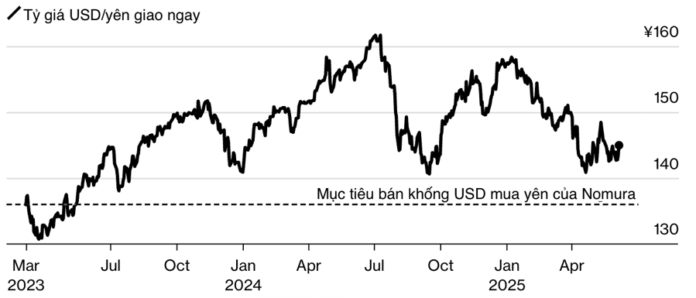

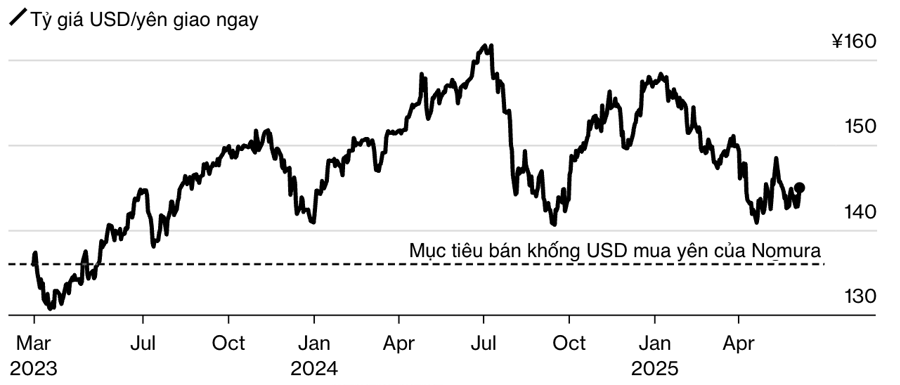

Nomura forecasts that the Japanese yen could appreciate by approximately 6% against the US dollar in the coming months as Japanese investors shift away from American assets due to rising domestic yields. This prediction is further supported by subtle pressure from the US regarding exchange rates in the ongoing trade negotiations between the two countries.

Nomura, one of Japan’s largest investment banks, currently recommends shorting the dollar to buy the yen, anticipating a decline in the USD/JPY exchange rate to 136 yen per dollar by the end of September from the current level of 145. The bank’s analysts foresee that the Bank of Japan’s (BOJ) continued interest rate hikes will encourage domestic investors to increase their holdings of Japanese bonds while reducing their foreign bond investments.

The recently published report by Nomura also highlights the possibility that the US administration’s concerns over the USD-yen exchange rate could intensify if the Japanese currency weakens, especially amid the sensitive bilateral trade negotiations. While the analysts do not predict a formal agreement between Washington and Tokyo on exchange rates, they believe that “the market will continue to expect an implicit deal demanding a weaker dollar.”

In its semi-annual currency report released on June 5, the US Treasury called for the BOJ to continue raising interest rates. The report suggested that a tighter monetary policy in Japan would support a “return to a weaker yen against the dollar” and a “much-needed structural rebalancing of bilateral trade.”

Nomura had previously recommended shorting the dollar to buy the yen but retracted this suggestion in May after the US-China trade deal led to a global sell-off of safe-haven assets like the yen. However, in the second quarter of this year, the yen has already appreciated by 3.5% against the dollar.

Strategists at another major Japanese bank, MUFG, maintain their recommendation for investors to sell dollars to buy yen. MUFG forecasts the USD/JPY exchange rate to fall to 138.3 yen per dollar before the end of the third quarter.

According to consensus forecasts collected by Bloomberg, the average prediction for the exchange rate by the end of the third quarter is 142 yen per dollar.

A former senior Japanese currency official recently commented that the yen could appreciate to the 135-140 yen per dollar range by the end of the year, attributing it to narrowing interest rate differentials between Japan and the US rather than any deliberate efforts by the Trump administration to weaken the dollar.

In an interview with Reuters, Mitsuhiro Furusawa, a former Japanese diplomatic official for currency affairs with close ties to current policymakers, stated that it was unclear whether the Trump administration had a clear policy to weaken the dollar. “It’s not easy for policymakers to deliberately weaken the dollar,” Furusawa said. “The US has made it clear that tariffs are a primary negotiating tool, so I don’t think Washington needs to rely heavily on exchange rates to achieve its goals,” added Furusawa, who served as deputy director of the International Monetary Fund (IMF) until 2021.

However, Furusawa suggested that the US may want to avoid further appreciation of the dollar to prevent disadvantages for American exporters. Meanwhile, Japan seeks to prevent yen depreciation to keep inflation in check.

“So, the US and Japan have a shared interest in the exchange rate issue. That means the yen could gradually appreciate,” said Furusawa, who currently chairs the Global Financial Affairs Institute at Sumitomo Mitsui Banking Corp.

The divergent monetary policies between Japan and the US will also contribute to the yen’s appreciation, as the Federal Reserve is expected to cut interest rates while the BOJ continues to raise rates, Furusawa emphasized.

“If Japan secures a large-scale trade deal with the US at the G7 summit this month, it would reduce uncertainty,” he said, adding that real wages in Japan are likely to continue rising and support consumption once food inflation eases.

“If such positive developments unfold, the BOJ may raise interest rates higher in the latter half of this year,” Furusawa predicted, forecasting that the yen could appreciate to around 135-140 yen per dollar by year-end.

Furusawa also suggested that the BOJ could increase interest rates above the current 0.5% level, possibly exceeding 1%, but there are no guarantees that policymakers will achieve this target.

Stable Deposit Interest Rates for Early June

As of early June, interest rates at banks have stagnated, with only a handful of institutions opting for a slight reduction in savings deposit rates.

“Central Bank’s Dollar Rate Cut: A Mixed Bag for Vietnam’s Financial Landscape”

The State Bank’s reduction in the central exchange rate has caused a decrease in the USD selling price cap for commercial banks. In response, many banks have strategically raised their USD buying rates.