According to Circular No. 19/2025/TT-BTC and the Amended Securities Law of 2024, the conditions for maintaining public company status have tightened significantly. Specifically, enterprises must have a charter capital and owner’s equity of at least VND 30 billion. Simultaneously, at least 10% of the voting shares must be held by a minimum of 100 small investors, excluding major shareholders. This regulation aims to ensure shareholder dispersion, curb power concentration, and enhance market transparency.

A Foretold Conclusion

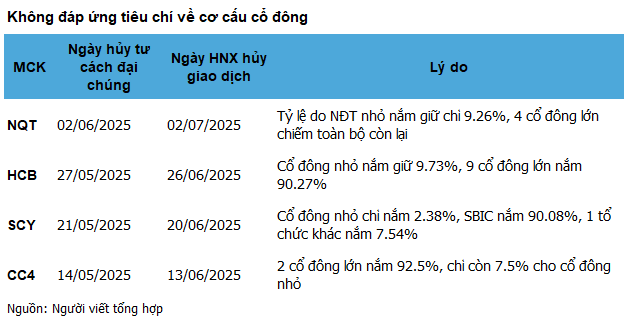

In reality, numerous businesses have failed to overcome these barriers. One noticeable aspect is the highly concentrated shareholder structure, with a majority of shares held by a handful of major shareholders, resulting in small investor ownership falling below the legal threshold. This is the primary reason many companies are forced to delist involuntarily.

|

Quang Tri Water Supply JSC (QTWACO, NQT) serves as a classic example. The percentage of shares held by investors who are not major shareholders stands at only 9.26%, below the minimum requirement; the rest is tightly held by four major shareholders, including the People’s Committee of Quang Tri Province with 51%, Vice Chairman Ngo Ngoc Tung with 24.05%, and two other individuals owning 7.85% and 7.84%, respectively. With this structure, the possibility of trading shares on the exchange is very limited, leading to the decision to revoke the public company status.

Similarly, 29/3 Garment JSC (Hachiba, HCB) also delisted due to losing its public company status, as the percentage of small shareholders dropped to 9.73%, below the 10% threshold. Despite its nearly 50-year history of stable operations and finances, Hachiba faced the issue of a highly concentrated ownership structure, with nine major shareholders holding 90.27% of the shares, mostly comprising internal stakeholders and leaders’ families.

In contrast, Song Cam Shipyard JSC (SCY), a large-scale enterprise with nearly 62 million shares, witnessed small shareholders holding less than 2.4% of the shares. The remaining shares were entirely owned by two institutional investors, with the Shipbuilding Industry Corporation (SBIC) holding a dominant 90.08% and Bach Dang Shipyard Company Ltd possessing 7.54%. This depicted a nearly absolute power dynamic, leaving little room for small investors.

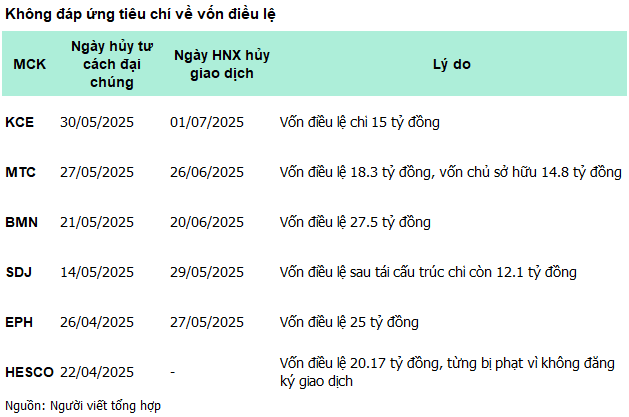

The requirement of a minimum charter capital of VND 30 billion is also one of the most explicit criteria for determining public company status. Nonetheless, several enterprises failed to meet this standard after years of listing, unable to raise capital and even reducing capital following restructuring.

|

Khanh Hoa Power Centrifugal Concrete JSC (KCE) with a charter capital of VND 15 billion, My Tra Tourist JSC (MTC) with VND 18.3 billion, Hanoi Educational Publishing Service JSC (EPH) with VND 25 billion, and 715 JSC (BMN) with VND 27.5 billion all fell short of the minimum requirement of VND 30 billion.

Song Da 25 JSC (SDJ) is another notable case. Following restructuring, SDJ’s charter capital decreased to VND 12.1 billion, failing to meet the mandatory standard. This enterprise not only relinquished its public company status but also spiraled into operational decline, grappling with substantial debts, the withdrawal of strategic partners, lost eligibility for bidding, a shortage of projects, and curtailed production.

Voluntary or Involuntary Choice?

Although companies like KCE, MTC, HCB, SCY, BMN, CC4, and EPH had shareholder meetings that approved the cancellation of their public company status, most of these cases were inevitable consequences of failing to meet legal requirements. The “voluntary” aspect often reflects a proactive choice to address the situation rather than awaiting forced delisting.

|

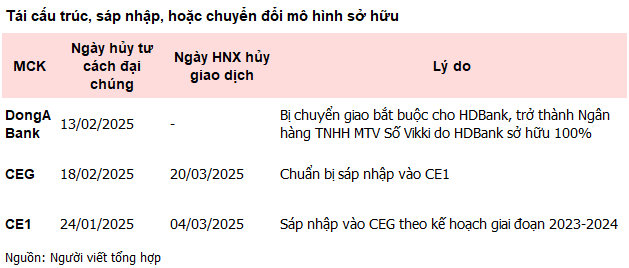

However, there are exceptions, such as CIE Group (CEG) and its subsidiary CE1, which withdrew from the stock exchange to facilitate merger plans, streamline operations, and consolidate business activities. As per the roadmap, CE1 is set to merge with CEG during 2023-2024. Both companies lost their public company status in January 2025.

Nevertheless, CIE Group’s decision to relinquish its public company status faced opposition from founding shareholders and major shareholder Truong Huu Chi (holding 7.19% of the capital). Specifically, at the 2024 Extraordinary General Meeting of Shareholders, Mr. Chi vehemently objected, stating that “the company’s situation is very dangerous” and “there is a huge conspiracy”. He argued that without public company status, no government agency would oversee and protect shareholder interests, especially given the weak management of the Board of Directors.

Mr. Truong Huu Chi also pointed out the abnormality of four Board members holding 6-9% of the shares, which he believed “indicated a plot affecting the company’s and shareholders’ interests.” Nonetheless, the proposals to revoke the public company status were approved by the 2024 Extraordinary General Meeting of Shareholders, despite over 23% of votes being cast against or withheld.

DongA Bank is a special case. Not only did it relinquish its public company status, but it also transformed its ownership structure when it was compulsorily transferred to HDBank in January 2025, becoming Vikki One-Member Limited Liability Bank (Vikki Bank), wholly owned by HDBank. This marked a significant step in the decade-long restructuring journey since DongA Bank was placed under special control in 2015 due to serious legal violations.

When Delisting Is Inevitable

|

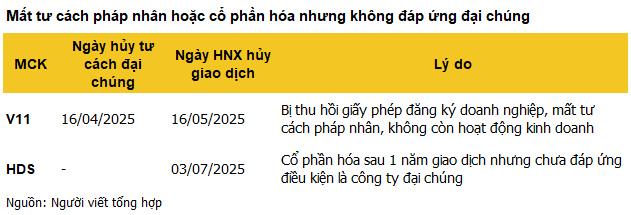

Losing legal entity status or ceasing business operations are also reasons why enterprises must delist. Construction No. 11 JSC (V11) is an illustration of this. With a bleak business landscape, V11 incurred losses for 14 consecutive years from 2011 to 2024, with cumulative losses of nearly VND 185 billion by the end of 2024, causing owner’s equity to turn negative at over VND 59 billion. The authorities revoked the company’s business registration, signifying not just delisting but also the end of a once-existing legal entity.

Hai Duong Plant JSC (HDS) is another unique case of delisting, as this enterprise, after one year from its first trading date, still failed to meet the requirement of being a public company as stipulated in the regulations.

Lastly, the question, “Why do enterprises delist?” delves deeper than mere legal compliance, exposing internal contradictions in governance and strategic direction. It signals the presence of numerous “empty codes” in the market—companies failing to meet fundamental standards regarding capital, governance, or operational efficiency.

While this process may cause short-term disruptions, it reflects the Vietnamese capital market’s endeavor to raise standards, especially as investors increasingly demand transparency and effectiveness. Maintaining public company status is not just an obligation but also a commitment to long-term engagement with investors. And for businesses unable or unwilling to fulfill this commitment—delisting is inevitable.

– 10:00 11/06/2025

A Sewing Brand is Unraveling: 50 Years of Threads Snipped and Over 2,500 Jobs at Risk.

With a robust financial standing, a generous dividend policy, and a nearly 50-year operational history, the 29/3 Garment and Textile Joint Stock Company, better known as Hachiba (UPCoM: HCB), stands apart from the myriad of companies that have delisted due to unforeseen circumstances or losses. Hachiba’s departure from the stock exchange is simply a consequence of its evolving shareholder structure, marking a shift towards a more closed-off business model.

The Ultimate Guide to the Perfect Cup of Tea: A Journey through the Historic Mỹ Trà Resort

After more than 12 years on UPCoM, My Tra Tourist will delist from the exchange at the end of June. The MTC stock price has plummeted to just VND 1,900, with no liquidity for months. The company has consistently made losses, experienced a significant decline in personnel, and halted dividend payments since 2019.

The $6.5 Billion Company: Addressing Delisting Concerns and Market Uncertainty

The amended Securities Law poses a delisting threat to GAS as it fails to meet the requirement of having at least 10% of voting shares held by a minimum of 100 retail investors. This regulatory hurdle underscores the importance of shareholder diversity and small investors’ role in a company’s compliance and long-term success.

“PCG Plunges to Historic Lows as Investors Bail Out Ahead of Delisting”

In the month leading up to its forced delisting, PCG’s stock price plummeted, hitting rock bottom at 2,200 VND per share – the lowest since its IPO. The company is mired in crisis with its financial statements rejected by auditors, obscure transactions, and consistent losses over the past three years.