Global stock markets were in sync in May 2025: the S&P 500 rose by 6.15%, Stoxx 50 by 4%, while in Asia, only Thailand saw a decline of 4.02%. Stock markets in Japan, South Korea, China, and India respectively increased by 5.33%, 5.52%, 2.09%, and 1.71%. The Vietnamese stock market impressively gained 8.67%.

MONEY WILL FLOW BACK INTO EMERGING MARKETS

Regarding the global stock market outlook, SGI Capital believes that the global financial market is becoming less sensitive to tariff news, with a general consensus that the final tariff rates will be moderate and manageable, around 10%-20%, and will not derail major economies.

However, the FED remains cautious and is waiting for the final tariff rates to assess their impact on inflation, which is now closer to the target. The FED faces a challenging situation as unemployment remains low, while inflation has the potential to rise again when tariffs are applied.

The market expects the FED to cut interest rates twice this year, with the first cut likely in September 2025. Notably, major organizations in the US predict that the USD will enter a depreciation cycle as the FED cuts interest rates and US economic growth slows. A weaker USD typically leads to a global financial easing trend, with capital flowing to countries with higher growth rates than the US, especially emerging markets.

The US stock market recovery is supported by large corporations’ ample liquidity, record-high stock buybacks, robust bottom-fishing by individual investors, and gradually improving profit growth. Although US market valuations are high, the combination of these favorable conditions suggests that the US stock market can adjust and consolidate while awaiting the FED to lower interest rates.

In the meantime, valuations of non-US markets, particularly emerging markets, are much more attractive. Europe, China, and South Korea have been consistently lowering interest rates to stimulate their economies, as inflation is already low. Nonetheless, the USD has weakened against most major currencies and Asian currencies, except for the Vietnamese Dong, since the beginning of the year.

Global investors recognize that the US economy will grow slowly amid government spending cuts and an unaccommodative monetary environment, while many other countries enjoy both fiscal support and accommodative monetary policies. The Chinese economy shows signs of a recovery fueled by the Deepseek technology boost. The real estate market is stabilizing, and trade negotiations with the US are progressing, as the US recently extended the tariff deadline to August 31, 2025.

According to SGI Capital, we may witness a weaker USD and a slower-growing US economy in the second half of this year, along with the FED embarking on a new rate-cutting phase. Provided that the US economy does not swiftly fall into a recession, global stock markets, especially emerging markets, could see a return of investment capital seeking opportunities after 3-4 years of net outflows.

VN-INDEX COULD REACH 1,500 OR EVEN HIGHER

Domestically, the government continues to negotiate to finalize tariff rates in June 2025, and SGI Capital anticipates rates within the 15%-20% range, with favorable terms for manufacturing enterprises with Vietnamese origin.

The impact of tariffs will no longer significantly affect the financial market. A segment of domestic and foreign investors is awaiting the final outcome to gain a clearer basis for identifying opportunities and executing investments.

The SBV continues to proactively manage the exchange rate, cautiously preparing for a scenario of unfavorable tariff rates. The VND has depreciated by 2.2% since the beginning of the year, while most Southeast Asian currencies have appreciated by around 5%, providing a competitive advantage for Vietnamese exports.

Regarding the USD Index movements, SGI Capital maintains its view that Vietnam’s exchange rate pressure will not be substantial in the second half of the year, especially after finalizing the tariff rates with the US. Government bond yields have slightly increased since the beginning of the year, largely influenced by US Treasury yields and public investment disbursement demand. Meanwhile, the SBV continues to inject liquidity, and interbank interest rates are declining to the lowest levels of the year, reflecting the banking system’s ample liquidity to serve credit growth and GDP targets.

After the US announced its retaliatory tariff rates on April 2, 2025, newly registered and disbursed FDI projects in Vietnam have not shown significant declines. On the other hand, public investment disbursement has been more positive. Consequently, Vietnam’s PMI in May 2025 improved, approaching the 50-mark. Retail sales and industrial production are also trending upwards.

Following Resolution 68, the government has been swift in introducing policies and implementing measures to create a conducive environment for private enterprises’ development. Many listed companies are ready to seize opportunities and thrive in this new era.

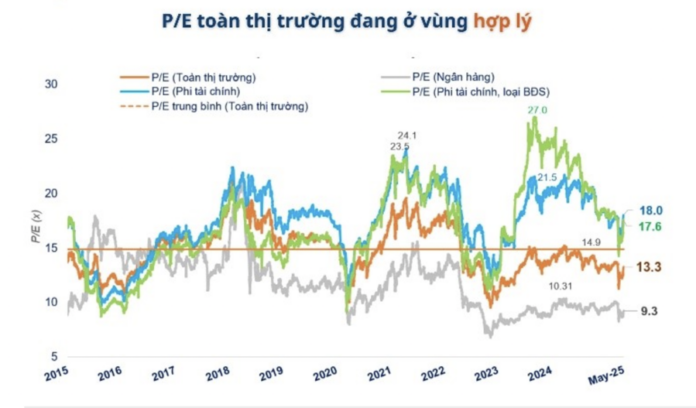

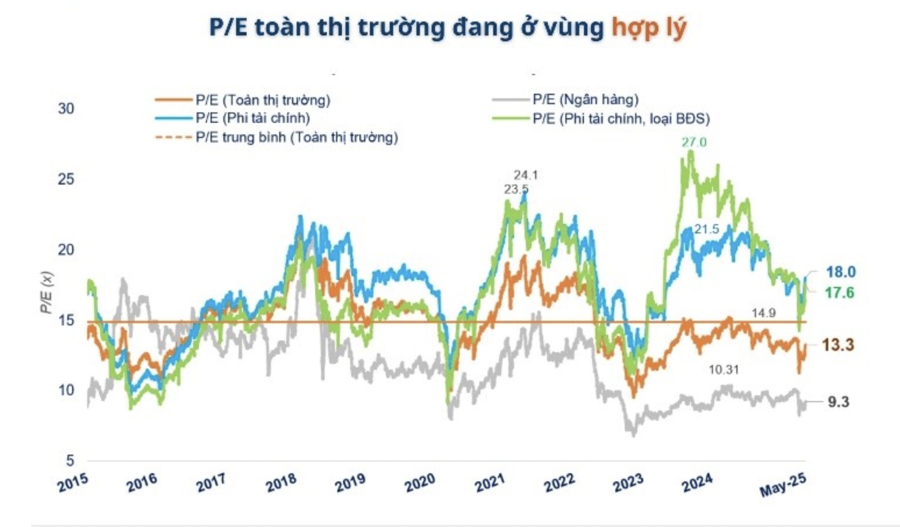

According to Fiinpro, the entire market’s after-tax profit in 2025 is expected to grow by approximately 14%, with financial enterprises achieving a growth rate of 17%. This business plan considers the reasonable cautiousness regarding the impact of tariffs. Positively, enterprises’ profit growth increasingly relies on the domestic market.

Thus, the current valuation remains attractive and has ample room for growth. With profit growth of 10-15% per year and P/E and P/B ratios sustaining at low levels, the VN-Index can certainly return to the 1500 peak in 2026.

If foreign investors resume net buying or Vietnam achieves an upgrade, the market’s valuation and indices will reach new highs. In May, foreign investors net bought for the first time after a record 15 consecutive months of net selling. However, they remain cautious as the final tariff rates are yet to be decided.

SGI Capital believes that finalizing reasonable tariff rates within the 15%-20% range will pave the way for foreign capital to return as exchange rate risks diminish. Caution will likely increase in June as the tariff negotiation deadline approaches and the market has already witnessed a strong recovery. Therefore, in the short term, the market is expected to consolidate and differentiate based on individual companies’ stories.

The Stock Market Plunge: A Sea of Red

Today’s trading session (June 9th) witnessed a broad-based decline among large-cap stocks. Sectors such as banking, securities, construction, materials, and chemicals were awash with red, indicating a day of losses and adjustments.

“Cautious Selling by Individuals and Foreign Institutions, Proprietary Traders Seize the Opportunity to Accumulate Positions”

The VN-Index continued its upward trajectory, with a notable net buying figure of 809.2 billion VND, of which 785.1 billion VND was matched orders.