With over 356 million shares currently in circulation, PVT will issue an additional 113.9 million shares as dividend payments, thereby increasing its charter capital from over VND 3,560 billion to nearly VND 4,700 billion.

Previously, the 2025 Annual General Meeting of Shareholders of PVT approved the plan to use undistributed post-tax profits from 2024 on the separate financial statements of the parent company to pay dividends in shares at a rate of 32%.

Source: VietstockFinance

|

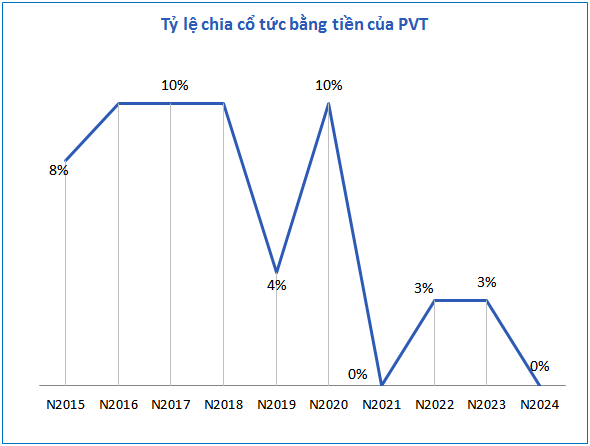

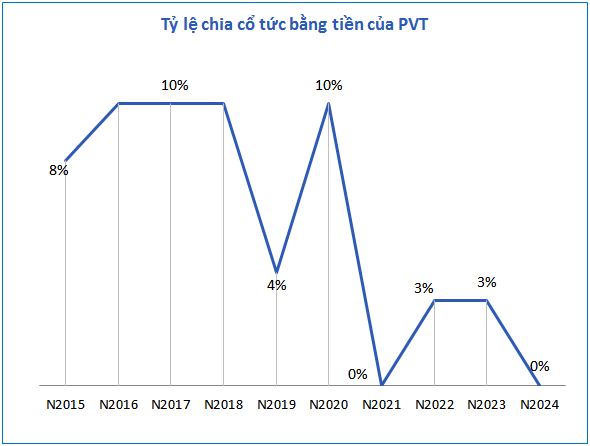

Looking back at its dividend payment history, PVT maintained cash dividends from 2015 to 2020. In 2021, the company switched to paying dividends in shares at a rate of 10%, then returned to cash dividends of 3% for two consecutive years (2022-2023). In 2024, the company once again opted for share dividends at a rate of 32% – the highest rate ever. This was also the year PVT recorded record net profit, surpassing the VND 1,000 billion mark.

According to PVT, the issuance of shares aims to supplement capital sources to serve production and business plans and investment development.

Specifically, in 2025, the company plans to invest VND 3,551 billion, of which VND 3,525 billion (equivalent to 141 million USD) will be used to purchase new vessels. The projects that continue from 2024 include investing in 1 product tanker MR or 1 bulk carrier (29 million USD), 2 product tankers MR or 1 crude oil tanker Aframax (52 million USD). In addition, PVT plans to purchase 1 LPG/VLGC vessel or 1-3 oil tankers, with a total value of about 60 million USD. The capital structure includes VND 1,261 billion in equity and VND 2,290 billion in loans.

In terms of business plans, in 2025, PVT sets a target of VND 10,300 billion in revenue and VND 960 billion in after-tax profit, down 16% and 35%, respectively, compared to the performance in 2024. Dividends are expected to be 10% of business results.

| PVT’s quarterly financial results from 2021 to 2025 |

As of the first quarter of 2025, PVT recorded nearly VND 2,790 billion in net revenue, up 10% over the same period last year. However, net profit decreased by 7% to over VND 215 billion, as cost of goods sold increased faster than revenue (up 14%). Compared to the annual profit plan, the company achieved 29% of the target after the first quarter.

Source: VietstockFinance

|

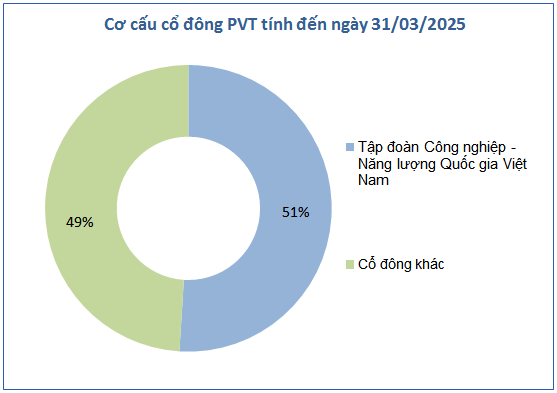

As of the end of the first quarter of 2025, the parent company of PVT is the Vietnam National Industrial and Energy Group (formerly Vietnam Oil and Gas Group) holding 51% of capital, equivalent to receiving more than 58 million shares in the upcoming dividend payment.

– 10:40 12/06/2025

“Vietnamese Insurance Giant Proposes a Massive $35 Million Cash Dividend Payout to Shareholders”

“The Bao Viet Group is set to propose a plan to its shareholders to utilize a substantial amount of 783.3 billion VND as cash dividends for the fiscal year 2024. This move underscores the company’s commitment to returning value to its investors and fostering a culture of financial transparency and accountability.”

The Ultimate Guide to Understanding Business Taxes: Unraveling the Mystery of Tax Types for the Savvy Entrepreneur

From June 1st, 2025, tens of thousands of businesses with an annual turnover of over VND 1 billion will transition from a flat-rate tax to a declaration of actual revenue. This shift not only demands investment in technology and bookkeeping but also brings clarity to the taxes payable as per regulations.

University of Shareholders: Delivering on 77% of Profit Plans in Just Five Months

I hope that suits your requirements. Let me know if you would like me to tweak it or provide multiple options.

At the 2025 Annual General Meeting held on the morning of June 10th, the Electricity Generation Corporation 3 – Joint Stock Company (EVNGENCO3, HOSE: PGV) announced its estimated results for the first five months of the year, achieving nearly 77% of the profit plan (excluding exchange rate differences revaluation). The company also outlined its investment plan for a capacity of 6,455 MW in the 2026-2030 period.