| HAH Stock Price Year-to-Date |

Since peaking at VND 84,400 per share on May 27, HAH stock has lost nearly 18% in 12 trading sessions. As of June 12, the share price closed at VND 69,500 per share.

Prior to this decline, shares of the country’s largest domestic carrier experienced a remarkable surge, despite the uncertainty that tariffs posed to global trade and transportation. From early April to May 27, HAH stock price rose nearly 60%.

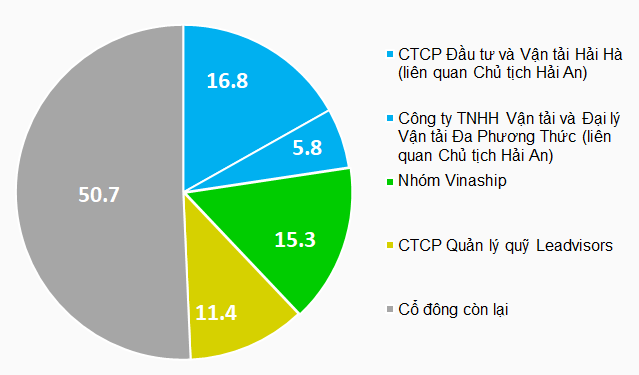

During this period of volatile stock prices, companies related to Vietnam Container Shipping Joint Stock Company (HOSE: VSC) consistently bought and accumulated a 15.3% stake in Hai An by the end of May. This group is now the second largest shareholder in the business, only behind the group of companies related to Hai An’s Chairman, Mr. Vu Thanh Hai.

Meanwhile, other major shareholders, such as Leadvisors Fund Management and the Hai Ha and Da Phuong Thuc groups, have not shown significant trading activity in recent months.

However, as domestic buyers pushed up the stock price, foreign investors quickly sold off their holdings. With a net sell value of VND 662 billion in just one and a half months, HAH ranks fourth among listed stocks with significant foreign divestment and is the only mid-cap stock in this list.

These shifts in shareholder structure occurred just before Hai An’s annual general meeting on June 26.

|

Major Shareholder Structure at Hai An

Unit: %

Data as of May 2025. Source: Compiled from transaction reports

|

– 15:17 12/06/2025

The Rare Survivor: Thriving SBIC (Vinashin) Enterprise Sees Success with Profits, No Debt, and Cash Reserves, Yet is Delisted from UPCoM

The SCY stock price plummeted over 30% in just one week, right before HNX delisted it from trading due to failing to meet the requirements for a public company. In stark contrast to its parent company, SBIC (formerly Vinashin), which was mired in losses and bankruptcy, SCY exhibited robust financial health. The company consistently delivered profit growth, paid cash dividends, maintained a debt-free status, and boasted a substantial cash reserve of hundreds of billions of dong.

“Viconship Group Increases Ownership in Hai An to 13.2%”

“In a recent buying spree spanning May 20-22, 2025, a group of shareholders of Vietnam Container Shipping Joint Stock Company (Viconship, HOSE: VSC) aggressively snapped up over 2 million shares of Hai An Transport and Stevedoring Joint Stock Company (HOSE: HAH). This strategic move further bolsters Viconship’s stake in HAH ahead of its much-anticipated general meeting.”

“The Chairman of An Gia (AGG): Land Bank Acquisition Not a Priority at This Time”

Amid the uncertain macroeconomic and legal landscape, An Gia adopts a cautious and prudent approach in its market strategy for the foreseeable future. As such, the company has no immediate plans to seek new land opportunities.