“Vietnam’s Banking Sector: Robust Credit Growth and Supportive Initiatives”

According to the Banking Times, the latest statistics from the State Bank of Vietnam reveal a significant surge in credit growth. As of May 2025, credit to the entire economy increased by 6.52%, a notable improvement from the 2.41% recorded in the same period last year.

Estimates suggest that in the first five months of this year, total credit outstanding increased by over VND 1 quadrillion to more than VND 16.6 quadrillion. This marks an unprecedented increase in credit outstanding for the first five months of a year.

To bolster economic growth, the State Bank has set a credit growth target of approximately 16% for 2025, translating to an injection of at least VND 2.5 quadrillion into the economy. In comparison, credit growth in 2024 was around 15.08%, resulting in VND 2.1 quadrillion of credit being pumped into the market.

To achieve the 16% credit growth target for 2025, the State Bank has implemented several key solutions: Commercial banks have been instructed to further reduce interest rates, making it easier for businesses and individuals to access capital; priority has been given to lending for production and business activities, especially in priority sectors such as high-tech agriculture and industry, while closely managing risks in sensitive industries; and there has been a push for greater technology adoption, digital transformation, and simplification of administrative procedures to expedite loan processing times.

Additionally, banks are encouraged to expand their engagement with businesses, particularly small and medium-sized enterprises (SMEs), to address challenges related to collateral and non-performing loans.

The banking sector has also launched significant credit packages with preferential interest rate mechanisms. For instance, the State Bank recently instructed nine banks to offer loans to individuals under 35 years of age for purchasing social housing, with a total credit limit of VND 145 trillion. The interest rate for these loans is set 2% lower than the average long-term VND loan rate of the four state-owned commercial banks for the first five years of the loan. In the following ten years, the interest rate is reduced by 1%.

Furthermore, the State Bank has expanded the scope and eligibility of its credit program for the agricultural, forestry, and aquatic sectors, with a total credit limit of VND 100 trillion.

Additionally, the State Bank has introduced a VND 500 trillion credit program (with the participation of 21 commercial banks) for lending to strategic infrastructure projects, offering preferential interest rates reduced by 1% or more compared to medium and long-term lending rates.

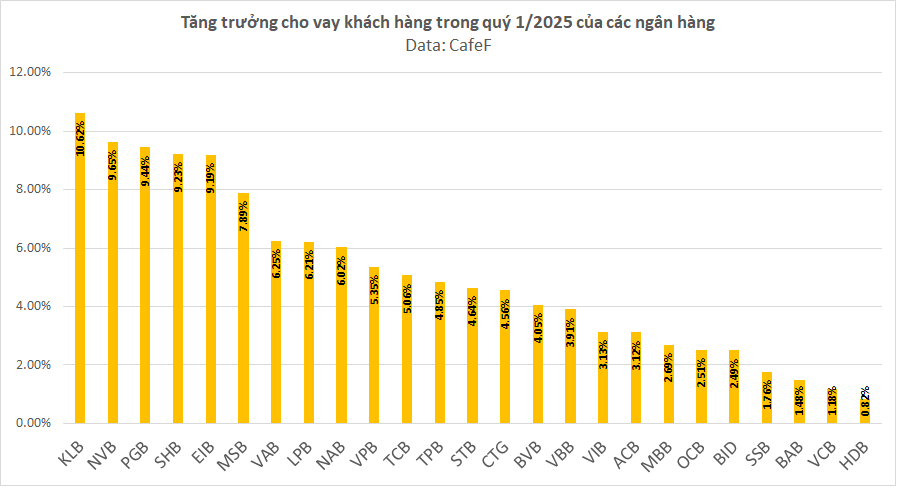

Financial reports for the first quarter of 2025 indicate that the total loans to customers by the 27 banks listed on the stock exchange exceeded VND 12.3 quadrillion, reflecting a 3.8% increase compared to the end of 2024.

Several banks recorded impressive growth rates of over 9%, including Eximbank, SHB, PGBank, and Kienlongbank. Large banks also showed positive growth, with increases of 4.56% for VietinBank, 5.06% for Techcombank, and 5.35% for VPBank.

The Vital Decision of Dong Nai Province Regarding the ‘Second Mountain Range’

Mount Chứa Chan, dubbed the “Second Highest Peak” in the Southeast region, has caught the attention of Dong Nai province. With its majestic presence, the mountain has become a focal point for a major project aimed at developing eco-tourism and wellness retreats in the area.

The Ultimate Guide to Investing: Navigating the Financial Markets with Confidence

The Vietnamese Dong (VND) continues its decline against the US Dollar (USD), with a 2.7% loss despite the greenback hitting a three-year low against other major currencies. The DXY index, which tracks the USD’s performance, has fallen by 9% since the start of 2025, yet the VND struggles to gain traction.