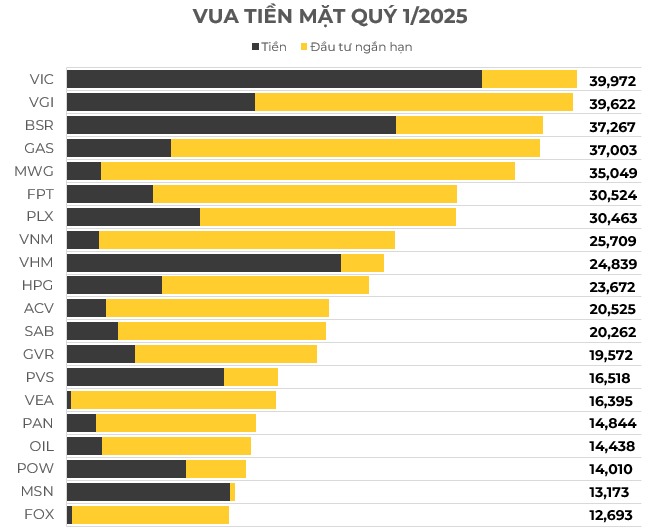

At the top spot, VIC boasts a staggering cash reserve of nearly VND 40 trillion, following an impressive performance in the first quarter of 2025.

The conglomerate recorded a remarkable VND 84 trillion in revenue, surging by 287% year-on-year. The real estate sector was the primary driver of this growth, contributing over VND 55 trillion, while the manufacturing sector brought in VND 15.7 trillion. The company netted a profit of nearly VND 7 trillion.

Closely following in second place is Viettel Global (UPCoM: VGI), with over VND 39.6 trillion. Viettel Global has consistently demonstrated strong performance, achieving over 20% revenue growth for six consecutive quarters. In the first quarter of 2025, the company recorded VND 9,657 billion in revenue and VND 1,310 billion in pre-tax profit.

The energy sector secured two spots in the top four. BSR firmly held on to the third position with nearly VND 37.3 trillion, while GAS ranked fourth with VND 37 trillion. In the first quarter of 2025, GAS posted impressive results, with VND 25.7 trillion in revenue (a 10% increase year-on-year) and a net profit of VND 2,760 billion. This growth was primarily driven by a 9% increase in LPG consumption and a significant 53% surge in LNG prices.

The Mobile World Group (HOSE: MWG) claimed the fifth spot with over VND 35 trillion. The retail giant reported optimistic results for the first quarter of 2025, with VND 36.3 trillion in revenue (a 15% increase) and an impressive 71% surge in net profit, amounting to VND 1,550 billion. This marked the second-highest profit in the company’s history.

Representing Vietnam’s technology sector, FPT ranked sixth with VND 30,524 trillion. The corporation also exhibited strong performance, recording VND 16,058 trillion in revenue (a 14% increase) and a net profit of VND 2,174 trillion (a 21% increase).

The top 15 cash-rich companies also include TCH, VNM, VHM, HPG, ACV, SAB, CVR, DXG, and VEA.

Source: VietstockFinance

|

– 10:00 12/06/2025

“Stock Recommendations for June: Tapping into Potential with a 33-35% Upside”

The sectors recommended in the May strategic report, including Real Estate, Exports, Oil & Gas, and Retail, are maintaining their positive momentum in the recovery process. Investors are advised to continue holding these stocks and to seize opportunities to increase their holdings when adjustments and positive signals arise.