Despite a slightly more active afternoon trading session, it couldn’t make up for the lackluster morning performance. For the first time in six weeks, the matching order value on the HoSE floor fell below 13,000 billion VND, and the two exchanges combined fell below 15,000 billion VND. It seems that investors are opting to stay on the sidelines and wait.

Selling pressure in the afternoon increased significantly, with the VN-Index and most stocks hitting their daily lows. The index fell to its intraday low at 1:45 PM, losing 0.76%, or 10 points. Bottom-fishing efforts emerged in the remaining time, balancing prices for many stocks, including large-cap ones, helping the VN-Index close with a minimal loss of 1.03 points (-0.08%).

At the bottom, the breadth index stood at 103 gainers and 172 losers, and by the end of the session, it improved to 151 gainers and 129 losers. The late bottom-fishing efforts proved effective, helping many stocks turn green.

The selling and bottom-fishing activities on the HoSE floor in the afternoon pushed the trading value up by 23.9% compared to the morning session, reaching 7,157 billion VND. The VN30 basket also saw a similar increase of about 16.7%.

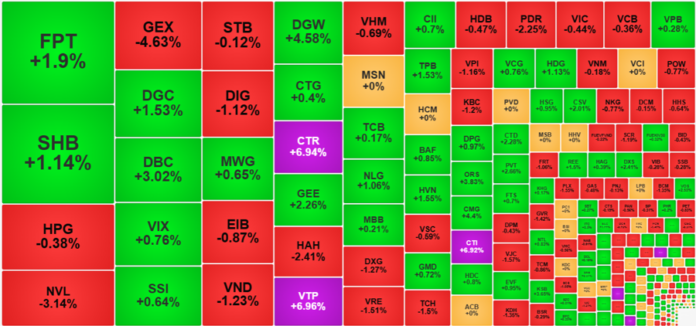

Compared to the morning closing prices, the VN-Index didn’t change much, but the intraday range was quite wide. The same was true for individual stocks, as their ability to maintain prices by the end of the session couldn’t hide the fact that they experienced significant intraday volatility. VHM closed with a slight loss of 0.69%, but its intraday range reached up to 2.4%. When the VN-Index hit its low, VHM was down 2.34% from the reference price. Even FPT, which closed impressively with a 1.9% gain, was up less than 1% at 1:45 PM.

SHB was the most actively traded and dynamic stock in the VN30 basket in the afternoon session. At the end of the morning session, SHB was trading around the reference price with dull liquidity of 140.6 billion VND. In the afternoon, large buy-side orders pushed the stock up by 1.14%, with an additional 511 billion VND in trading value. The only downside was SHB’s limited market capitalization, which contributed very little to the index in terms of points. CTG was another stock that attracted attention due to late buying interest. At the end of the continuous matching session, CTG was still down 0.66%, but it managed to close with a 0.4% gain. Compared to the morning session, CTG was up 1.2%. However, as it had to struggle to overcome the previous losses, CTG’s impact was limited.

The VN30-Index managed to turn positive, ending with a 0.02% gain, mainly due to the strong influence of FPT. This stock contributed 2.5 points to the VN30-Index, while its impact on the VN-Index was only about 0.75 points. Additionally, MWG rose 0.65%, TPB climbed 1.53%, and SHB and BVH also had a positive impact on the VN30-Index.

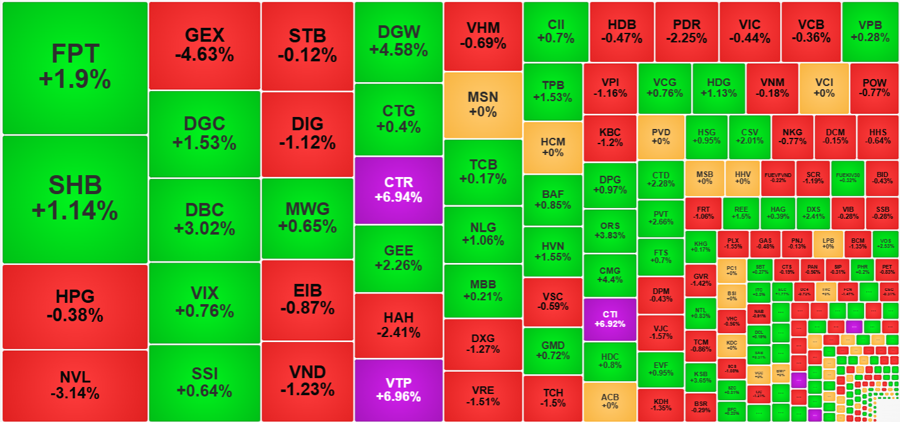

Nevertheless, the late rally wasn’t entirely disappointing. As mentioned earlier, the breadth improved quite well during the final recovery, and by the close, the number of gainers slightly exceeded the losers. However, the group of strongest gainers in the market didn’t see any notable additions, as they had already been strong since the morning. Several stocks that hit the daily maximum gain included CTI, VPG, and HT1. The best-performing stocks in terms of liquidity remained DGC, DBC, DGW, GEE, NLG, CTR, VTP, and HVN. Nearly 32% of the HoSE floor’s trading value was concentrated in the 66 stocks with gains of 1% or more, indicating that while the overall liquidity was small, it still had a significant impact on specific stocks.

On the downside, the situation worsened. Among the 129 losing stocks, 53 fell by more than 1%, compared to 41 in the morning session. Twenty-four of these stocks had trading values of 10 billion VND or more (compared to ten in the morning). In simple terms, selling pressure increased among the weakest stocks. NVL fell 3.14%, GEX tumbled 4.63%, DIG lost 1.12%, VND declined 1.23%, HAH dropped 2.41%, DXG slipped 1.27%, VRE decreased by 1.51%, and PDR fell 2.25%. These stocks all had trading values of over 100 billion VND.

With the market breadth and most stocks fluctuating within a narrow range (66% with intraday gains or losses of less than 1%), the market is currently in a state of equilibrium. While this isn’t necessarily a positive sign, as sentiment was quite optimistic yesterday, it does indicate that sellers haven’t appeared in overwhelming numbers. However, with a significant contraction in liquidity, the impact of limited funds will eventually be reflected in prices, especially as the ability to support the market becomes increasingly concentrated.

“SGI Capital: VN-Index to Reach 1,500 Points This Year, Potentially Hitting All-Time High with Upgraded Status”

The VN-Index has the potential to rebound and reach new heights, surpassing the 1500 mark in 2026. With foreign investors resuming net buying and the potential upgrade for Vietnam, the market valuation and index could soar to unprecedented levels.

The Foreign Block Sells Off Hundreds of Millions in the First Trading Session of the Week, with a Bank Stock Taking a Beating

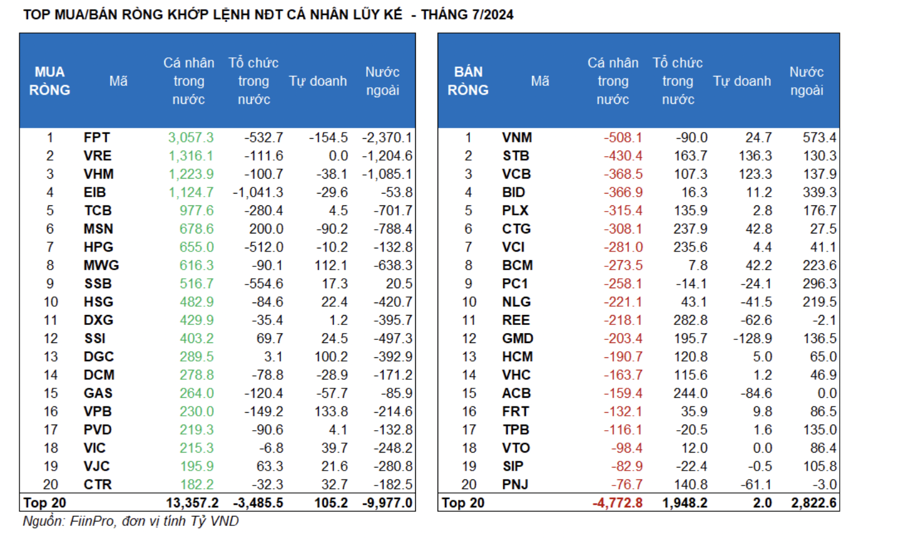

“Foreign sell-off continues to be a drag, with a net sell-off value of VND 331 billion across all three exchanges.”