Vietnam’s Power Sector Prospects: Insights from the Adjusted Power Development Plan VIII

On April 15, 2025, the Prime Minister issued Decision No. 768/QD-TTg approving the Adjustment of the National Power Development Plan for the period 2021-2030, with a vision towards 2050 (Power Plan VIII). This plan outlines a comprehensive development strategy for Vietnam’s power sector, emphasizing diversification and a more balanced energy mix to ensure energy security and reduce reliance on imported fuels.

The adjusted plan prioritizes the robust development of renewable energy sources (including hydroelectric, wind, solar, and biomass) and green energy (such as hydrogen and green ammonia). It also encourages the acceleration of domestic gas-fired power projects and the import of LNG-fired power on a suitable scale, while gradually reducing the proportion of coal-fired power.

By 2030, the total capacity of power plants serving domestic demand is expected to reach 183,291 – 236,363 MW, with renewable energy (excluding hydroelectric) accounting for 28-36%. The transmission system also requires significant investment to accommodate the increasing capacity of large-scale renewable energy projects and ensure a balanced supply-demand equation across regions. The plan targets approximately 500.4 – 557.8 billion kWh of commercial electricity by 2030, with a vision to reach around 1,237.7 – 1,375.1 billion kWh by 2050.

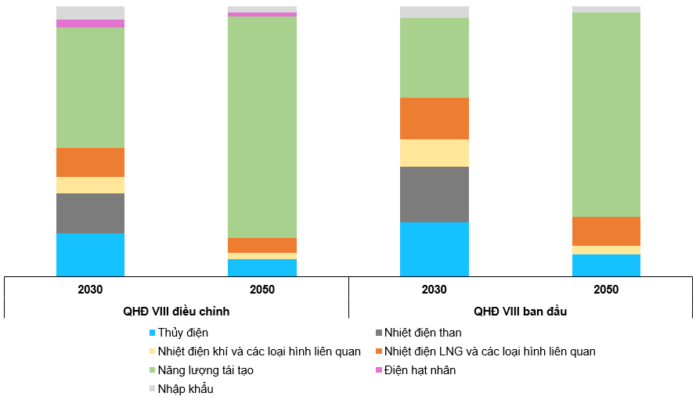

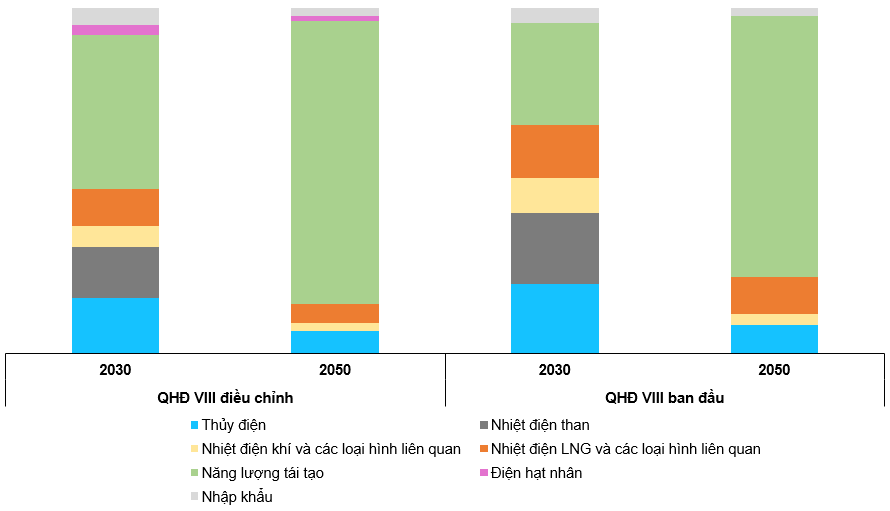

Shift in Power Source Capacity Distribution according to Power Plan VIII before and after the Adjustment

(Unit: Percentage)

Source: Power Plan VIII

These directions present long-term growth opportunities for businesses engaged in the development and operation of renewable energy projects, as well as for those with the capability to invest in and construct transmission infrastructure.

Q1 2025 Financial Results: A Boost from Hydropower

For Q1 2025, REE reported positive financial results, driven by a strong recovery in the energy segment due to favorable hydrological conditions. Revenue reached VND 2,068 billion, a 12.6% increase compared to the same period last year, while after-tax profit attributable to the company’s shareholders stood at VND 611 billion, a significant 27% surge.

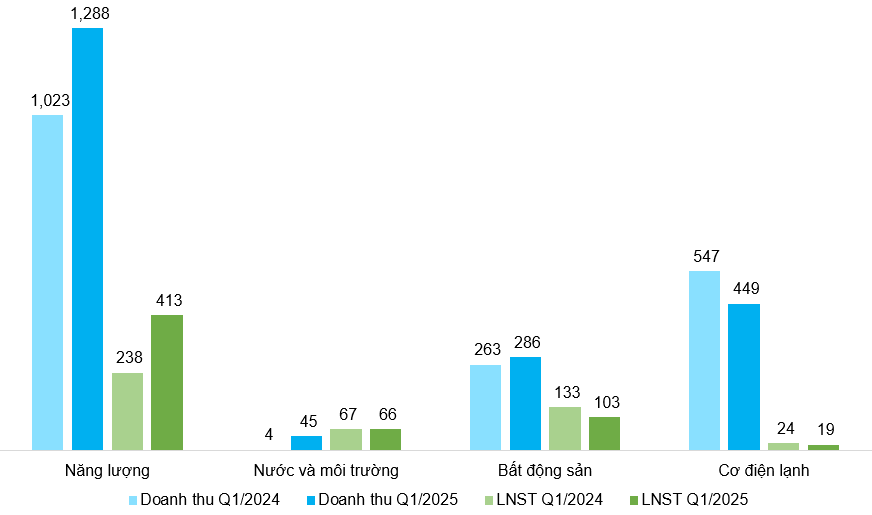

Q1 2025 Financial Performance of REE

(Unit: Billion VND)

Source: REE’s Financial Statements

The primary growth driver was the hydropower segment, with a 29.8% increase in electricity output, particularly in the Central region. Overall hydropower output for the period reached 1,238 million kWh, notably a 77% increase at Vinh Son – Song Hinh and 94% at Thuy Dien Mien Trung. Additionally, the company benefited from reduced financial expenses due to debt restructuring and improved selling prices as a result of deeper participation in the competitive power generation market, leading to expanded profit margins in the energy segment.

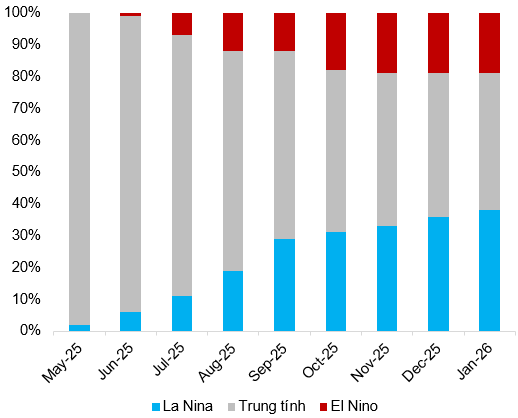

Regarding weather conditions, forecasts by the National Oceanic and Atmospheric Administration (NOAA) indicate a high likelihood of neutral ENSO conditions (92%) from May to July, persisting above 50% through October, and around 40% from January to March 2026. These projections suggest stable weather patterns in the upcoming months, which is favorable for balancing water resources in reservoirs for hydropower production and operations.

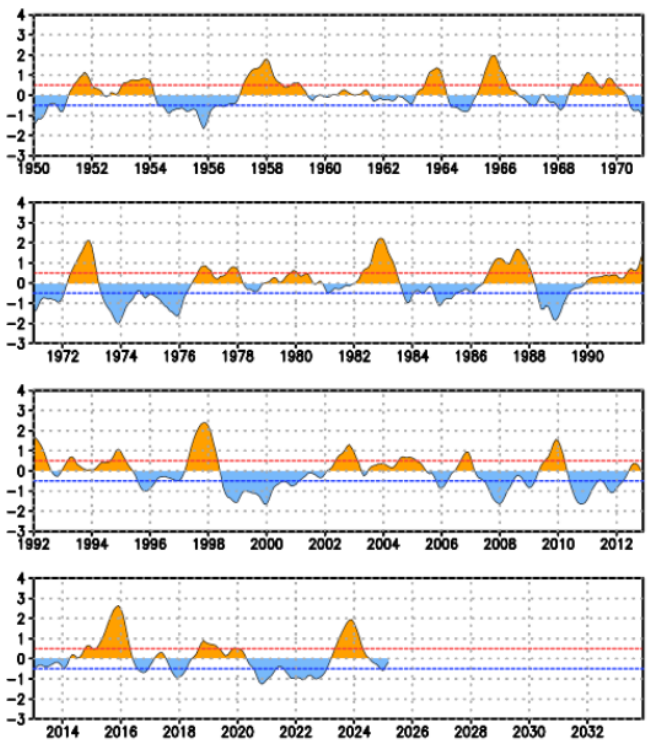

Oceanic Nino Index Trends from 1950-2025

(Unit: Degrees Celsius)

ENSO Phase Probability Forecast for 2025-2026

(Unit: Percentage)

Source: NOAA

Expansion Plans in the Energy Segment

In parallel with its operational activities, REE is also actively pursuing new investments with the goal of adding 100 MW of capacity in 2025, an additional 500 MW in the next three years, and targeting a total capacity of 2,000 – 2,500 MW by the end of 2030.

The Thac Ba 2 Hydropower Plant with a capacity of 18.9 MW officially began commercial operations in early April 2025, contributing to the company’s electricity output. Additionally, the construction of the 30 MW Tra Khuc 2 Hydropower Project is being expedited, with completion expected in Q3 2026 and power generation commencing in early 2027. REE is also participating in bids for three onshore wind power projects with a total capacity of 176 MW, which could become operational by Q4 2026 if the bids are successful.

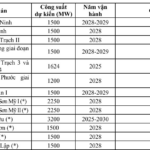

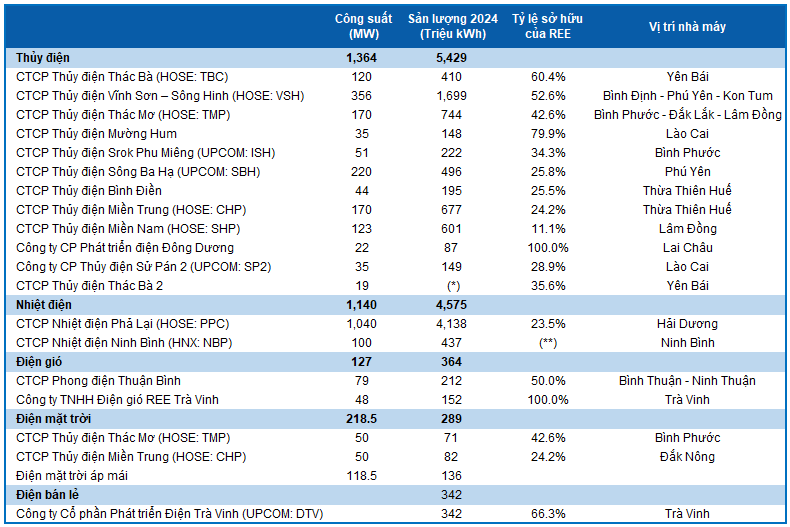

Energy Segment Breakdown of REE

Note:

(*) Thac Ba 2 Hydropower Plant commenced commercial operations in April 2025, estimated to contribute 51.5 million kWh of annual electricity output.

(**) In early 2025, REE fully divested its 29.45% stake in Ninh Binh Thermal Power JSC (HNX: NBP)

Vietstock Enterprise Research Team

– 09:00 11/06/2025

Solar Power in Industrial Zones: Policy Push Needed

The potential for industrial rooftop solar energy is immense, driven by the growing demand for clean energy and decreasing investment costs. However, there are still significant challenges in investment, installation, grid connection, and power purchase within industrial zones that need to be addressed promptly.

The First $1.4 Billion LNG-to-Power Plant in Vietnam Sets a Date to Power Up, Enough to Light Up 60% of Dong Nai Province

Nhơn Trạch 3 and Nhơn Trạch 4 power plants are set to boost Vietnam’s electricity supply significantly. With a combined annual output of 9 to 12 billion kWh, these power plants will contribute a substantial amount to the national grid, meeting the energy demands of Đồng Nai province, which currently accounts for the fourth-highest electricity consumption in the country. This equates to an impressive 60% of the province’s total electricity consumption, showcasing the immense impact these power plants will have on Vietnam’s energy landscape.

“The Private Sector: Leading the Charge Towards a Low-Carbon, Green Growth Economy”

Although the nation’s economic growth model remains carbon-intensive, Vietnam’s private sector has begun to seize green growth opportunities. The private sector will also be pivotal in Vietnam’s efforts to reduce emissions and transition to a low-carbon economy.