Mr. Pham Le Duy Nhon, Portfolio Management Director at Vietcombank Fund Management Company (VCBF), shared his insights on the capital flow in the stock market. He noted that market liquidity has significantly improved in April and May, increasing from an average of $700 million per session in the first quarter to over $900 million per session.

$1 BILLION PER DAY IS NOT ENOUGH FOR A MARKET BOOM

This improvement comes after the stock market experienced a significant correction in April due to concerns over President Donald Trump’s tariff policies. While one’s risk can be another’s opportunity, smart domestic capital flowed back into the market as many stocks were deeply discounted amid low-interest rates.

Subsequently, more positive signals emerged on the tariff front, such as a 90-day tariff delay, a temporary pause in the escalation between the US and China to negotiate, and timely actions by Vietnam in its negotiations with the US. These factors played a crucial role in shifting market sentiment from negative to positive, which was key to enhancing market liquidity.

It is worth mentioning that after the sell-off, when most stocks declined sharply, the market realized that the impact of retaliatory tariffs was not evenly distributed across all sectors and stocks. Many stocks were less affected, and when they were deeply discounted, they presented excellent accumulation opportunities. In fact, at present, many stocks have even surpassed their pre-tariff levels.

According to Mr. Nhon, while market liquidity has improved substantially, it is not yet sufficient for a strong market breakout. With nearly $1 billion per day at present, this liquidity is comparable to the period from April to June 2024, when the VN-Index hovered around the 1,300-point mark.

In reality, liquidity depends on two main factors: the opportunity cost (interest rates) and investor confidence. While interest rates remain low, market confidence needs time to strengthen, especially with the presence of significant macroeconomic uncertainties and daily information noise that complicates investment decisions. The tariff negotiations have shown positive progress, but no official outcome has been announced yet.

Another factor to consider is the banking group, which accounts for 40% of the VN-Index’s weight. Except for a handful of stocks with good performance, bank stock prices have generally been lackluster, with an average increase of 1.4% since the beginning of the year and a 3.3% decline in the past two months. This underperformance stems from macroeconomic challenges and first-quarter financial results that fell short of expectations.

Out of approximately 18 banks tracked by the fund, the average total operating income in the first quarter decreased by 11% compared to the previous quarter, NIM declined by 36 basis points, while the non-performing loan ratio increased by 26 basis points, and the loan loss provision coverage ratio also decreased.

TARIFF RISKS REMAIN PRESENT

The most significant risk to the market currently stems from the US global tariff policies.

The Vietnamese government has been proactive and devised countermeasures, such as proposing to reduce import taxes to 0%, increasing purchases of American goods, curbing origin fraud, and enhancing intellectual property protection. Meanwhile, the US has no intention of relocating the production of simple goods (textiles, footwear, etc.) back to their country. Moreover, the Trump administration is eager to reach trade agreements with major trading partners, including Vietnam.

Given these factors, VCBF anticipates a positive outcome from the US-Vietnam trade negotiations. This could result in significantly lower tariff rates than 46% or targeted policies focusing on specific sectors that the US wishes to relocate, such as electronics, semiconductors, and pharmaceuticals.

However, in any tariff scenario, Vietnam needs to rely more on alternative growth drivers such as public investment and tourism in the short term. In the long run, it is crucial to reduce dependence on the US market by leveraging the 17 free trade agreements already signed and promoting domestic private investment through institutional reforms.

The stock market has recovered significantly from its lows as tariff risks have temporarily eased, even though these risks remain. Corporate profits will face pressure from tariff risks and weakened global consumption and investment sentiment. The extent of the impact varies depending on the outcome of the Vietnam-US trade negotiations and differs among companies.

On a positive note, market valuations are not expensive compared to historical levels, and Vietnamese listed companies generally maintain healthy financial positions. VCBF believes that institutional reforms and the government’s commitment to supporting growth will create long-term growth momentum for businesses. Therefore, if Vietnam can secure a tariff rate that maintains its export advantage to the US market, the stock market will have numerous opportunities for exceptional growth in the coming period.

Regarding investment strategies, Mr. Nhon suggested that the investment environment for stocks in Vietnam and globally has been challenging in recent years, making short-term investing difficult and risky. He recommended investing in companies with attractive valuations relative to their growth prospects and strong management teams. Secondly, maintaining a long-term vision and diversifying portfolios across multiple quality stock groups are key. “Don’t panic when the market panics, and don’t get overly excited when the market is euphoric,” Mr. Nhon advised.

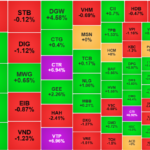

The Cautious Cash Flow: Paused Revival

The afternoon session witnessed a slight uptick in liquidity; however, it failed to make up for the lackluster morning performance. For the first time in six weeks, the HoSE floor’s matching value fell below 13 trillion dong, with the combined value of the two floors dipping below 15 trillion dong. Investors seem to be adopting a wait-and-see approach.

“Novaland Seeks Bondholder Approval for Restructuring of $55 Million Bond Issue”

Novaland seeks approval from bondholders to amend and supplement certain provisions of its bond documents and to extend the maturity date of its VND 1.3 trillion bond package.