Silver bars and coins stacked on a table, with a silver price chart in the background.

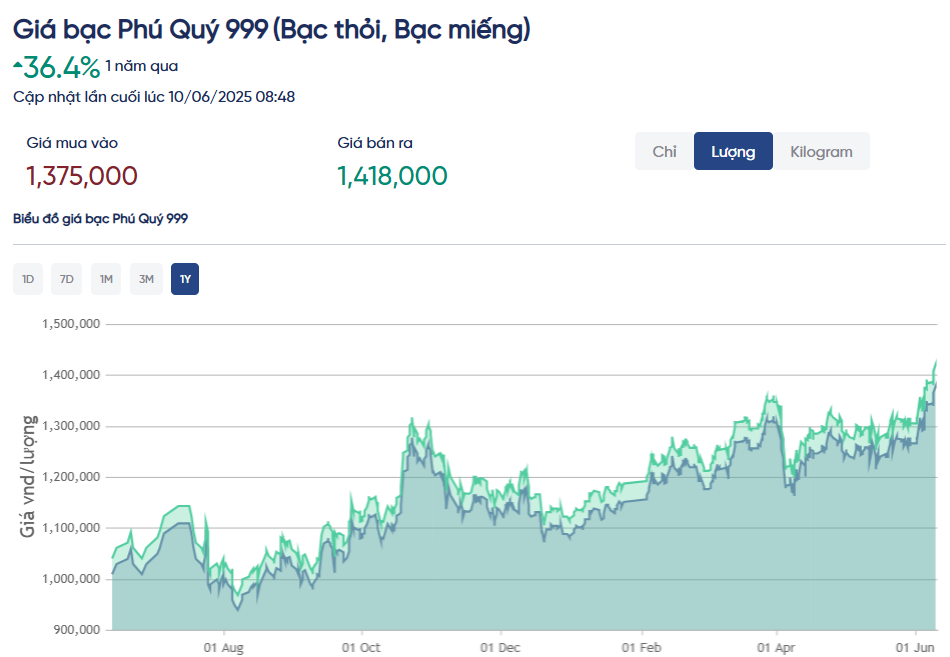

At the Phu Quy Gold and Gems Group, silver prices surged today, trading at 1,375,000 VND per tael for buyers and 1,418,000 VND per tael for sellers in Hanoi. This marks a significant 36.4% increase over the past year, reaching its highest level since the introduction of this silver bar product.

Meanwhile, the price of 1kg 999 silver bars stood at 36,666,575 VND for buyers and 37,813,239 VND for sellers, as of 10:12 am on June 10th.

Globally, silver prices reached 36.5 USD per ounce, or 950,000-956,000 VND per ounce, outpacing the previous session and marking a 13-year high for the metal.

A quote by David Erfle, a precious metals and mining stocks analyst, predicting a potential surge in silver prices.

“Historically, silver tends to lag behind gold during price rallies, but then it often plays catch-up and outperforms as speculative money pours into this precious metal,” says David Erfle, a market analyst specializing in precious metals and mining stocks. He adds that silver remains significantly undervalued compared to its all-time high of 50 USD per ounce, last seen in 1980 and again in 2011.

Mike Maloney, a renowned American expert on gold and silver, goes even further, suggesting that silver could potentially soar to over 300 USD per ounce, a tenfold increase from its current levels.

Maloney attributes this potential surge to central banks’ continued money printing, economic expansion, and industrial demand, which could further drive up silver prices in the long run, despite short-term challenges.

This potential breakout has caught the attention of investors, including Robert Kiyosaki, author of “Rich Dad Poor Dad.” In a recent social media post on June 2nd, Kiyosaki predicted a strong summer for gold, silver, and Bitcoin, amidst a volatile stock market, bonds, and real estate landscape.

Kiyosaki highlights silver as the most promising investment opportunity due to its current undervalued state. “By 2025, silver prices could triple. At around 35 USD per ounce currently, silver is 60% below its all-time high, while gold and Bitcoin have already hit or neared their all-time highs,” he writes. “I’ll exchange paper money for real silver, not ETFs. At 35 USD per ounce, anyone can build wealth.”

Silver Price Today, June 2nd: Steady Start to the Week

The silver market has steadied after three consecutive days of declines, with prices holding firm across both domestic and global markets.