|

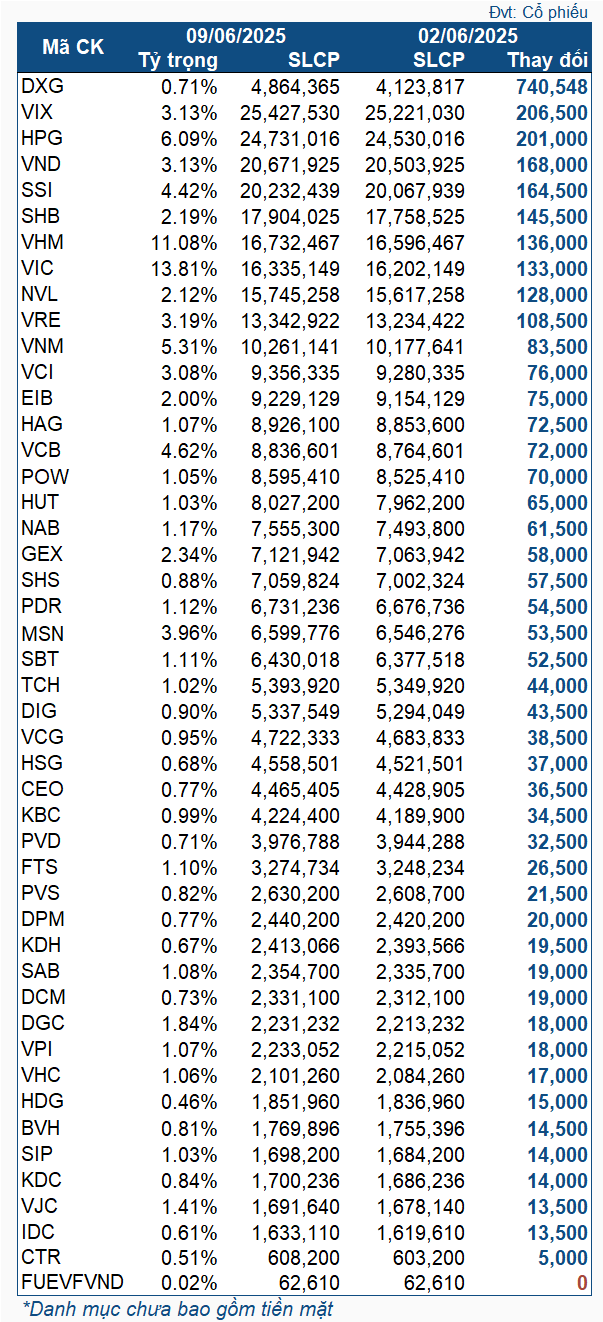

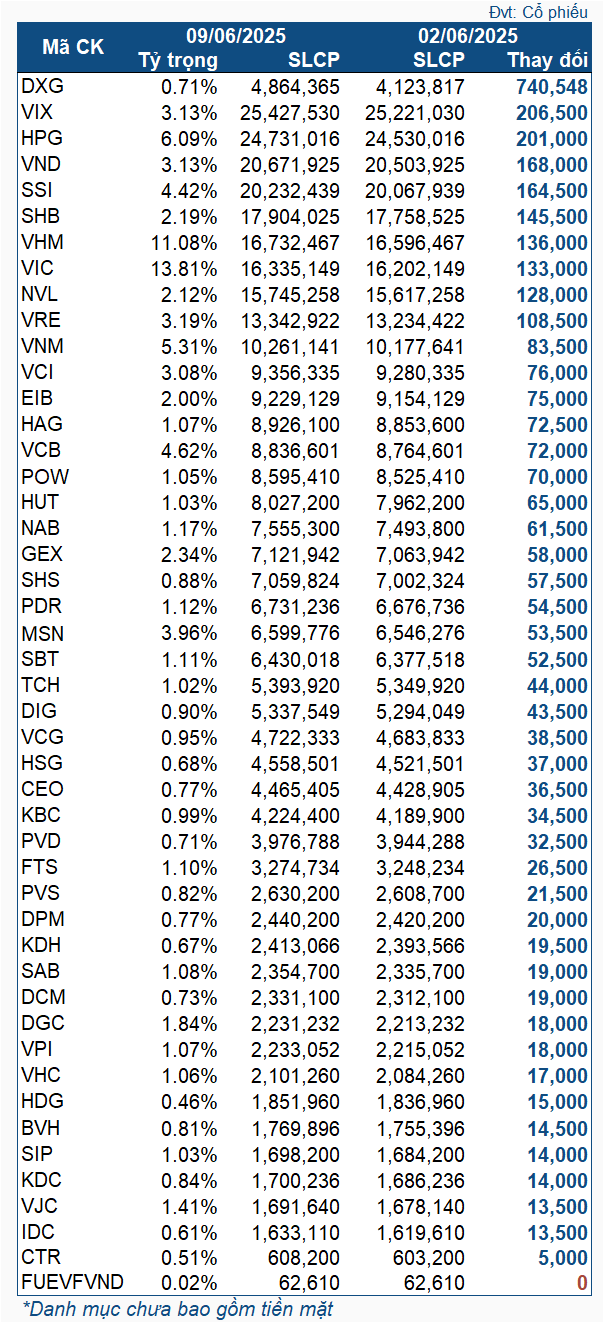

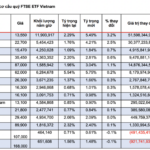

Stock Changes in VNM ETF from 02-09/06/2025

|

All the stocks in the VNM ETF portfolio witnessed an upward movement. The most significant change was observed in DXG, with an increase of over 740,000 shares. However, the majority of this growth can be attributed to DXG‘s bonus share issuance at a ratio of 17% (04/06). Nonetheless, the theoretical increase was lower than the actual figure, indicating that the Fund had net purchased DXG (approximately 40,000 shares).

Following closely were VIX and HPG, with net purchases of over 200,000 shares each. VND and SSI also saw net purchases of more than 160,000 shares each.

These net purchasing activities by VNM ETF took place just before the week of the announcement of the review results of the MarketVector Vietnam Local Index (early morning of 14/06) – the reference index for the fund. According to BSC Securities Company’s forecast, VNM ETF may sell large volumes of VIC (7.4 million shares) and VHM (2.4 million shares), along with divesting from HUT, MSN, GEX, and HPG, with hundreds of thousands of shares sold for each code.

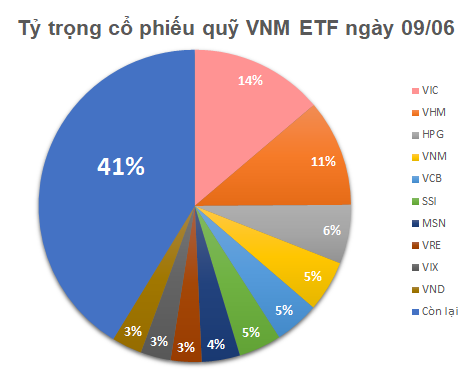

As of 09/06, the total net assets of VNM ETF exceeded 410 million USD, a decrease from the previous week’s figure of over 420 million USD. These assets are allocated across 46 stocks, 1 fund certificate, and cash holdings. The top holdings by weight are VIC (13.81%), VHM (11.08%), HPG (6.09%), VNM (5.31%), and VCB (4.62%).

– 12:00 11/06/2025

The Stock Market Plunge: A Sea of Red

Today’s trading session (June 9th) witnessed a broad-based decline among large-cap stocks. Sectors such as banking, securities, construction, materials, and chemicals were awash with red, indicating a day of losses and adjustments.

Technical Recovery, But Is the Market Risking a “Bull-Trap”?

The VN-Index continued to be heavily influenced by a few key stocks, with VHM taking center stage today. Investors took advantage of the technical rebound to exit their positions, resulting in a gradual weakening of the market throughout the session. The VN-Index failed to reclaim the 1320-point threshold, while trading volume remained subdued.

The Market Beat: Vingroup Stocks Turn the Tide, Keeping VN-Index in the Green.

The market psychology couldn’t sustain the mid-session confidence. As today’s session drew to a close, the divergence intensified. The market breadth at the end of the session showed nearly 380 gainers compared to 320 losers.

The Imminent Sale of Large-Cap Stocks by Foreign ETFs: A Preview

According to MBS’s forecast, Vingroup’s stocks (VIC and VHM) are expected to experience significant selling pressure in the upcoming rebalancing of the two foreign ETFs. This is due to their strong performance in Q2, which has pushed their weights beyond the allowed threshold in both the FTSE and VNM ETFs. On the buying side, EIB, HPG, and NAB are expected to be among the notable stocks in terms of purchase volume.