Illustrative Image

Preliminary statistics from the General Department of Vietnam Customs indicate that soybean imports to Vietnam in May reached over 233,000 tons, valued at more than $110 million. This marks a significant increase of 84.5% in volume and a surge of 97.2% in value compared to the previous month.

Cumulative figures for the first five months of the year show that Vietnam has imported over 937,000 tons of soybeans, valued at over $428 million. This represents a 6.3% decrease in volume and an 18.8% decline compared to the same period in 2024.

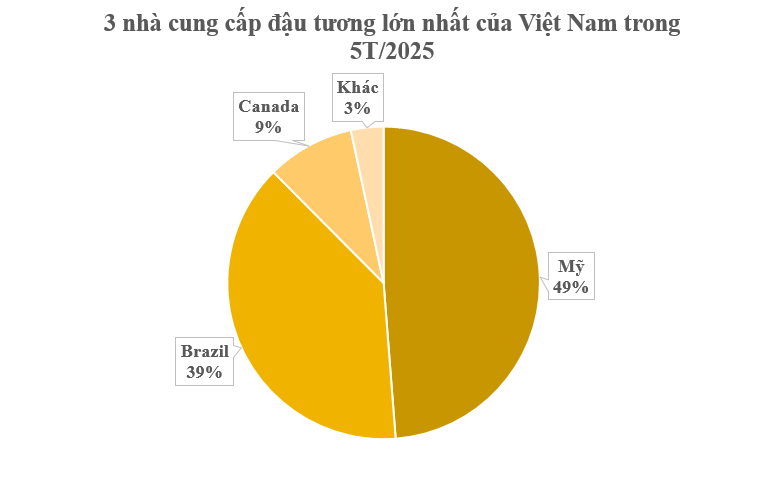

In terms of market sources, the United States has emerged as Vietnam’s largest soybean supplier, providing over 457,000 tons valued at over $205 million. This reflects a substantial increase of 38% in volume and a 13% rise in value compared to the same period in 2024. The average price stood at $450 per ton, an 18% decrease from the previous year.

Brazil, the second-largest soybean supplier to Vietnam, contributed over 363,000 tons valued at more than $167 million. However, this marks a 36% volume decrease and a 42% value drop compared to 2024. The price also witnessed a 9% decline, settling at $461 per ton.

Canada, the third-largest supplier, provided over 85,000 tons valued at over $40 million, exhibiting a notable surge of 78% in volume and a 40% increase in value. Despite the increased supply, prices dropped by 21%, equating to $480 per ton.

Vietnam currently ranks as the third-largest importer of dry soybeans and the ninth-largest importer of soybeans globally. Over the past decade, the country has consumed nearly 2 million tons of soybeans annually. The combination of declining soybean prices and rising pork prices has resulted in a double benefit for livestock farmers since the beginning of the year.

In China, according to Chinese Customs data, the volume of soybeans purchased by the country in May doubled compared to the previous month, reaching 13.92 million tons, equivalent to a 73% increase.

Chinese soybean processing plants swiftly sought affordable soybeans from South America, with a minimum of 40 shipments from Brazil in a single week in early April. This move was driven by concerns that trade tensions could complicate the acquisition of crops from the United States. Conversely, there are suggestions that the domestic supply of grains and oilseeds for animal feed will remain unaffected, given the abundant alternative sources globally and substantial domestic reserves.

Turning to the United States, the USDA forecasts higher soybean production, exports, and ending stocks for 2024/25. Soybean production for 2024/25 is projected at 4.6 billion bushels, reflecting an increase of 154 million bushels due to expanded acreage and improved yields. Preferential import tax rates for dry soybean oil from the United States into Vietnam have been reduced from 1-2% to 0%.

The United States Department of Agriculture (USDA) predicts a global soybean production of 428.7 million tons for 2024/25, marking an increase of 6.9 million tons. This growth is attributed to increased production in the United States, Ukraine, Russia, India, and Benin. Global soybean exports are expected to reach 181.2 million tons, a 1-million-ton increase due to higher exports from the United States, Ukraine, Russia, and Benin. This increase is partially offset by reduced exports from Argentina. Import demand for soybeans is projected to increase in Egypt, the EU, Iran, and Turkey.

The Secret to Laos’ Success: How a Small Country Exports Hundreds of Thousands of Tons of Tax-Free Goods to Vietnam, a Market That Consumes Over 10 Million Tons Annually

“Laos is the third-largest provider of this significant product to Vietnam, highlighting a crucial trade relationship between the two nations. This statistic underscores the interdependence and economic ties that exist within the region, with Laos playing a pivotal role in ensuring a steady supply of this vital commodity.”

Customs Collects Over $2 Billion in Additional Budget Revenue

The National Assembly’s budget estimate for the customs sector in 2024 is VND 375,000 billion. However, according to the General Department of Customs, this year’s revenue is expected to reach VND 418,000-420,000 billion, an increase of VND 53,000-55,000 billion compared to the same period last year (equivalent to USD 2.1-2.2 billion).

The Rise of Vietnam’s Electronics and Consumer Goods Imports from China

Consumer electronics, raw materials, produce, and fast-moving consumer goods were among the top imports from China to Vietnam in the first ten months of 2024.

The Art of Trade: Unveiling November’s $681 Billion Dollar Secret

Despite a decline in the first half of November, the total trade value of goods from the beginning of the year to November 15, 2024, reached an impressive $681.48 billion. This remarkable figure marks a 15.7% increase compared to the same period in 2023. Exports witnessed a 14.8% surge, while imports climbed even higher, reaching a 16.6% increase.