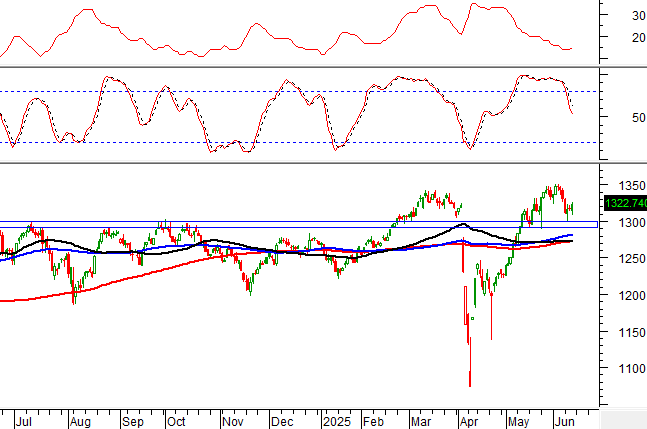

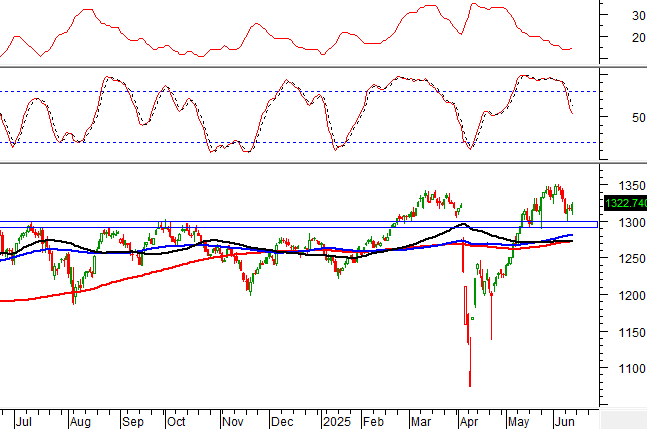

Technical Signals for VN-Index

In the trading session on the morning of June 12, 2025, the VN-Index witnessed a slight increase alongside a notable improvement in volume, indicating a positive shift in investor sentiment.

Currently, the VN-Index is moving sideways and retesting the old peak from October 2024 (1,290 – 1,310 zone) while the ADX indicator is heading towards the gray zone (20

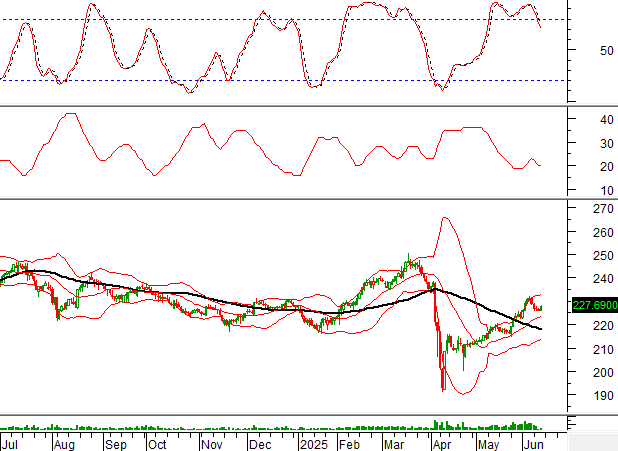

Technical Signals for HNX-Index

On the morning of June 12, 2025, the HNX-Index witnessed a slight increase in trading volume, indicating improved investor confidence.

Additionally, the index is positioned above the Middle line, while the Bollinger Bands are narrowing (Bollinger Squeeze), reflecting a gradual improvement in investor sentiment.

If conditions remain unchanged, we can expect alternating rises and falls in the upcoming sessions until a new trend emerges.

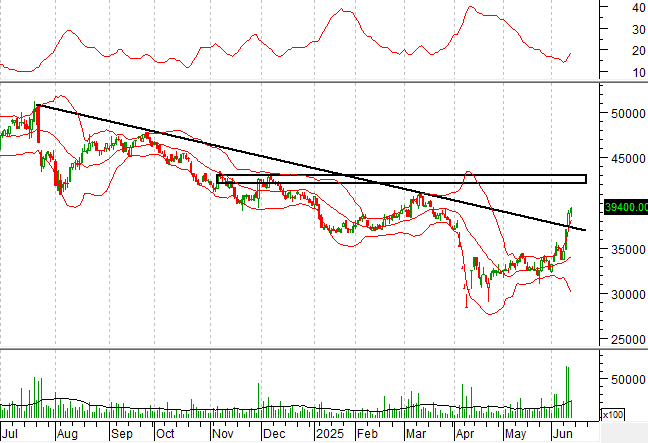

DGW – Digital World JSC

On the morning of June 12, 2025, DGW stock price witnessed a slight increase and continued its recovery trend after two strong gaining sessions.

The Average Directional Index is sloping upwards, approaching the 25 level, and the Bollinger Bands are expanding, indicating a stronger recovery trend for the stock price in the upcoming sessions.

The old peak from December 2024 (42,000-43,000 zone) is a potential target price for this recovery.

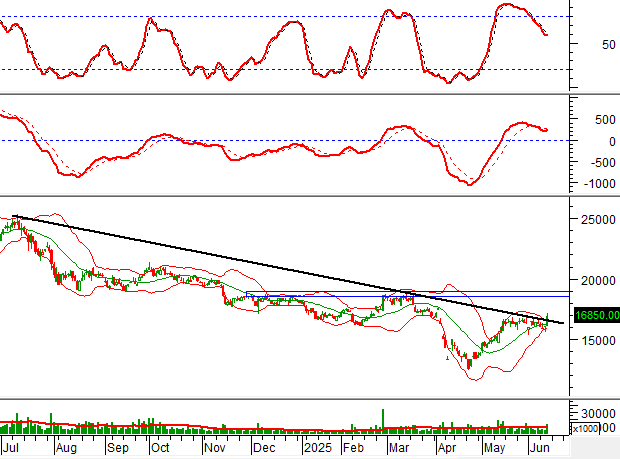

HSG – Hoa Sen Group JSC

On the morning of June 12, 2025, HSG stock price surged, forming a candle pattern similar to a White Marubozu, with trading volume exceeding the 20-session average, indicating active participation from investors.

Additionally, HSG has broken out of its downward trend, and both the MACD and Stochastic Oscillator have generated buy signals, reinforcing the stock’s recovery trend.

If positive dynamics persist, HSG price is expected to recover towards the old peak from March 2025 (18,500-18,800 zone) in the near future.

Technical Analysis Team, Vietstock Consulting Department

– 1:03 PM, June 12, 2025

Market Pulse June 12: Choppy Trading with Narrowing Ranges After Initial Spike

The market maintained its positive momentum from the opening bell, with the VN-Index climbing 7.54 points to 1,322.74, the HNX-Index gaining 1.46 points to 227.69, and the UPCoM-Index rising 0.28 points to 98.32. Green dominated the market across the board.

A Brokerage Firm Launches Margin Loan Package with 6.6% Interest, Up to VND 3 Billion Credit Limit

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented offer is accompanied by a host of other benefits, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.

Has the Stock Market Passed the Tariff Test?

If tariffs are considered a stern test of the stock market’s health, then the VN-Index’s journey from 1,300 points, falling below 1,100, and then rebounding to 1,335 can be interpreted in two ways: either as a reflection of the robust fundamentals of listed companies or as a manifestation of investors’ unwavering optimism.