According to An Binh Securities’ (ABS) newly published June strategy report, the stock market in June will receive information about the financial statements of listed companies, which are expected to be positive. The second-quarter GDP growth figure for 2025 is expected to be high at over 7%.

However, ABS also noted that this is a period when the Vietnamese economy has not yet been negatively affected by tariffs and is even more positive than usual due to the acceleration of many export activities before the negotiation deadline of July 8, 2025, and the government’s efforts to boost the economy. With a 22% increase since mid-April, many stocks have surged in anticipation of these positive financial results.

In the second half of June, the outcome of tariff negotiations will be the market’s focus. Vietnam is making efforts to meet US demands for fair trade, notably by recently tightening the handling of counterfeit and pirated goods, managing the origin of goods, and controlling illegal transportation.

Apart from the issue of retaliatory tariffs, Vietnam is also on the US Monitoring List for currency manipulation. While the latest report from the US Treasury Department does not consider Vietnam a currency manipulator, if Vietnam violates the rules or the US expands its criteria, Vietnam could still face tariffs.

With Vietnam’s efforts, ABS expects a positive outcome from the negotiations, with US tariffs on Vietnam expected to be in the range of 15-25%.

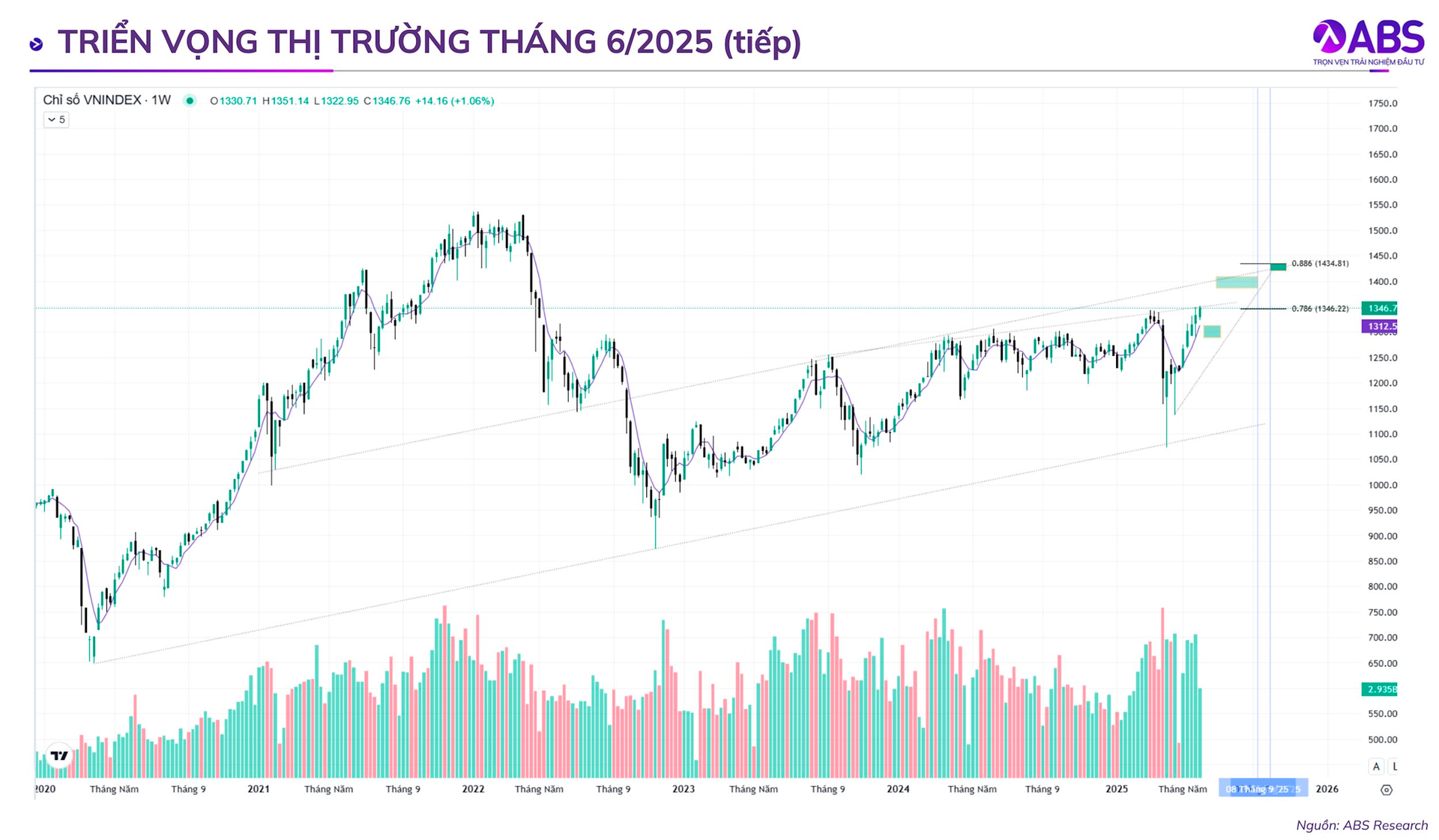

In terms of valuation, with the recovery in April and early May, the P/E ratio of the VN-Index for the last four quarters increased from 10.86x on April 9, 2025, to 13.1x on June 6, 2025, equivalent to a three-year average of 13.12x.

Large-cap stocks in the VN30 have a P/E valuation of 11.40x, significantly lower than mid-cap stocks in the VNMID (15.95x) and small-cap stocks in the VNSML (14.01x). Except for the VNMID index, these P/E ratios are lower than the three-year average, indicating that the current valuations still offer upside potential for certain stock groups.

Overall, ABS believes that the market is in a phase of medium-term growth potential due to positive tariff negotiation outcomes and government efforts. ABS highlights a range of stocks with growth potential in June, including VPB, BVH, DGC, GAS, PVD, CNG, POW, SAB, PAN, ANV, MPC, DRC, and TCM. Some notable investment arguments are as follows:

For VPB stock , ABS believes that asset quality is likely to improve by year-end due to: (i) The government is expected to consider legalizing Resolution 42/2027/QH14 on bad debt settlement during its June 2025 session, providing the banking sector with a legal framework to expedite bad debt handling; (ii) A robust economic recovery, along with a rebound in consumer demand and the real estate market; and (iii) FE Credit, after its restructuring phase, is demonstrating improved loan quality.

For BVH stock , ABS forecasts positive financial results in 2025 due to: (i) A slight increase in net revenue as customer confidence gradually recovers from the crisis, Circular 34/2024/TT-NHNN allowing commercial banks to sell insurance, and an economic rebound driving demand for life and non-life insurance products.

(ii) Improving financial revenue as its investments, mainly in certificates of deposit, benefit from the upward trend in deposit interest rates. (iii) A decrease of 2.9 percentage points svck in the compensation ratio and 7.6 percentage points svck in the provisioning ratio in the first quarter of 2025. These ratios are expected to continue decreasing in subsequent quarters due to the company’s efforts to improve its insurance policy assessment and product design.

For PVD stock , the demand for rigs in Southeast Asia remains balanced, while Vietnam is expected to be more vibrant. Additionally, PVD’s rigs are fully employed. Investing in new rigs contributes to PVD’s revenue and profit growth in a new growth cycle. Furthermore, significant industry projects are accelerated, notably the Lot B-O Mon Project, which will provide considerable work for PVD in the coming period.

For SAB stock , ABS notes that low-alcohol beer is gaining popularity, and SAB has launched low-alcohol beer products to catch up with this trend. Increasing SAB’s ownership in SABIBECO to 65% at the end of 2024 improved SABECO’s profit margin and operational efficiency, and this positive impact is expected to continue in 2025.

For MPC stock , the growth driver for MPC comes from implementing plans to focus on developing high-quality broodstock, increasing self-sufficiency in shrimp materials, and expanding export markets.

For DRC stock , ABS anticipates improved financial performance in the following quarters due to: (1) A decrease in raw rubber prices, supporting profit margins; and (2) A strategy to boost domestic consumption as the demand for tires in the domestic market remains positive.

Market Pulse June 11: VN-Index Caught in Tug-of-War, VGI and CTR Surge Ahead

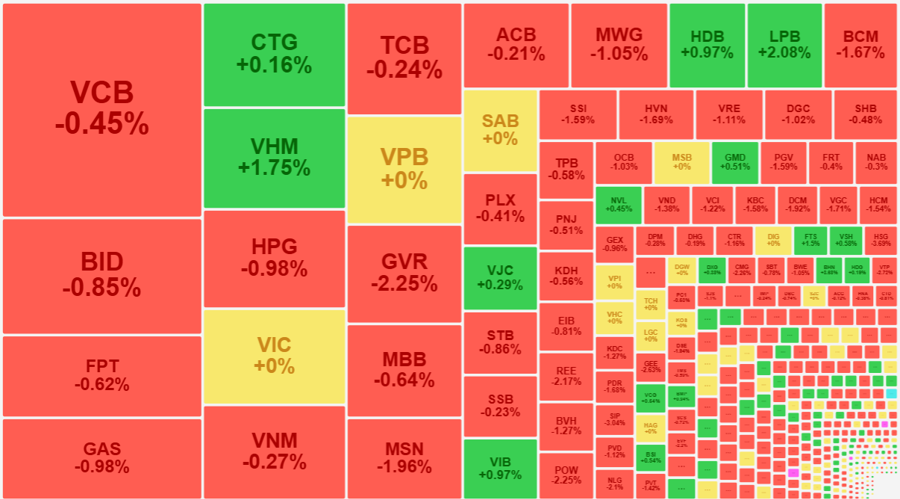

The market closed with the VN-Index down 1.03 points (-0.08%), settling at 1,315.2; while the HNX-Index dipped 0.17 points (-0.08%), ending at 226.23. It was a mildly positive day for the broader market, with buying interest outpacing selling pressure as 345 tickers advanced against 309 declining names. However, the large-cap universe painted a different picture, with the VN30 basket witnessing a sea of red – 16 tickers declined, 11 advanced, and 3 remained unchanged.

The Cautious Cash Flow: Paused Revival

The afternoon session witnessed a slight uptick in liquidity; however, it failed to make up for the lackluster morning performance. For the first time in six weeks, the HoSE floor’s matching value fell below 13 trillion dong, with the combined value of the two floors dipping below 15 trillion dong. Investors seem to be adopting a wait-and-see approach.