On June 9th, the Market and Global Economics Research Division of UOB Bank (Singapore) released its forecast for Vietnam’s economic growth in the second quarter.

According to UOB, economic activity has rebounded due to the 90-day tax deferment period, with April’s export and import figures significantly surpassing expectations compared to the same period last year, increasing by 20% and 23%, respectively. This surge was primarily driven by businesses rushing to complete transactions before the end of the tax moratorium. Notably, exports to the US market rose by 34% year-on-year, the fastest growth since January 2024.

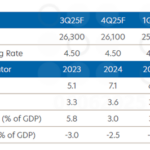

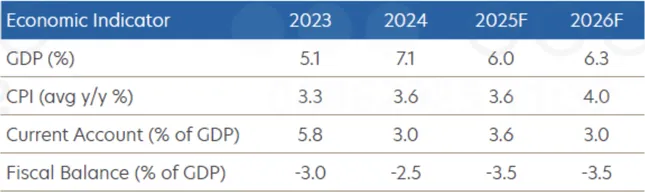

UOB Bank’s forecast for Vietnam’s economic indicators.

However, given the uncertainties surrounding tariff policies, UOB maintains a cautious outlook on Vietnam’s prospects due to the country’s heavy reliance on trade (with exports accounting for approximately 90% of GDP), particularly with the US market, which accounts for about 30% of total exports.

UOB retains its economic growth forecast for Vietnam at 6% for 2025 and 6.3% for 2026. Specifically, for the second and third quarters of this year, UOB predicts GDP growth rates of 6.1% and 5.8%, respectively.

The bank’s experts suggest that inflation in Vietnam has shown signs of cooling down, hovering around 3.1% year-on-year, remaining below the 4.5% target. This backdrop of moderate inflation, coupled with escalating global trade tensions and tariff uncertainties, presents an opportunity for the State Bank of Vietnam to loosen monetary policy.

Nevertheless, unlike some neighboring countries in the region, the current weakness of the VND is a factor that the State Bank needs to consider. Given the circumstances, UOB forecasts that the State Bank will maintain its policy interest rates, keeping the refinancing rate at 4.50%.

“If domestic business conditions and the labor market deteriorate significantly, we expect the State Bank to cut the refinancing rate once to the COVID-19 low of 4%, and it could potentially be lowered further to 3.5% provided the foreign exchange market remains stable and the US Federal Reserve cuts interest rates,” said a UOB expert. “For now, our base case scenario remains that the State Bank will keep interest rates unchanged,” they added.

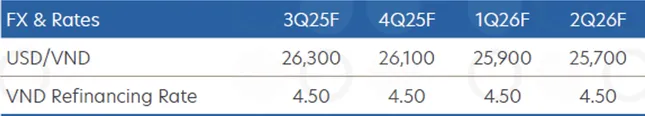

UOB Bank’s forecast for the VND/USD exchange rate.

So far this quarter, the VND has depreciated by 1.8%, hitting a new all-time low of around 26,000 VND per USD. This weakness stems from the less favorable economic outlook and the heightened risk of the US reimposing a 46% tariff if US-Vietnam trade negotiations do not show significant progress. These factors are expected to continue putting pressure on the VND in the short term.

UOB predicts that the VND will continue to fluctuate within a weak range against the USD until the end of the third quarter of this year. However, from the fourth quarter onwards, the VND may start to regain momentum and recover, joining the overall improvement trend of Asian currencies as trade tensions ease.

UOB updates its forecast for the USD/VND exchange rate as follows: 26,300 in Q3, 26,100 in Q4, 25,900 in Q1 2026, and 25,700 in Q2 2026.

The Ultimate Guide to Mastering the Art of Currency Trading: Fiin Ratings’ Fresh Forecast on USD/VND Exchange Rates Unveiled

According to Fiin Ratings, the weakening of the US dollar is predicted to ease exchange rate pressure in the coming months.

Stable Deposit Interest Rates for Early June

As of early June, interest rates at banks have stagnated, with only a handful of institutions opting for a slight reduction in savings deposit rates.