After numerous failed attempts to break through – even as gold consistently reached new historic highs – silver has finally embarked on its long-awaited price surge. But what’s truly driving this trend? Has silver’s outlook changed significantly, or does this rally reflect a broader picture?

A Shift in Market Psychology

According to Peter Krauth, author of The Great Silver Bull and founder of SilverStockInvestor, silver’s price surge indicates a shift in the overall market psychology.

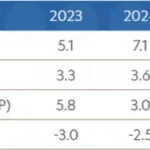

“I think this has a lot to do with the macro picture,” Krauth says. He argues that concerns about economic stagnation coupled with high inflation, or “stagflation,” are creating an ideal environment for silver to shine. He interprets the decline in the US first-quarter GDP growth as a worrying sign, indicating that the economy may be entering a prolonged period of weak growth, even as the cost of living and interest rates remain elevated.

Signals from the Bond Market

Another factor contributing to silver’s upward momentum is the bond market. Krauth points out that yields on US Treasury bonds are trending higher, reflecting expectations of long-term inflation. The 20-year bond ETF (TLT) is showing signs of a potential technical breakdown, suggesting that the bond market may continue to weaken, prompting investors to seek safe-haven assets like silver.

The 30-year bond yield index, which has been on a four-decade-long decline, has now broken above its downward trend line that began in 1980. From a low yield of 0.1% in 2020, it has now climbed to nearly 5%, an elevenfold increase in just a few years. This indicates that long-term inflation expectations are firmly entrenched in the financial markets.

Silver price performance over the past year. Source: Trading Economics.

The Burden of US National Debt

Another factor Krauth emphasizes is the massive US national debt. Of the $36 trillion in total debt, a staggering $9 trillion will come due this year. While the government can restructure the debt with different maturities, the financial strain is immense.

“The only way for the US to continue servicing its debt is to print more money,” Krauth says. “And I think the market is starting to realize that.”

The prospect of money printing to service debt further enhances the appeal of gold and silver as traditional safe-haven assets in investors’ eyes.

Impact of US Politics and Budget

Beyond economic factors, Krauth also points to a recent catalyst for silver’s price surge: the standoff between Donald Trump and Elon Musk. This feud has drawn attention to the new budget bill that Trump supports – a bill that Musk criticized as “incredibly inflationary.”

“Trump is pushing for a massive spending bill, while Musk, who was expected to curb spending, has backed out,” Krauth analyzes. “I think that’s the most recent catalyst for silver’s strong rally. It’s like pouring fuel on the fire.”

Gold-Silver Ratio and Upside Potential

Krauth also believes that the gold-silver ratio presents an opportunity for silver. While gold may have already priced in much of the inflation risks, silver still has room to “catch up.” He predicts that the ratio could drop to 75:1 in the second half of this year – a more reasonable level compared to the current ratio, which favors gold.

Should this happen, and assuming a gold price of around $3,500 per ounce, silver could reach approximately $45 per ounce – just $5 away from its all-time high. Krauth is even optimistic that the $50 level could be breached next year.

“Not only is $50 feasible, but I think silver could add another $10 to $15 after breaking that level,” he says. “We’ve never seen silver above $50, so if that happens, there’s really no clear limit after that.””

Peter Krauth expresses confidence in silver’s outlook.

$50 and Beyond?

According to Peter Krauth, silver’s prospects for the second half of the year and beyond extend beyond what the market is currently witnessing. He forecasts that silver could easily reach the $40 level in the coming months and surpass the $50 mark – an all-time high set in 1980 and repeated in 2011 – within the next year.

“I’ve emphasized multiple times in the past six months that the $40 level is very achievable in the second half,” Krauth says. “And I believe the $50 level will be breached at some point next year.”

Moreover, he contends that once silver breaks through the historical ceiling of $50, the market will enter uncharted territory. “We’ve never traded silver above $50. If that happens, there’s really no clear limit after that,” he assesses. “Depending on the context, $60 or even $65 is not out of the question.”

Optimizing the Gold Market: Starting with Transparency

After 13 years, Decree No. 24/2012/ND-CP on the management of gold business activities remains pertinent in removing gold from the banking credit system and preventing the “goldification” of the economy. However, the question of how to channel these resources into productive business ventures rather than hoarding and clandestine transactions remains unanswered.

“Inflation’s Creeping Climb: A Mid-Year Review”

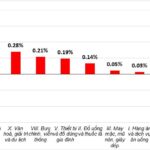

According to data from the Statistics Bureau, the consumer price index (CPI) in May 2025 rose by 0.16% from the previous month, mainly due to increases in housing rent, housing maintenance materials, electricity, and dining out. For the first five months of 2025, the CPI increased by an average of 3.21% year-on-year, with core inflation rising by 3.10%.