Mr. Dao Xuan Tuan, Director of the Foreign Exchange Management Department (SBV)

In a recent interview, Mr. Dao Xuan Tuan, Director of the Foreign Exchange Management Department, shared that the State Bank of Vietnam will promptly study and refer to international experiences to propose the establishment of a national gold exchange or allow gold trading on commodity exchanges.

Previously, at a meeting of the Government’s Standing Committee on gold market management, the Prime Minister instructed relevant ministries to research the formation of a gold exchange, allowing citizens to freely trade and buy gold, separating state management from gold production and business activities. This will contribute to macroeconomic stability and promote growth.

In fact, the proposal to establish a national gold exchange has been made by several economic experts over the years. A few years ago, the Vietnam Gold Business Association requested the State Bank of Vietnam (SBV) to submit to the Government a decree replacing Decree 24/2012 on gold business management, which included this issue.

According to the Association, a gold exchange would create price connectivity between the domestic and international gold markets, ensuring minimal price differentials. It would also enhance market liquidity, curb illegal gold imports and exports, reduce physical gold transactions, mobilize domestic gold reserves, increase national gold reserves, reduce cash payments for gold purchases, increase tax revenue, and eliminate illegal underground gold exchanges.

Globally, there are numerous gold exchanges facilitating gold trading in various forms, such as physical gold (gold bars and bullion), gold accounts, or gold futures contracts. Examples include the COMEX in the US, which sets global gold prices, and the LBMA in the UK, the world’s largest wholesale gold trading center. Central banks, large investment funds, and gold companies use this exchange for large-scale transactions. The Shanghai Gold Exchange (SGE) is China’s largest gold exchange, trading physical and account-based gold products.

Some economic experts believe that Vietnam should promptly establish a gold exchange to manage the gold market transparently and effectively, following global trends.

According to Professor Dr. Hoang Van Cuong, a National Assembly member and a member of the National Assembly’s Finance and Budget Committee, a Vietnamese gold exchange would change people’s psychology. They won’t have to travel far or worry about gold storage and purity, as gold certificates will guarantee its value. Gold will be traded publicly, improving liquidity.

“We can manage the market and ensure control over foreign currencies. Moreover, when gold is traded on the exchange with transparent matching, anyone participating will know the number of buyers and sellers in the market. Transparent information enables participants to make wiser decisions, and state control will be more effective,” said Professor Dr. Hoang Van Cuong.

In a National Assembly Q&A session in late 2024, Governor Nguyen Thi Hong answered that the State Bank would work with relevant ministries to thoroughly study and assess the impacts to advise the Government on establishing a gold exchange at an appropriate time.

According to Ms. Hong, the positive aspect of establishing a gold exchange is transparent trading, making it more convenient for citizens and enterprises to buy and sell gold. However, establishing a gold exchange requires infrastructure investment. As Vietnam is not a gold-producing country, gold traded between market participants would need to be imported from the international gold market.

Gold at Risk of Breaking $3,300/oz Mark Ahead of US-China Trade Talks Outcome

The gold price dipped to just above the $3,300/oz mark as investors anxiously awaited the outcome of trade negotiations between the US and China in London, with key US inflation data also expected to be released later this week.

Optimizing the Gold Market: Starting with Transparency

After 13 years, Decree No. 24/2012/ND-CP on the management of gold business activities remains pertinent in removing gold from the banking credit system and preventing the “goldification” of the economy. However, the question of how to channel these resources into productive business ventures rather than hoarding and clandestine transactions remains unanswered.

The End of Easy Profits: Riding the Golden Wave

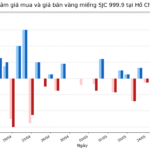

The Vietnamese gold market witnessed a tumultuous surge in April 2025, with gold prices fluctuating by up to VND 7.5 million per tael per day. This volatility presented a lucrative opportunity for savvy traders and investors to profit from the rapid price movements. However, those days of frenzied gold trading seem to be over, as the current market offers little room for such lucrative waves.