VFS JSC Securities (code: VFS on HNX) has just approved the issuance of bonus shares for 2024 dividends as per the resolution of the 2025 Annual General Meeting of Shareholders (AGM).

Accordingly, VFS plans to distribute an 8% dividend, equivalent to the issuance of 10.36 million new shares. The entitlement ratio is 100:8, meaning that for every 100 shares owned, shareholders will receive 8 new shares.

The issuance will be funded by undistributed post-tax profits from the 2024 audited financial statements. The bonus shares will not be subject to transfer restrictions. The expected timeline for the issuance is the second or third quarter of 2025.

Upon completion of the issuance, VFS will increase its total number of outstanding shares to 139.96 million, equivalent to a charter capital of VND 1,399.6 billion.

VFS to issue 10.3 million shares as 2024 dividend

This dividend plan was approved at the 2025 AGM held on March 20. At the same meeting, VFS shareholders also approved a plan to offer 120 million shares to existing shareholders during 2025-2026, following the issuance of shares for 2023 and 2024 dividends.

With an offering price of VND 10,000 per share, VFS expects to raise VND 1,200 billion. Of this, VND 600 billion will be allocated to proprietary trading activities, and the remaining VND 600 billion will be used for margin lending.

For 2025, VFS targets total revenue of over VND 515 billion, a 75% increase from 2024. The main contributors remain proprietary trading (nearly VND 271 billion), margin lending (over VND 169 billion), and brokerage fees (nearly VND 65 billion).

VFS forecasts pre-tax and post-tax profits of over VND 172 billion and nearly VND 138 billion, respectively, both up more than 10% year-on-year. If achieved, these figures will mark a historic high for the company.

In other news, VFS appointed a new CEO in early May 2025. The company announced the resignation of Mr. Tran Anh Thang from his position as CEO and legal representative effective May 8.

His replacement is Ms. Nguyen Thi Thu Hang, who will also serve as the Head of Corporate Governance. Ms. Hang holds a Master’s degree in Economics and has been with VFS since 2020, serving as the Hanoi Branch Director and later as Deputy CEO from March 2023. She is also the authorized representative for information disclosure.

Ms. Nguyen Thi Thu Hang is the sister-in-law of Mr. Tran Anh Thang.

“Vietnamese Insurance Giant Proposes a Massive $35 Million Cash Dividend Payout to Shareholders”

“The Bao Viet Group is set to propose a plan to its shareholders to utilize a substantial amount of 783.3 billion VND as cash dividends for the fiscal year 2024. This move underscores the company’s commitment to returning value to its investors and fostering a culture of financial transparency and accountability.”

“T-Cap: Unveiling a New Era of Financial Strategy”

The annual General Meeting of Shareholders of Tri Viet Securities Joint Stock Company (HOSE: TVB), held on June 07, 2025, approved a name change to T-Cap Securities. Amid challenging market conditions, the company has set conservative business targets for 2025 and plans to offer over 33.6 million shares to existing shareholders.

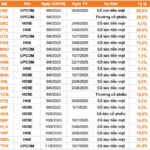

“Dividend Payment Schedule for June 9-13: Top Cash Dividends Over 40%, State-Owned Enterprise Allocates Approximately VND 1,500 Billion for Dividend Payments”

Introducing the top-performing stocks that offer lucrative cash dividends! 32 companies stand out with their generous cash payouts, ranging from a remarkable 41% to a solid 1.6%. These figures showcase a diverse range of opportunities for investors seeking steady income streams and strong returns. This impressive lineup underscores the potential for substantial gains in the stock market, providing a compelling proposition for those looking to grow their wealth.