The VN-Index closed the trading session with a slight loss of nearly 1 point. Market liquidity plummeted, with a cooling-off in selling pressure observed in large-cap stocks within the VN30 basket, such as VHM and VRE compared to the morning session. However, stocks like VJC, PLX, GVR, and BCM continued to decline by more than 1%.

VIC reversed its morning gains and ended slightly lower. Several bank stocks and blue chips, including VCB, BID, and GAS, also closed in negative territory.

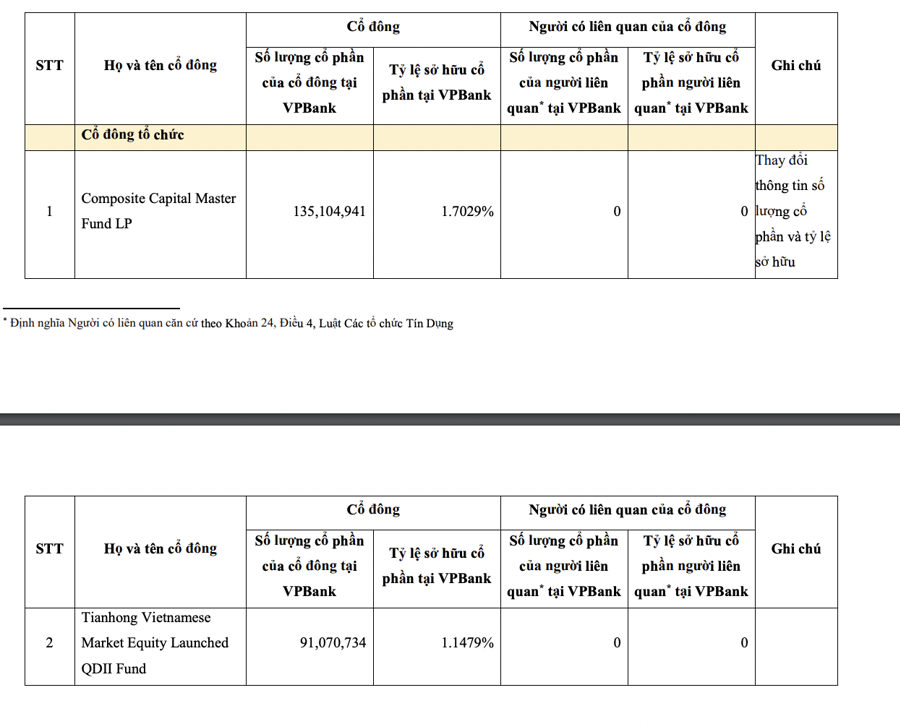

On a brighter note, FPT stood out as a top performer, maintaining its upward momentum, alongside TPB, SHB, and BVH. The banking sector exhibited some divergence, with CTG, VPB, and MBB holding on to gains, while NAB and OCB posted the steepest losses within the group.

FPT led the gains among the VN30 constituents.

Securities stocks generally fared well, with ORS, TVB, and SSI posting gains, while VND and VDS were notable exceptions. The real estate and steel sectors also witnessed mild divergence without significant fluctuations.

Notably, VPG of Vietnam Export-Import Commercial Joint Stock Company (Viet Phat) surged to the daily limit after a series of previous plunges. Currently, VPG is trading at VND8,610 per share. From June 3 to June 9, VPG suffered five consecutive session losses, equivalent to a 29.9% drop. The stock witnessed a sell-off following the prosecution of its leadership.

Regarding the steep decline, VPG attributed the five-session losing streak to investors’ psychological impact due to certain information related to the company’s insiders.

“At present, the company is striving to stabilize its personnel and maintain normal operations to ensure the fulfillment of the production and business plan,” VPG emphasized in its explanation.

Concerning VPG, the Ministry of Public Security has initiated a criminal case for “Violation of regulations on the management and use of state assets, causing losses and waste; Bribery; Receiving bribes; and Brokerage of bribes,” involving Viet Phat and related units. Eight suspects have been prosecuted, including Mr. Nguyen Van Binh, former Chairman of VPG’s Board of Directors, and Mr. Nguyen Van Duc, General Director, who were charged with bribery.

At the close, the VN-Index lost 1.03 points (0.08%) to finish at 1,315.2 points. The HNX-Index declined 0.17 points (0.08%) to 226.23 points, while the UPCoM-Index fell 0.15 points (0.15%) to 98.04 points.

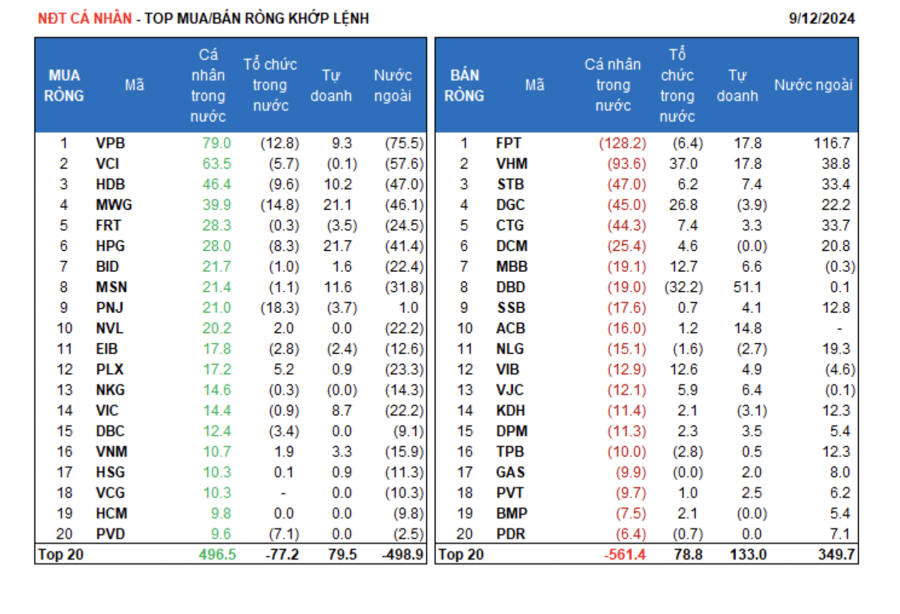

Liquidity weakened, with the trading value on HoSE reaching just over VND14,100 billion. Foreign investors net sold nearly VND230 billion, focusing on HPG, GEX, CTG, and STB.

Market Pulse June 12: Choppy Trading with Narrowing Ranges After Initial Spike

The market maintained its positive momentum from the opening bell, with the VN-Index climbing 7.54 points to 1,322.74, the HNX-Index gaining 1.46 points to 227.69, and the UPCoM-Index rising 0.28 points to 98.32. Green dominated the market across the board.

A Brokerage Firm Launches Margin Loan Package with 6.6% Interest, Up to VND 3 Billion Credit Limit

In the midst of a robust stock market recovery, VPBank Securities slashes margin interest rates to an all-time low of just 6.6%/year. This unprecedented offer is accompanied by a host of other benefits, including lifetime waiver of trading fees, loyalty points redeemable for gifts upon account opening, and exciting gaming rewards.

Has the Stock Market Passed the Tariff Test?

If tariffs are considered a stern test of the stock market’s health, then the VN-Index’s journey from 1,300 points, falling below 1,100, and then rebounding to 1,335 can be interpreted in two ways: either as a reflection of the robust fundamentals of listed companies or as a manifestation of investors’ unwavering optimism.

“Stock Recommendations for June: Tapping into Potential with a 33-35% Upside”

The sectors recommended in the May strategic report, including Real Estate, Exports, Oil & Gas, and Retail, are maintaining their positive momentum in the recovery process. Investors are advised to continue holding these stocks and to seize opportunities to increase their holdings when adjustments and positive signals arise.