached VND 66,000 billion, a 35% increase compared to the previous month. Thus, for the first five months of 2025, the total new issuances hit VND 137,000 billion, a significant 79% rise year-on-year.

This growth was mainly driven by commercial banks. The banking sector issued up to VND 100,000 billion in the first five months, an impressive 193% increase compared to the same period last year. According to VIS Rating, the primary reason for this is that loan growth is significantly higher than deposit growth, forcing banks to increase long-term bond issuances to meet capital demands.

This trend is forecasted to continue in the second half of the year, as banks plan to issue nearly VND 200,000 billion in 2025, with significant contributions from Military Commercial Joint Stock Bank (VND 30,000 billion) and Asia Commercial Joint Stock Bank (VND 20,000 billion).

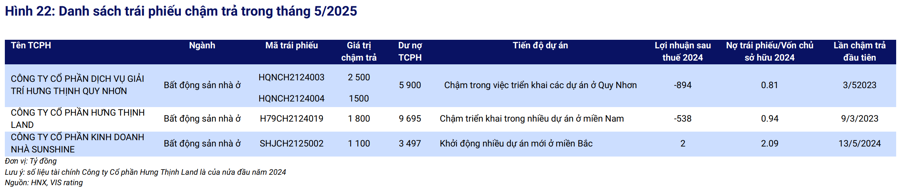

In contrast to the positive outlook for the banking industry, the real estate sector remains a focal point for credit risk concerns. In May 2025, the market recorded four additional delayed payments from three real estate companies related to Hung Thinh Group and Sunshine Group (including Hung Thinh Quy Nhon Entertainment Service Joint Stock Company, Hung Thinh Land Joint Stock Company, and Sunshine Housing Investment Joint Stock Company). These companies have a history of delayed payments and weak credit profiles, characterized by low profits and high financial leverage.

According to VIS Rating’s statistics, the situation among some large enterprise groups is tense. All bonds issued by the Hung Thinh Group and related companies have fallen into a delayed payment status. Meanwhile, the Sunshine Group has delayed payments of VND 6,600 billion out of a total of VND 25,000 billion in circulating bonds.

The pressure on the market is expected to increase in the last six months of 2025, as 474 bonds with a total debt of VND 150,000 billion will mature. Notably, the real estate sector accounts for half of this maturing value.

Notably, VIS Rating has issued a warning about 26 soon-to-mature bonds with a debt of VND 19,000 billion, issued by 15 real estate companies, which are at high risk of first-time delayed payment.

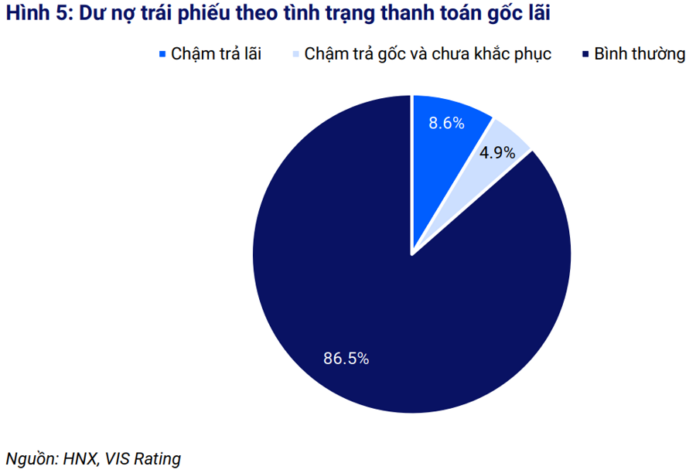

Although there are some positive signs in debt resolution, with six real estate companies repaying nearly VND 5,000 billion in overdue principal in May 2025, and the market’s recovery rate for overdue principal slightly increasing to 31.9%, the upcoming maturity pressure still poses a significant challenge that demands close monitoring by investors.

“Housing Revolution: Bank Pledges $330 Million for 100 Social Housing Projects”

The commercial banks have pledged a credit package worth VND 7.8 trillion for 100 social housing projects. This significant financial commitment underlines their support for the development of much-needed social housing initiatives across the country.

“Vice Governor: Youth Under 35 to Enjoy Subsidized Loans for Affordable Home Ownership”

“A standout initiative, according to the Vice Governor of the State Bank of Vietnam, Pham Thanh Ha, is the introduction of a dedicated credit package for individuals under 35 years of age to purchase social housing. This initiative stands alongside the comprehensive program outlined in Resolution 33.”

The Great Real Estate Debt Shuffle

The pressure is on for private placement corporate bond issuers this year, especially in the real estate sector, with maturities totaling over VND 130,000 billion. A significant number of real estate companies are now planning to issue private placement bonds to repay the principal and interest of previously issued bond batches.