Top 10 Capitalized Banks in Vietnam: A Dynamic Landscape

As of Q1 2025, the combined chartered capital of 28 banks (including Agribank and 27 listed banks) reached VND 868 trillion, equivalent to over USD 33 billion. Compared to the end of 2024, the banks’ chartered capital increased by more than VND 46,000 billion.

Vietcombank stood out with the most significant increase in chartered capital. The bank completed a stock dividend payout at a record ratio of 49.5%, boosting its chartered capital from VND 55,890 billion to VND 83,557 billion. This leapfrogged Vietcombank from 4th to 1st place in the industry rankings. As a result, Vietcombank also overtook VPBank in these rankings. Prior to this, VPBank had maintained its top position for over two consecutive years.

MB also witnessed a substantial increase in its chartered capital, adding VND 7,960 billion through a 15% stock dividend payout. This propelled MB to 5th place in the rankings, up one spot from the previous year.

LPBank attracted attention by climbing from 15th to 11th place in the chartered capital rankings. During Q1 2025, LPBank completed a stock dividend payout at a ratio of 16.8%.

The top 10 banks with the highest chartered capital as of now are: Vietcombank, VPBank, Techcombank, BIDV, MB, VietinBank, Agribank, ACB, SHB, and HDBank.

However, this ranking is dynamic and may soon change, with potential surprises in store.

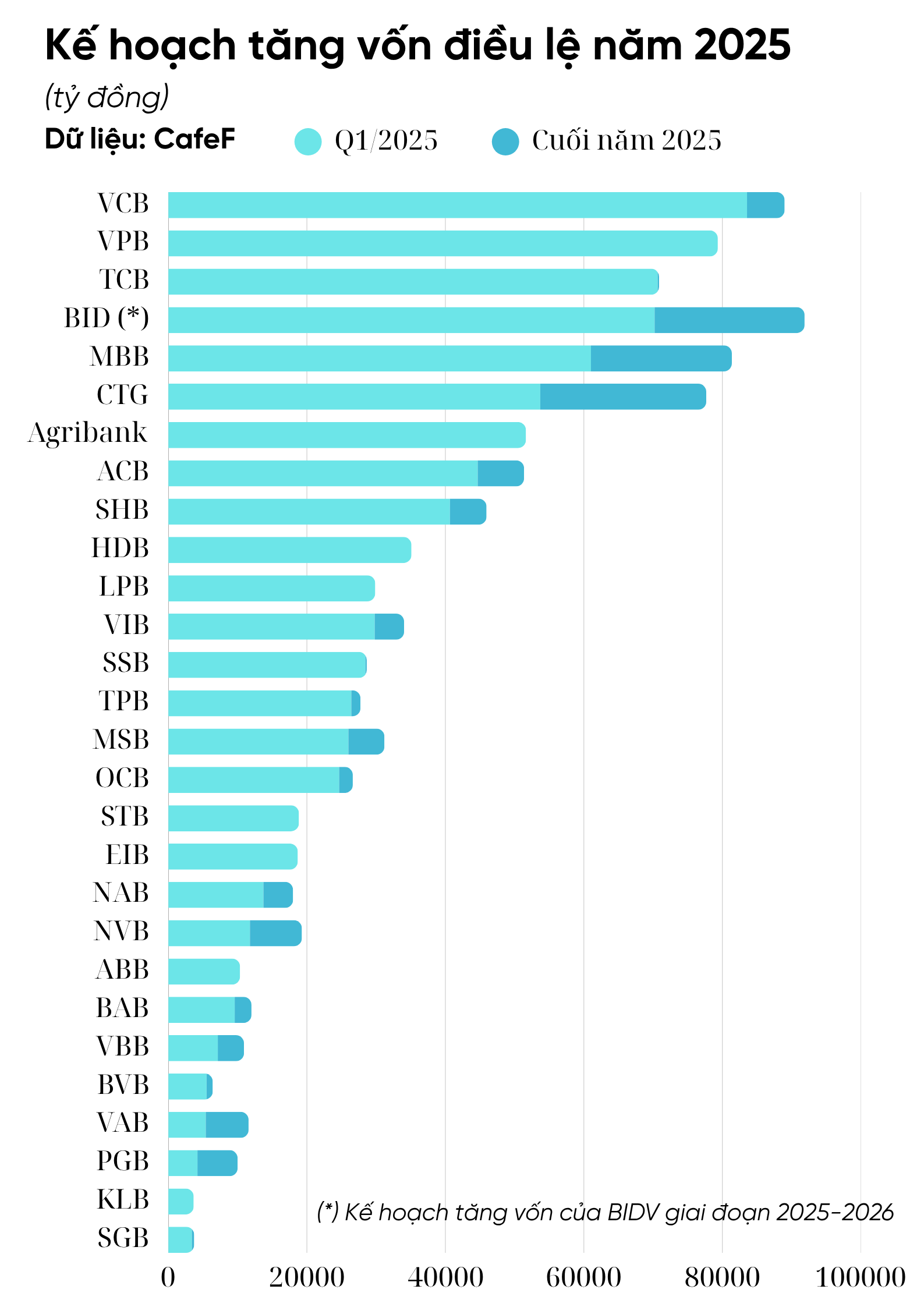

According to our data, 20 banks have planned to increase their chartered capital this year. Notably, the state-owned bank group (Vietcombank, BIDV, and VietinBank) aims to increase their capital to unprecedented levels.

If successful, these banks’ chartered capital is expected to increase by more than VND 127,000 billion over the next 1-2 years.

Ambitious Capital Increase Plans

Will BIDV Become the Bank with the Highest Chartered Capital?

The most notable plan belongs to BIDV, as their Annual General Meeting of Shareholders approved a chartered capital increase of VND 21,656 billion, representing a 30.8% surge compared to its chartered capital as of March 31, 2025. The bank will increase its capital through three methods: utilizing the supplementary capital reserve fund, issuing stock dividends, and additional issuance (private placement or public offering). This three-pronged approach will be implemented during 2025-2026, elevating BIDV’s capital to VND 91,870 billion.

Currently, BIDV’s chartered capital stands at fourth in the system, following Vietcombank, VPBank, and Techcombank.

VietinBank also has ambitious plans to increase its capital significantly by proposing a stock dividend payout ratio of 44.6%, which would boost its chartered capital to VND 77,671 billion. With this increased capital, VietinBank could potentially surpass Techcombank.

Vietcombank, after its capital increase in Q1 2025, aims to further boost its chartered capital to VND 88,988 billion through a private placement of up to 6.5% of its shares.

NCB to Surpass Sacombank and Eximbank?

Another dramatic shift is expected for NCB. Before 2023, the bank was among those with the lowest chartered capital in the system, barely above the legal capital threshold during the pre-2019 period. However, through continuous capital increases by offering shares to investors and existing shareholders, NCB’s chartered capital currently stands at VND 11,780 billion.

NCB is in the process of implementing a plan to increase its capital by VND 7,500 billion through the issuance of 750 million private placement shares, raising its chartered capital to VND 19,280 billion. This issuance has been approved by the State Bank of Vietnam. With this projected increase, NCB may surpass Sacombank and Eximbank, two well-known private banks.

Capital increase plays a crucial role in NCB’s restructuring roadmap for the coming years. According to the approved restructuring plan, NCB aims to reach a chartered capital of VND 29,000 billion by 2028.

Sacombank and Eximbank, on the other hand, have not announced specific plans for increasing their chartered capital. At the 2025 Annual General Meeting of Shareholders, Sacombank presented a dividend plan with the intention of retaining profits to increase capital. However, this plan is contingent upon the completion of the Restructuring Proposal and requires the approval of the State Bank of Vietnam.

Beyond these significant changes, the rankings also showcase a tight competition between ACB and Agribank (both above VND 51,000 billion), MSB, LPBank, and VIB (around the VND 30,000-35,000 billion mark), and VietBank, VietABank, ABBank, and PGBank (around the VND 10,000-12,000 billion mark).

The race to increase chartered capital goes beyond rankings. It is a critical mission for Vietnamese banks in the coming years to meet their development needs. This enables them to comply with Basel II and III standards, maintain a minimum CAR (Capital Adequacy Ratio) of 8%, and enhance risk resilience. With Vietnam targeting an 8% GDP growth in 2025 and aiming for double-digit growth in the following years, credit demand is expected to surge. Consequently, larger chartered capital will empower banks to expand their scale and meet market demands. The new capital will also enable banks to invest in technology, accelerate digital transformation, and enhance their services in a highly competitive environment.

“For the First Time, Vietnam Makes It to the Top 30 Most Valuable Brands in Southeast Asia, as Reported by Kantar”

“Vietcombank’s brand value soars above $2.1 billion, an impressive feat for the esteemed financial institution. With a reputation for excellence, Vietcombank has solidified its place as a powerhouse in the banking industry, not just in Vietnam but across the region.”

I aimed to maintain the key information while adding a touch of flair to highlight the brand’s strength and reputation.

The Big Three’s Banking Strategies: Unveiling the Intriguing

In 2025, while many private banks are pursuing aggressive credit growth strategies to capitalize on the economic recovery cycle, state-owned banks such as Vietcombank, VietinBank, and BIDV are taking a more cautious approach. Instead of focusing on expansion, they are prioritizing credit portfolio restructuring, risk management, and optimizing cash flow.