In a polarized market, retail stocks have emerged as a magnet for investors with a host of positive catalysts. MWG, FRT, PNJ, PET, PSD, MSN, and DGW, among others, have seen strong gains, even hitting the daily limit-up with no sellers. This rare consensus is notable, as there are usually distinct segments within the retail sector due to product differences.

In reality, the listed retail businesses all boast large-scale, reputable operations or are authorized distributors or exclusive agents for well-known brands. Notable examples include the mobile phone and appliance segments, with the World of Mobile Devices/Electricity Green (TGDĐ/ĐMX) chains from MWG, FPT Shop from FPT Retail, Digiworld, and others, which have the largest market share. Petrosetco and PSD, on the other hand, are both authorized distributors of Apple products.

In the fast-moving consumer goods (FMCG) and essential goods sectors, Winmart/Winmart+ of Masan and Bach Hoa Xanh (BHX) of MWG are the two dominant forces in the market. Meanwhile, PNJ is Vietnam’s leading enterprise in the gold and jewelry business.

In the pharmaceutical retail space, Long Chau from FPT Retail, An Khang from MWG, and Pharmacity are the top three chains in Vietnam. As of June 2025, Long Chau boasts the largest network with over 2,117 stores nationwide.

These enterprises are expected to reap significant benefits from the recent crackdown on counterfeit and substandard goods, as well as tax-related changes.

According to SSI Research’s June strategy report, the short-term impact of the campaign against counterfeit and substandard goods will accelerate the shift from traditional trade (GT) to modern trade (MT). Modern chains of pharmacies and supermarkets are expected to be the primary beneficiaries as consumers seek out reliable retailers.

Additionally, SSI Research suggests that the elimination of lump-sum tax for businesses with a turnover of over VND 1 billion will enhance the competitiveness of the MT channel. Under Decree 70/2025/ND-CP, which took effect on June 1, 2025, businesses are required to equip themselves with invoice-generating devices when selling goods, thereby reducing tax evasion.

Some businesses have temporarily ceased operations as they adjust to the new legal procedures, while others have to pay higher taxes and may need to increase their selling prices accordingly. This narrows the price gap between GT and MT channels, encouraging consumers to shift their purchases to the MT channel.

Furthermore, the report highlights how recent e-commerce-related policy changes have reduced the competitiveness of non-compliant businesses.

According to the amended Law No. 56/2024/QH15, effective April 1, 2025, e-commerce platforms are required to declare and pay taxes on behalf of individuals doing business on their platforms. As a result, shops selling untaxed imported goods on e-commerce platforms will face higher tax burdens, reducing price differentials with compliant enterprises.

Additionally, according to Decision 01/2025/QD-TTg, which took effect on February 18, 2025, imported goods worth less than VND 1 million sent via express delivery services will be subject to VAT, whereas previously, they were VAT-exempt. These low-value goods mainly include clothing, cosmetics, phone accessories, and small household appliances.

As of April 1, 2025, Shopee and Tiktok Shop, the two largest e-commerce platforms in Vietnam with a combined market share of over 90% in 2024, simultaneously increased seller fees. This levels the playing field for compliant enterprises (mostly MT channel operators) by reducing the intensity of price competition.

The Stock Market is ‘Back with a Bang’

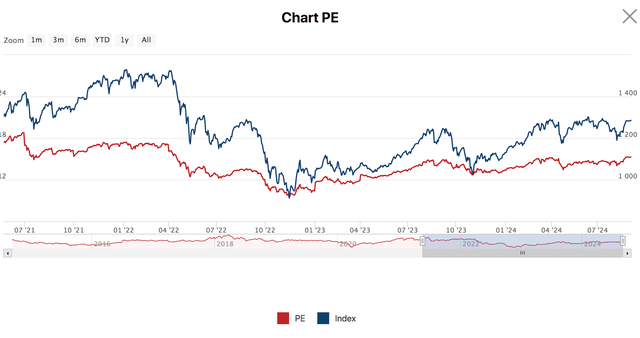

After a sharp decline in the early week, VN-Index rebounded on Tuesday (June 10th). VHM and VRE led the benchmark’s recovery, along with several large-cap stocks and banking shares.

“VN-Index to Surpass 1,500 Points This Year: VNDirect Names 3 Stock Groups to Attract Investments”

“VNDirect anticipates that the downward trend of the DXY index, coupled with the potential upgrade of the Vietnamese market by FTSE in September, will serve as positive catalysts for the stock market in 2025. This upgrade has the potential to attract increased foreign investment and boost the country’s economic outlook, making it an opportune time for investors to capitalize on the market’s growth potential.”

The Ultimate Audio Experience: Fender Audio, Tivoli, Linklike, and Tribit Arrive in Vietnam

“PHDT is proud to announce that it is now an official distributor of audio equipment from four renowned brands: Fender Audio, Tivoli, Linklike, and Tribit. With this expansion into the Vietnamese market, PHDT aims to bring high-quality audio products to music enthusiasts across the nation, offering an unparalleled listening experience.”