As two essential sectors for infrastructure development and energy transition, cement and steel production are also associated with high-emission manufacturing processes. Reducing greenhouse gas emissions in these industries requires fundamental changes in technology, policies, and investment models. Amid global net-zero emission efforts, the question of achieving zero-emission cement and steel has garnered significant attention.

The Dual Role of Cement and Steel in the Net-Zero Equation

Economic Significance and Environmental Pressures

Cement and steel are vital construction materials for infrastructure, including housing, schools, transportation, and renewable energy infrastructure. Global steel demand is projected to increase by 30% by 2050, reflecting the trends of urbanization and investment in clean energy. [1] Meanwhile, cement demand is forecast to grow at an average rate of 2.4% per year until 2026. [2] The construction industry consumes more than half of the world’s steel production, highlighting the close link between these two industries in the supply chain.

However, both industries are among the highest emitters of carbon dioxide. The steel industry directly emits approximately 2.6 gigatonnes of CO₂ annually, accounting for 7% of global emissions from the energy system, surpassing even road transportation emissions. [3] Steel is also the largest industrial consumer of coal, accounting for about 75% of its energy requirements. [4]

The cement industry, on the other hand, emits around 3 gigatonnes of greenhouse gases annually. [5] In 2024, emissions from this sector decreased by 4% compared to 2019 levels, mainly due to a 3% drop in demand rather than technological improvements. [6]

Why Are Cement and Steel Industries Hard to Decarbonize?

Cement and steel are considered “hard to abate” sectors because emissions arise not only from energy use but also as a direct result of chemical reactions during production.

In cement production, approximately 39.8% of CO₂ emissions come from the raw materials used to produce clinker, the main component of cement. [7] Additionally, the combustion of fuels to operate production processes contributes significantly to emissions.

In steelmaking, coal plays a dual role as an energy source and a reducing agent in the smelting process, making it technically and economically challenging to eliminate carbon entirely.

To align with net-zero trajectories, the cement industry needs to reduce its emission intensity by about 22% by 2030 compared to 2023 levels, aiming for 1.91 Gt of CO₂e. [8] For the steel industry to meet the Paris Agreement’s goal of limiting global temperature rise to 1.5°C, direct emissions must decrease by 90% compared to 2020 levels, reaching approximately 220 Mt CO₂ by 2050. [9] These targets present significant technical and financial challenges, necessitating profound technological innovations throughout the production chain.

Emission-Reducing Technologies: Current Limitations and Future Prospects

Breakthroughs in Low-Carbon Cement Production

In the cement industry, several emission reduction strategies are being explored and implemented. One effective method is reducing the clinker-to-cement ratio by using supplementary cementitious materials (SCM) such as slag and fly ash.

According to the IEA, the clinker-to-cement ratio is expected to decrease from 0.71 (in 2022) to 0.65 by 2030 and further down to 0.57 by 2050. [10] McKinsey estimates that wider adoption of SCM could increase global SCM revenues to $40-60 billion by 2035, up from the current $15-30 billion. [11]

Carbon capture, utilization, and storage (CCUS) is a critical technology for achieving low-emission cement production. According to the IEA roadmap, CO₂ capture in the cement industry is projected to increase from zero today to 170 Mt CO₂ by 2030 and reach 1,310 Mt CO₂ by 2050. [12] However, the cost of this technology remains a significant challenge.

|

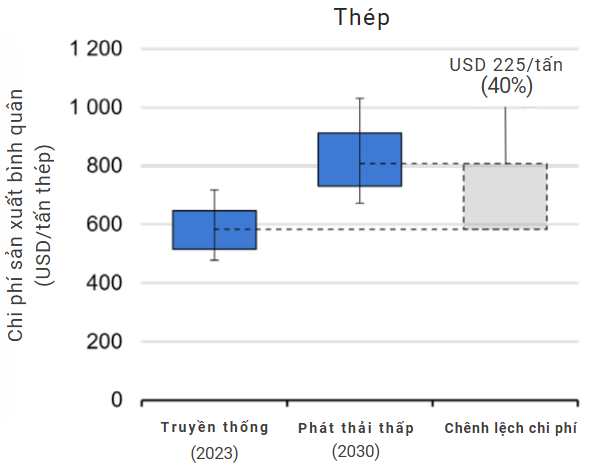

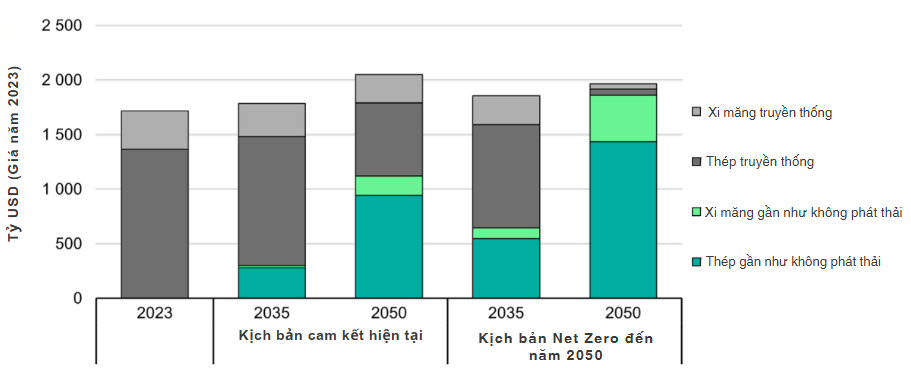

Comparing production costs between conventional and low-emission materials by 2030

|

Source: International Energy Agency (IEA), Demand and Supply Measures for the Steel and Cement Transition, 2023, page 27.

|

The IEA predicts that transitioning to low-emission steel and cement production will lead to significant cost increases by 2030. Specifically, the cost of producing near-zero-emission cement could average $160/ton, a 70% increase, or $60/ton, compared to traditional cement. [13]

Low-emission steel is expected to be $225/ton (a 40% increase) more expensive than conventional steel today. [13] This poses a considerable financial burden, especially since clean technologies such as electric arc furnaces (EAFs), green hydrogen, and CCUS are still in the testing phase and have not yet reached optimal scale.

On the other hand, carbon-negative concrete technology involves mineralizing CO₂ into construction aggregates. According to a BCG report, CO₂-based aggregates are estimated to reduce emissions by 12-48 kg per ton of aggregate compared to conventional products, which have an average emission of 3 kg/ton. [14] This results in negative emissions of -9 to -45 kg/ton, providing a net climate benefit as carbon is permanently stored in construction aggregates. [15]

Advancements in Green Steel Production

In the steel industry, zero-emission technologies revolve around three pillars: the use of electric arc furnaces (EAFs), the application of green hydrogen in the DRI (direct reduced iron) process, and the integration of CCUS into traditional blast furnace plants. EAFs are currently the preferred technology for recycling steel and have significantly lower emission intensities, especially when coupled with renewable energy sources. [16]

For primary steel, green hydrogen is considered a potential substitute for carbon as a reducing agent in the smelting process. According to BloombergNEF, the cost of producing hydrogen-based steel could reach $489/ton by 2050 if hydrogen costs decrease to $1/kg. [17] As of September 2023, at least 32 commercial agreements or memorandums of understanding have been signed in the field of hydrogen-based steel, reflecting the market’s high expectations for this technology.

However, CCUS in steelmaking is still in the pilot phase and faces several limitations. The IEA forecasts that hydrogen-based production will account for up to 42% of global steel production by 2050 in the net-zero emission scenario. [18] The decarbonization pathway in the steel industry is heavily tilted towards hydrogen rather than solely relying on CCS, as is the case with cement.

Policies and Market Trends: Are They Strong Enough to Drive Transformation?

The shift towards low-emission material production is driven by a range of policies and market mechanisms, but their effectiveness remains a question.

Among global policies, the European Union’s Carbon Border Adjustment Mechanism (CBAM) is considered the toughest measure to curb carbon leakage. Initially, CBAM required importers of cement and steel to report direct and indirect emissions from goods produced outside the EU. However, starting January 1, 2026, importers will have to purchase emission allowances equivalent to the emissions associated with those goods, effectively imposing carbon costs on high-emission imports.

Globally, decarbonization pathways are being harmonized at the industry level. The Global Cement and Concrete Association (GCCA), representing about 80% of the industry outside China, has published a Net Zero 2050 Roadmap, committing to provide net-zero concrete, with an intermediate target of reducing CO₂ emissions by an additional 25% by 2030. [19]

Meanwhile, regions like the EU and the United States are employing financial instruments to drive transformation. While Europe relies on the Emissions Trading System (EU ETS), the US combines tax incentives with one-time capital grants for large-scale decarbonization projects. However, according to BCG analysis, the cost of emission reductions in cement and steel far exceeds the market’s ability to absorb them, necessitating more aggressive policy adjustments to maintain transformation momentum. [20]

In addition to policy pressures, investor and consumer market expectations are also exerting significant influence. According to the World Economic Forum, 61% of listed companies in the cement industry have formally integrated climate change into their strategic decision-making processes. [21] Major corporations like Holcim have announced targets to reduce GHG emissions by 95% per ton of cement in Scope 1 and 2 by 2050, while also cutting Scope 3 emissions by 90% compared to the baseline. [22]

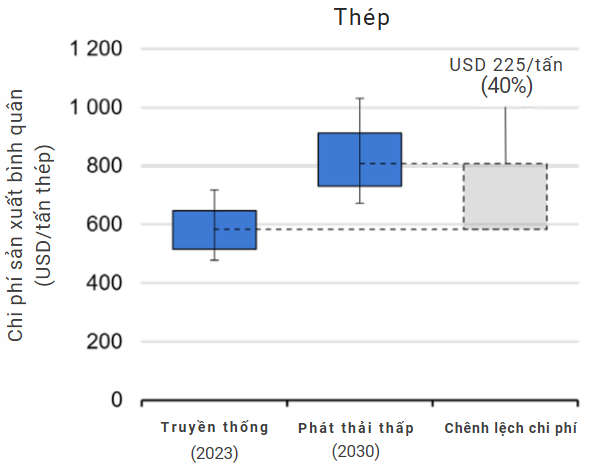

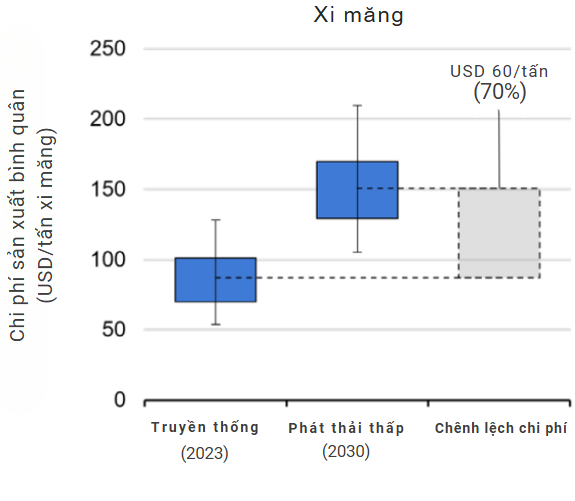

|

Global market size of cement and steel – conventional and near-zero-emission – according to scenarios by 2050

Source: International Energy Agency (IEA), Demand and Supply Measures for the Steel and Cement Transition, 2023, page 16.

|

The strong demand for green building materials, along with the growing trend of hydrogen-based steel trading, is notable. In the IEA’s net-zero emission scenario by 2050, green steel is predicted to dominate the market, while low-emission cement will experience significant growth.

Zero-Emission Cement and Steel: Feasible or Far-Fetched?

Despite the challenges, both industries have made notable progress in their decarbonization journeys.

In the cement sector, according to the GCCA, CO₂ emissions from cement production have relatively decreased by 20% over the past three decades, and the current trajectory aims for a similar reduction within the next decade. The target is to reduce CO₂ emissions related to concrete by 25% by 2030. [23]

One notable approach is increasing the proportion of low-emission clinker. The IEA forecasts that the production of near-zero-emission clinker will reach 8% by 2030, 27% by 2035, and 93% by 2050. Simultaneously, the use of low-emission fuels in thermal energy could rise from the current 5% to 86% by 2050. [24]

In the steel industry, production technologies based on hydrogen offer promising prospects. BloombergNEF predicts that these methods will account for 42% of global production by 2050 in the net-zero emission scenario. [25] As of September 2023, 32 agreements or memorandums related to hydrogen-based steel have been signed, indicating growing market and investor interest.

Cost barriers and infrastructure challenges remain significant hurdles. The BCG report suggests that implementing CCS in the cement industry could increase the cost per ton of product from the current $90-130 to $160-240 by 2050. [26] For the steel industry, to make green hydrogen competitive, a carbon price of up to $96/ton by 2030 would be necessary. [27]

The infrastructure for CCUS, clean energy, and green hydrogen is also inadequate. WEF estimates that the current capacity is less than 1% of what is required by 2050. [28] Scaling up to an industrial level will require over $1,000 billion in investment over the next 25 years. Additionally, the cost of CCS is significantly lower for plants located near storage sites (within 200 km) compared to those farther away (over 750 km), creating a wide disparity in feasibility between regions. [29]

Outlook and Projections

In the net-zero emission scenario, the IEA forecasts that the cement industry could reduce its direct emissions by 18% by 2050 if it receives adequate policy and financial support. [30] Sufficient CCS capacity must be deployed to cut over 35% of GHG emissions in the sector. [31]

For the steel industry to meet the Paris Agreement targets, direct emissions must decrease by 90% compared to 2020 levels, reaching approximately 220 Mt CO₂ by 2050. [32] This requires a 35% reduction in carbon intensity by 2030 and a further reduction to 90% by the middle of the century. [32]

The three main mitigation methods for the cement industry include CCS (expected to reduce emissions by 52%), material optimization (23%), and bioenergy utilization (9%). Combining these solutions with technological innovations and energy transition will be essential to drive comprehensive transformation. [33]

[1] [2] https://www.chevron.com/newsroom/2024/q2/explainer-what-do-we-mean-by-hard-to-abate-industries

[3] [4] https://www.iea.org/reports/iron-and-steel-technology-roadmap

[5] [20] [26] [29] [31] https://web-assets.bcg.com/36/29/d6c7915c4dbabed165a44162ae49/cement-industry-carbon-footprint.pdf

[6] [8] [21] [28] [33] https://reports.weforum.org/docs/WEF_Net_Zero_Industry_Tracker_2024_Cement.pdf

[7] https://www.holcim.com/sites/holcim/files/docs/28022025-holcim-climate-report-2024.pdf

[9] https://steelforum.org/steel-indicator-decarbonisation-dashboard.pdf

[10] [12] https://www.iea.org/reports/cement-3

[11] https://www.mckinsey.com/industries/engineering-construction-and-building-materials/our-insights/the-future-cement-industry-a-cementitious-golden-age

[13] https://iea.blob.core.windows.net/assets/c432d713-d778-46cd-9566-024075124fa5/DemandandSupplyMeasuresfortheSteelandCementTransition.pdf

[14] https://web-assets.bcg.com/9a/ee/1cc6f2444de8a63fe10f47b16cc1/ccu-report.pdf

[15] https://web-assets.bcg.com/9a/ee/1cc6f2444de8a63fe10f47b16cc1/ccu-report.pdf

[16] [17] [18] [25] [26] https://assets.bbhub.io/media/sites/25/2024/01/Scaling-Up-Hydrogen-The-Case-For-Low-Carbon-Steel-Bloomberg-New-Economy.pdf

[19] https://gccassociation.org/cement-industry-net-zero-progress/

[22

The Oil and Gas Industry Under Pressure to Reduce Carbon Emissions

The oil and gas industry is at the forefront of sectors facing immense pressure to reduce carbon emissions. As a significant contributor to global greenhouse gas emissions, it also has a pivotal role to play in the transition to a low-carbon future.

The Cost of Congestion: Unraveling the Billion-Dollar Traffic Woes in Hanoi and Ho Chi Minh City, with a Revolutionary ‘Traffic Circle’ Solution

“With his keen eye for optimization, Delegate Nguyen Van Canh proposes a revolutionary idea to alleviate traffic congestion at major roundabouts in urban areas across Vietnam. His suggestion, inspired by the successful implementation at the Phu Dong roundabout in District 1, Ho Chi Minh City, offers a glimmer of hope for smoother traffic flow in the country’s bustling metropolises.”

“TTC AgriS: Strategic Partnership with the Ministry of Agriculture and Environment”

On May 10, 2025, in Bac Ninh, TTC AgriS took a giant leap forward in the agricultural sector by partnering with the Ministry of Agriculture and Environment. This strategic collaboration marks a pivotal moment as we pioneer the implementation of Resolution 57-NQ/TW, leading the way in the digital transformation of circular agriculture.