Vietnam’s stock market ended an eventful trading day on June 11, 2025, with the VN-Index hovering around the 1,320-point mark.

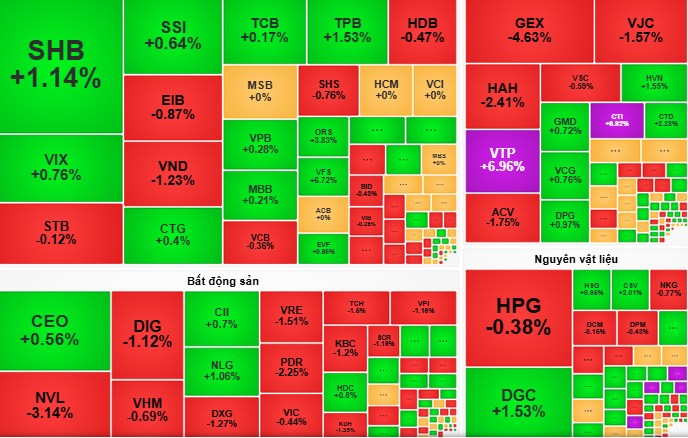

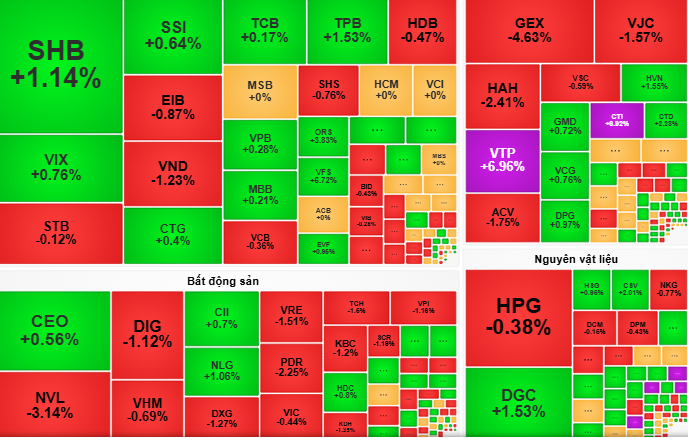

On June 11, Vietnam’s stock market experienced a volatile trading day, fluctuating around the 1,320-point level. During the morning session, large-cap stocks such as VIC, FPT, and DGC were the main drivers of the index’s upward movement. The retail sector (DGW), chemicals and fertilizers (DGC, CSV, DDV), and individual stocks like VTP, CTR, and VGI attracted strong buying interest.

However, selling pressure from VHM and VRE prevented the VN-Index from surpassing the 1,320-point threshold.

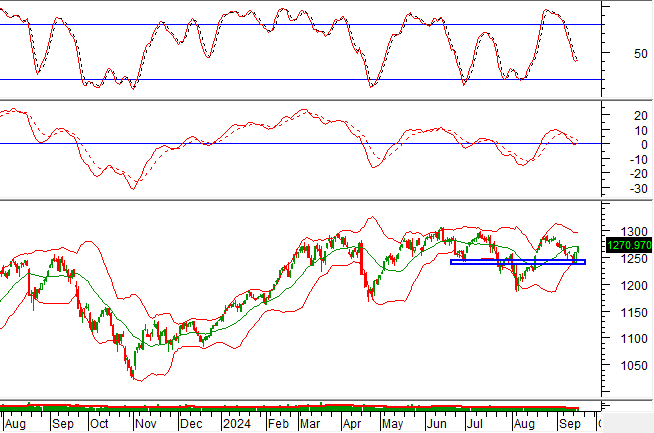

In the afternoon session, the VN-Index continued to fluctuate, hitting a low of 1,310 points at the start. However, the emergence of buying pressure helped the index narrow its losses, finishing close to the reference level at the closing bell.

At the end of the trading day, the VN-Index stood at 1,315 points, a slight decline of 1 point (0.08%) for the session.

According to several securities companies, the market is striving to return to the 1,320-point region, supported by buying interest in select stocks that have been accumulating in recent times. However, sectors that previously attracted large amounts of capital, such as real estate, continue to face corrective pressure. While the supply of stocks is not significant, buying pressure remains insufficient. Investors are advised to remain cautious in the next session.

VCBS recommends that investors refrain from chasing stocks during strong upward rallies and consider partial allocation towards stocks that are accumulating to take advantage of short-term opportunities.

In contrast, Rồng Việt Securities (VDSC) suggests that investors adopt a cautious approach, carefully selecting stocks, and focusing on short-term opportunities in stocks displaying positive signals.

Market Pulse June 12: Afternoon Jitters Shake Markets, Late Rally Boosts VN-Index by Almost 8 Points

The market opened the afternoon session with a strong rally, surging towards the 1,326-point mark, but this momentum was short-lived as it quickly faced resistance and entered a corrective phase, dipping to 1,317 points. It was only in the final hour of trading that the market staged a recovery, returning to the morning’s price levels.

Technical Analysis for June 12: The Tug-of-War Continues

The VN-Index and HNX-Index both witnessed a slight uptick in the morning session, accompanied by a noticeable improvement in liquidity. This indicates a continued cautious sentiment among investors, with a subtle shift towards optimism.