Despite today’s indices being constrained by the Vin group of stocks, the rest of the market traded well and even enthusiastically. With hundreds of stocks rising over 1%, there’s little need to pay too much attention to the VNI. Nonetheless, this is still just a normal recovery dynamic.

The most positive aspect of today’s session was the rebound in liquidity. The total matched value of the two exchanges exceeded 20k billion, excluding agreements. After three consecutive sessions of sharp declines, money flowed back into the market. Active money is always a positive sign as it indicates opportunities being spotted, and no one wants to buy into risks. Abundant liquidity and rising prices are a positive combination, reflecting a proactive buying sentiment at higher price levels.

Of course, one enthusiastic session like today doesn’t tell us much in the grand scheme of things. Considering the recent sessions, most stocks have already formed a short-term peak, and the rebound dynamics are typical. This only confirms that the adjustment is healthy and will likely form a higher-level fluctuation zone rather than a real downward trend.

The remaining question is about maintaining this enthusiasm. In terms of trends, liquidity is still gradually weakening. Trading during this phase can be erratic, with money flow uncertainty; it’s normal to have ups and downs. What’s more important is forming a clear price foundation to signal either a reduction in selling pressure or the presence of stable supportive money flow. If there’s a strong belief in a fluctuation accumulation zone, as prices retreat to support levels, more money will enter to catch the bottom. Because adjustments aren’t necessarily about price but about managing expectations, once those who want to sell the most have sold, the pressure naturally decreases. Unless there’s a sudden adverse event, it’s a normal cycle of finding a supply-demand balance.

The current price adjustments vary across different stocks. Some are still at very high peaks and may continue to adjust, with one-day jerks not carrying much significance. Patience is key, waiting for prices to stabilize and reduce risks, rather than focusing solely on price declines. Ultimately, position flexibility and portfolio management aim to reduce risks; if buying low and selling high isn’t feasible, one can still buy high and sell higher.

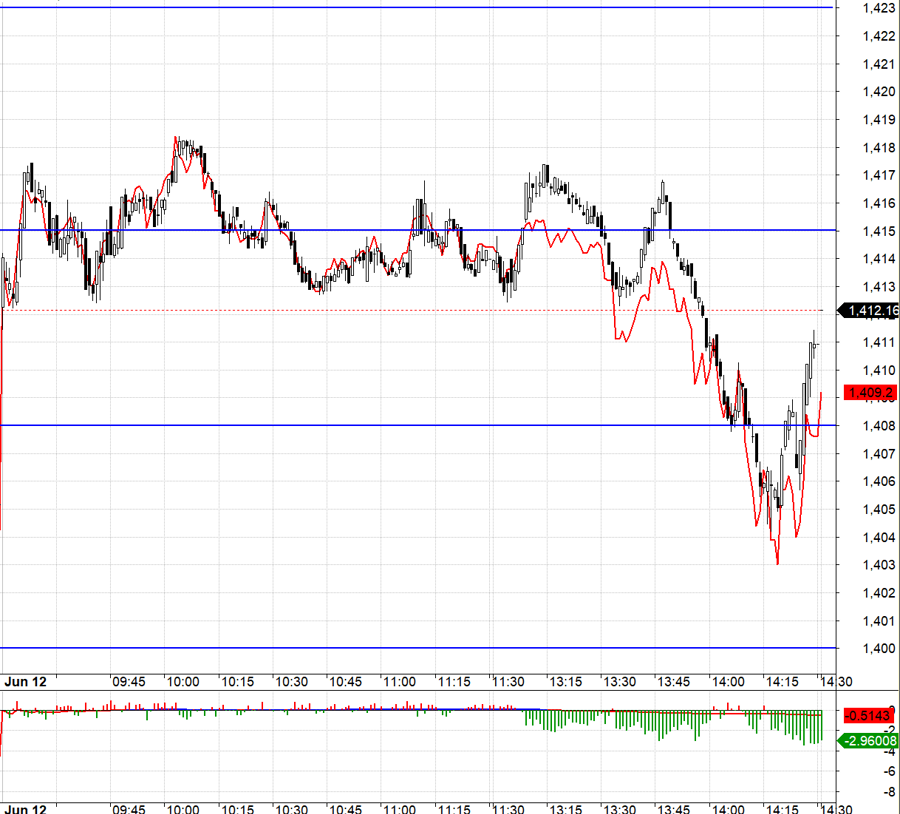

Today’s derivatives market was challenging to trade despite a tight basis that reduced risks for both Long and Short positions. As most of the gains occurred during the opening gap, the VN30 fluctuated narrowly around the high of 1415.xx for most of the day. The restraint shown by VIC, VHM, and VRE prevented the index from gaining momentum. Long attempts to push VN30 above 1415.xx fell short of reaching 1423.xx, and Short attempts below 1415.xx only managed to dip to around 1413. The only successful Short move occurred just before 2 PM, with strong support and pressure on the pillar stocks, pushing the index down to 1408.xx and beyond.

Today’s unexpected enthusiasm doesn’t significantly change the landscape of the underlying market. The likely scenario remains a fluctuation accumulation zone, and the probability of a recovery to previous peaks remains low. The strategy continues to be buying on dips, with flexible Long/Short approaches in derivatives.

VN30 closed today at 1412.16. Tomorrow’s resistances are at 1418, 1426, 1432, 1442, 1448, and 1460. Supports are at 1408, 1402, 1393, 1384, and 1378.

“Blog on Securities” reflects the personal views of the author and does not represent the opinions of VnEconomy. The views, assessments, and investment advice are solely those of the author, and VnEconomy respects the author’s views and writing style. VnEconomy and the author are not responsible for any issues arising from the published assessments, views, or investment advice.

Market Pulse June 12: Choppy Trading with Narrowing Ranges After Initial Spike

The market maintained its positive momentum from the opening bell, with the VN-Index climbing 7.54 points to 1,322.74, the HNX-Index gaining 1.46 points to 227.69, and the UPCoM-Index rising 0.28 points to 98.32. Green dominated the market across the board.

“Stock Recommendations for June: Tapping into Potential with a 33-35% Upside”

The sectors recommended in the May strategic report, including Real Estate, Exports, Oil & Gas, and Retail, are maintaining their positive momentum in the recovery process. Investors are advised to continue holding these stocks and to seize opportunities to increase their holdings when adjustments and positive signals arise.

The Stock Market’s Hidden Gems: Unveiling June’s Top Growth Stocks

The An Binh Securities (ABS) team believes that the market is currently presented with a medium-term growth opportunity, attributed to positive developments in trade negotiations and the government’s proactive efforts.